Send Inquiry

Mar 10, 2023

The tech industry has struggled owing to several factors like inflation and layoffs in the recent past, but has also been able to innovate successfully owing to the exponential rise in data. More importantly, organizations have been forced to confront some of the biggest challenges related to the collection, storage, analysis, and management of data, while keeping costs at bay.

As the volume of data and its usage continues to grow, the need for organizations to democratize data or make it available to their employees and other stakeholders has become more important. Unlimited access to digital information empowers employees and drives communication and decision-making based on data-driven insights, while also safeguarding company data.

Leadership Role

The top management’s role in actively supporting and participating in the data democratization process is critical, as it causes a huge cultural impact on the organization. Therefore, business leaders need to inform stakeholders about the strategies and operational changes, and lead processes to drive a data-driven ecosystem. They must connect and communicate more often with their employees, while the data analytics team must focus on building a data governance approach to help drive actionable insights.

Data-driven Ecosystem

Data democratization brings about a complete cultural change, wherein employees and stakeholders must be trained to infuse data into their day-to-day operations and also share data to influence the decision-making course. Leaders also need to invest in training and change-management practices to understand how to extract the value of data to make well-informed decisions.

Process Definition

All employees and stakeholders would need access to a robust data management architecture, including the tools, software, and processes. Such a strategy ensures that all authorized users would access the same data or be guided by the same data management principles (training, data sources, security, governance, storage, etc.) to build their decisions.

Cloud is a Game Changer for Governing Data

Integrating and evaluating the large volumes of data stored in siloed systems across industries can be challenging to control, resulting in compliance irregularities, reduced sales, and unnoticed opportunities. As a result, most organizations have been relying on the cloud to store, manage, share, govern, and protect their data across financial services, logistics and supply chain, and other sectors. Cloud enables businesses to gain competitive and customer advantage, and at the same time helps earn maximum business value from data.

Feb 03, 2023

The rise in the adoption of digital technologies and big data is drawing the marketplace’s attention toward a new buzzword – Datafication. Data is growing fast; by the end of 2022, 97 zettabytes of data are expected to exist worldwide, as cited by Bernard Marr & Co. The big data available at businesses’ disposal compels them to try to make sense of the asset in their hands, paving the way for ideas like datafication, dataism, and dataveillance to come to the fore.

With datafication aiming to quantify life aspects previously experienced qualitatively, businesses can draw the right inferences by contextualizing data. Resultantly, companies can improve their productivity by ensuring daily task completion at the micro-level, thereby streamlining strategies and attaining competitiveness at the macro-level.

Future of Datafication

Datafication cannot be viewed in isolation; rather, its utility can be heightened by teaming it up with other tech concepts and trends, viz., virtualization, Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), 5G, and Everything-as-a-Service (XaaS), etc.

As datafication quantifies daily experiences in the physical world, it is applied in emerging trends like the Metaverse, a virtual parallel world. Forbes cites that by building immersive simulations of the real world with devices that offer extensive tactile feedback, and the Internet of Senses (Ericsson’s advanced technology), the goal of achieving virtual experiences that accurately mimic reality will be a possibility by 2030.

