Reality behind CAWI

Computer-aided primary research methodologies are at the forefront of modern market research. SG Analytics’ State of Market Research Survey was aiming to assess respondents‘ specific preferences pertaining to computer-aided research methodologies. We interviewed 480 senior executives (C-Suite/ VPs/ Directors/ Managers) of companies across various sizes and sectors in the US and UK.

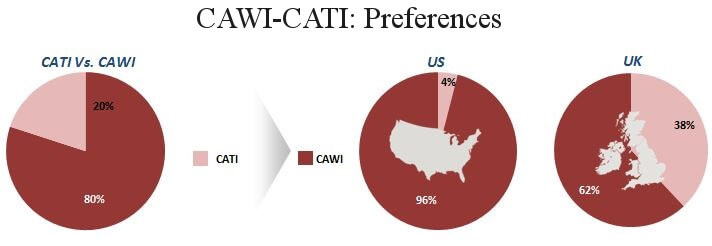

The survey findings are clear, respondents majorly prefer CAWI (Computer Aided Web Interviewing) methodologies. Overall, 80% of the respondents from the two countries preferred CAWI over CATI (Computer Aided Telephone Interviewing). The proportion is even higher in the US, where 96% of all senior executives opt-in for CAWI given a choice.

Online survey participation rates

CAWI’s popularity among respondents is also apparent in interview participation rates. 3 out of 4 respondents participate in over 40% of the online surveys they receive. Our respondents that the following reasons were driving their higher participation rate in online surveys:

- Flexibility and time convenience of CAWI surveys.

- Respondents feel that they are/can be more honest and open in their responses.

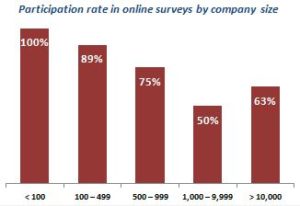

However, our data suggest that senior executives are very selective about the surveys they receive. Around 63% of our respondents stated they wouldn’t participate in surveys if the surveys were not relevant to them or the surveys were long and cumbersome. The participation rate also varies significantly across company sizes.

Respondents’ preconditions for CAWI participation

Some market researchers associate several notions with CAWI. These notions relate to respondents’ unwillingness to share personal details or to engage in follow-up discussions. Another notion is that respondents tend to be more dishonest in CAWI responses. However, our surveys indicate that these notions are baseless.

- Respondent details: 75% of our respondents stated the willingness to share personal details to prove authenticity. However, most of them also demanded the provision that they would not be contacted for any sales purpose.

- Follow-ups: Nearly 30% of our respondents are ready for a follow-up discussion given appropriate incentives and recognition for their contribution.

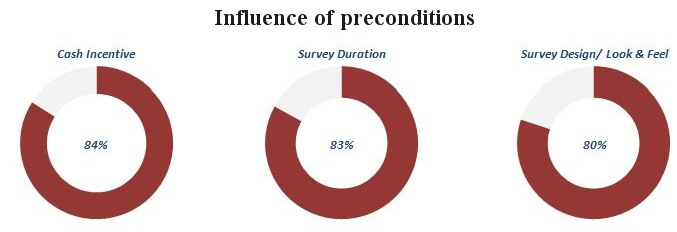

- Attentiveness: Overall, 88% of our respondents said they would be “very attentive” while participating in an online survey under the condition of appropriate cash incentives and an appealing look & feel of the survey.

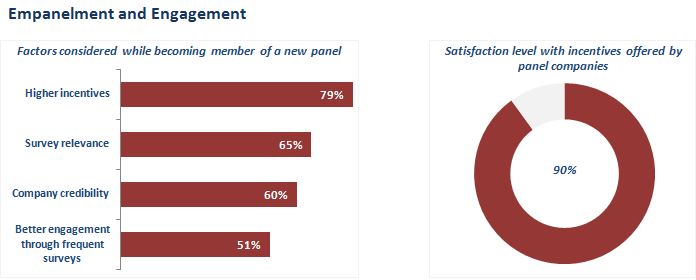

Appropriate incentives: Cash preferred

A majority of our respondents stated cash as an appealing incentive and showed no interest in options, such as industry reports, donations to charity, or lucky draws. However, 90% of our respondents were satisfied with the incentives that panel companies usually provide.

Improved success and quality of CAWI surveys

In summary, ensuring a high-level of attention and involvement from respondents depends on:

- Incentives offered by panel companies,

- Clarity on the duration of the survey,

- Acceptable look and feel of the survey.

The above factors play a significant role in improving the response rate and reliability.