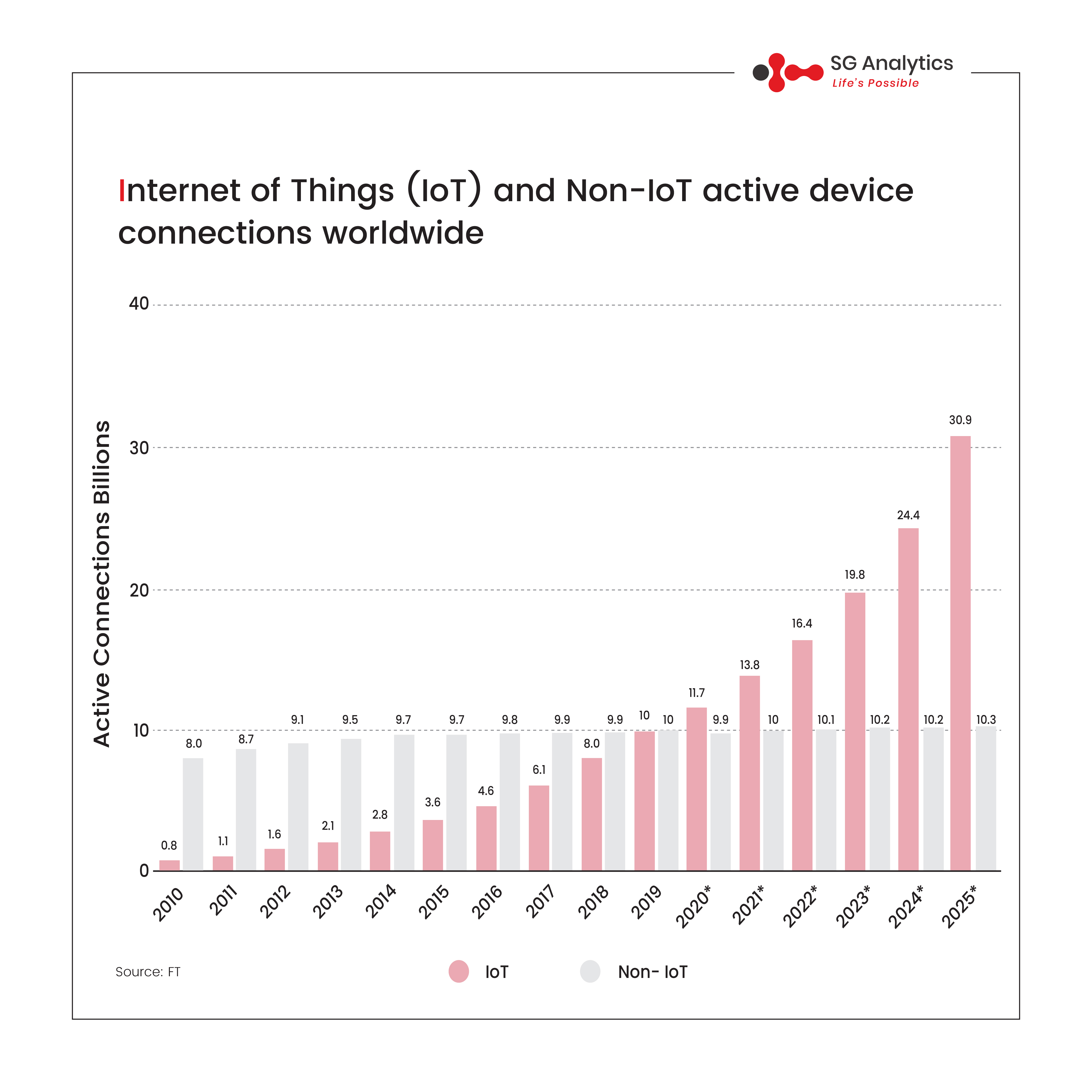

With Statista citing that the total installed base of IoT-connected devices is expected to touch 30.9 billion units by 2025, the imperativeness of datafication to make sense of volumes of data will be evident. Furthermore, datafication has found its way into all facets of human life. From sports teams leveraging analytics to better their game to Europe’s Smart Water Network is a testament to real-time data being leveraged via sensor deployment to track/modify water and electricity distribution in smart cities.

Datafication is at the helm of the tech/data revolution driving disruptive technologies that challenge existing systems and normalize advanced solutions/ideologies. It is certainly a trend to watch out for in 2023!

Aug 18, 2022

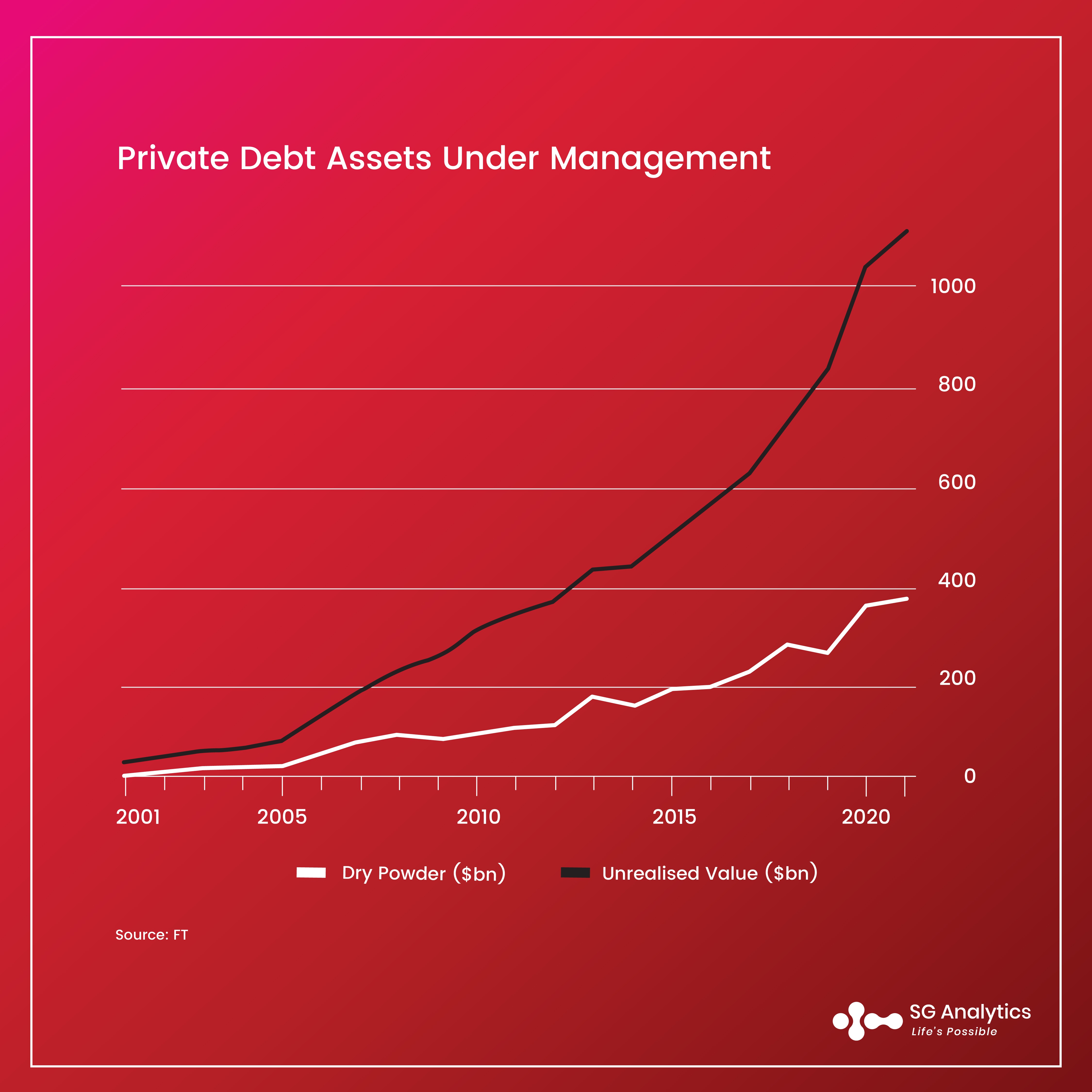

The private debt market experienced exponential growth over the last decade. The market expanded from less than $400bn worth of assets at the end of 2008 to $1.2tn at the end of 2021, albeit one-fifth of the private equity market. Private lending has been evolving rapidly, especially post the financial crisis of 2008 and the ensuing low-interest rate environment. The stringent regulations marginalise traditional lenders from engaging in riskier loan businesses, thereby allowing private lenders to fulfil the liquidity needs of small- and mid-sized companies. As private loans bear relatively higher interest rates, they become attractive for yield-craving investors in an otherwise ultra-low interest rate environment, which makes traditional fixed-income instruments less compelling. Private debt lenders also provide amendments and capital infusions that help borrowers to avoid bankruptcy, often in exchange for equity in times of distress, making the market even more lucrative for credit investors. On top of it, private debt has the highest number of ESG commitments of any asset class, with 49% of its asset under management committed to ESG.

With looming recessionary pressure, banks might again become hesitant to deal with small companies. This may further provide opportunities for direct or private debt lenders because they can quickly execute the deals considering the bilateral relationship between the borrower and the lender as compared to the syndicated loan market. Moreover, given the steady track record of private credit performance over the last decade with annual returns averaging around 10% since 2008, this asset class could look compelling amongst investors even during the potential economic slowdown ahead. Private credits have ideally a shorter duration and remain favourable in a rising interest rate environment and falling private equity valuations. Furthermore, capital commitments in the private debt market have reached new levels, with an unallocated capital (dry powder) standing at $405.4bn as of March 2022, setting the stage for the market to expand further. However, investors should note that the private debt market is characterised by the presence of highly leveraged borrowers, illiquidity and less transparency.

Aug 01, 2022

Are default rates set to rise ahead of the potential recessionary pressure?

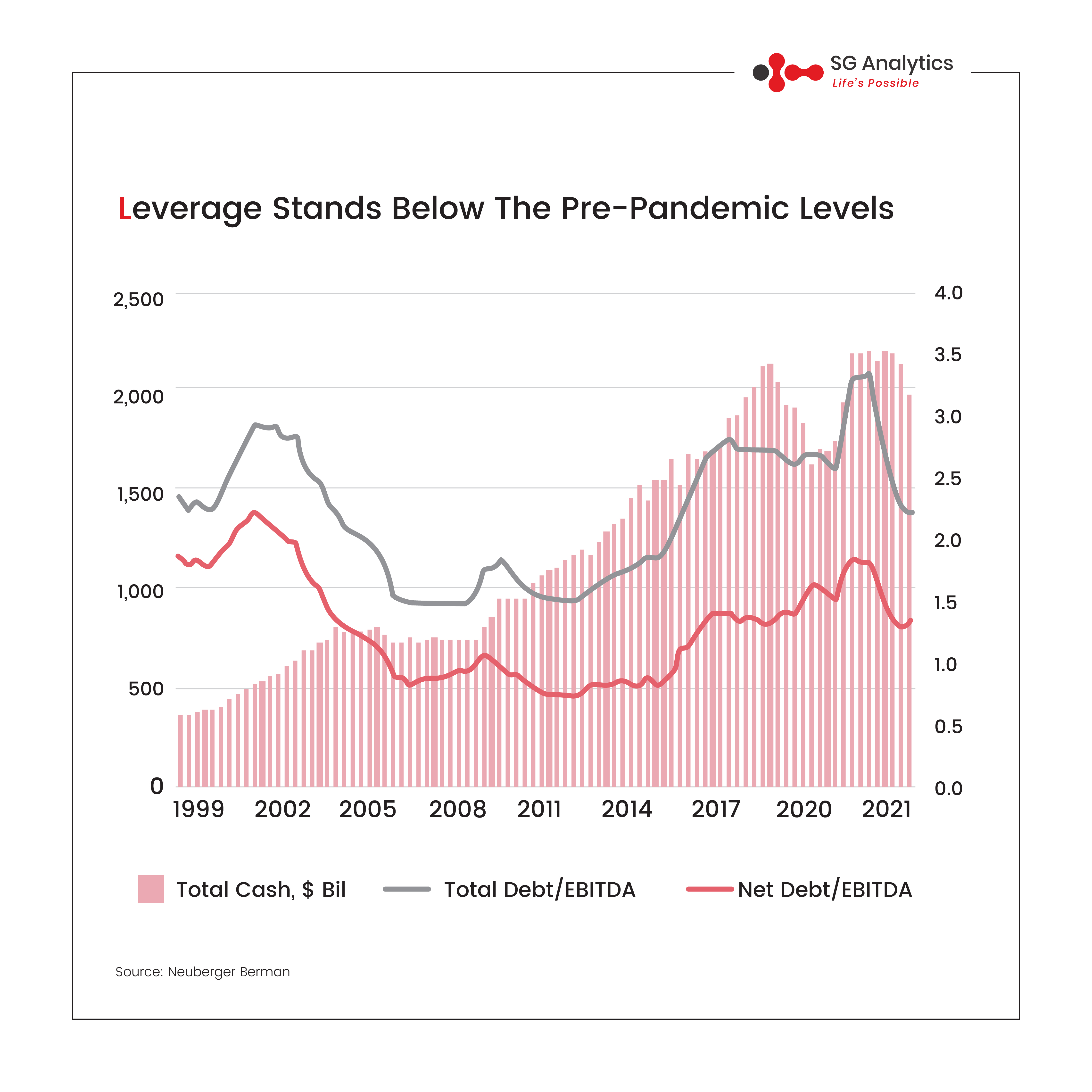

Assessing deeper into the corporate sector’s financial health, both positives and negatives appear to be playing a balancing act for the credits. On a positive note, it would be safe to assume that several vulnerable and inefficient sub-investment corporate firms were washed out during the uncertain covid times while only the stronger firms have weathered the storm. The debt maturity walls, generally a harbinger for default rates, may not prove to be a useful predictor as several corporate firms have piled up massive debt taking the near-zero interest rate to their advantage. Several firms were seen elongating their maturity profile through refinancing and more so in the sub-investment grade segment. Consequently, the default rates have remained at historically low levels. Looking ahead, with prospects of a slowdown and a potential recession the defaults are set to rise but should remain limited compared to previous recessions at least through 2024.

Notably, the investment grade corporate balance sheets now look healthy as net leverage has already peaked and the current elevated cash flows, albeit declining lately, offer a significant cushion. That said, in the current scenario, defensive positioning would be the theme amidst slowing economic growth. Investors should focus on Utilities, Telecommunication, and Consumer Staples businesses and avoid sectors that are highly sensitive to interest rates such as Real Estate and Technologies as the companies from these sectors are highly likely to witness earnings downgrades.

Jul 20, 2022

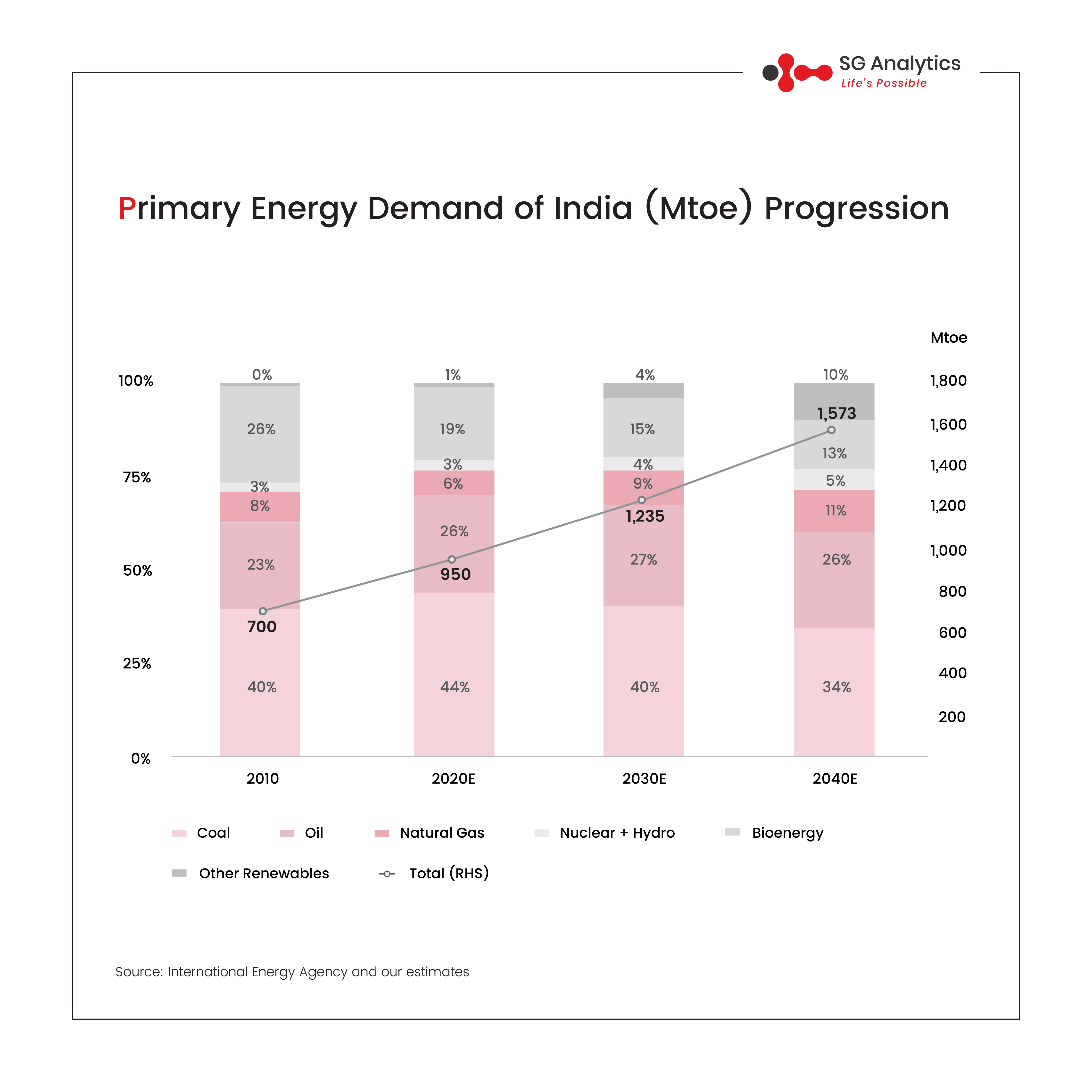

As per International Energy Agency’s (IEA) report on India’s Energy Outlook, India is the world’s third-largest energy-consuming country and will soon become the world’s most populous country in coming years, thereby increasing its energy demand further. Energy use in India has already doubled since 2000, and ~75-80% of estimated energy demand is still fulfilled from Coal, Oil and Natural gas. India would like to increase the share of renewable energy going ahead to reduce its carbon footprints and move towards sustainable energy solutions especially as its energy demand is expected to increase due to the growing population and its increasing needs.

Based on the Stated Policies Scenario (STEPS) provided by IEA which assumes current policy settings and constraints and the assumption that the spread of Covid-19 is majorly brought under control in 2021, we believe that primary energy demand would increase from an estimated 950 Mtoe in 2020 to 1,235 Mtoe in 2030 and eventually 1,573 Mtoe in 2040 (chief drivers being urbanisation and industrialization). But the demand will still be met majorly by coal and oil, although their share is expected to reduce from an estimated ~70% in 2020 to 60% in 2040. Below is the summary of the expected progression of the primary energy demand in India over the decades.

Incremental demand to be met from renewable energy:

In the last decade (2010-20), the incremental energy demand of 250 Mtoe was primarily met by coal and oil. Over the next decade (2020-30), although the majority of the incremental energy demand would still be met by coal, oil and natural gas, we expect that there would be a gradual and evident shift towards renewable energy sources in that decade. We expect the major shift towards reliance on renewable energy to happen in the 2030-40 decade when renewable energy would be the primary source through which the incremental energy demands in the decade are met. Below is the estimated summary of incremental energy demand in India:

Jun 27, 2022

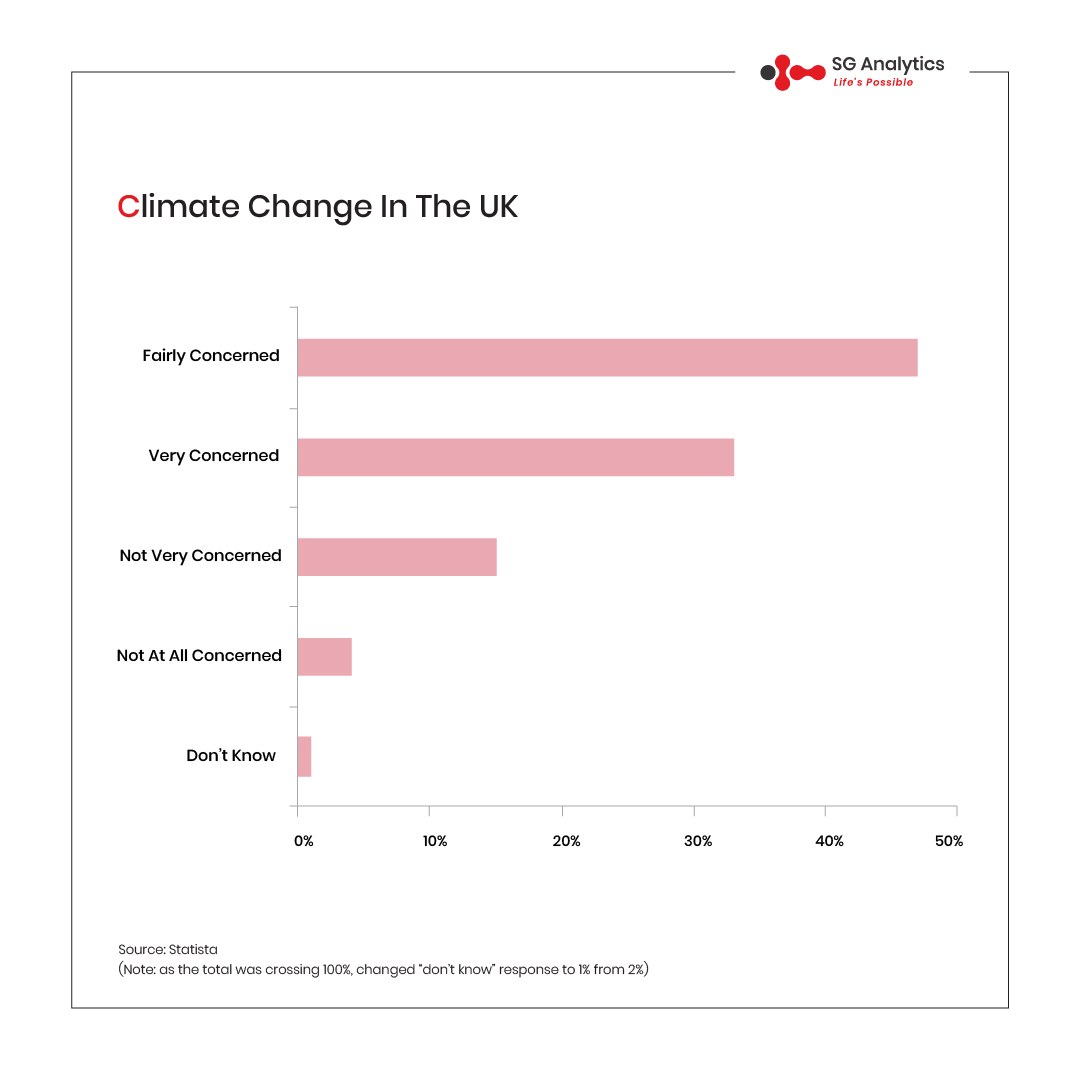

Climate change is defined as the long-term variation of temperature or climate patterns in a particular region (increase in average temperature, torrential rain, and severe droughts). While natural causes of climate change include variations in the Earth's orbit, changes in the sun and volcanic emissions, the causative agent of climate change is the concentration of carbon dioxide (CO2) emissions in the atmosphere as a result of anthropogenic actions. The increasing capacity of the atmosphere to absorb heat, known as the "greenhouse effect," causes global warming.

Effects of climate change in the UK

Climate change has become a reality in the UK, and a number of research reports predict that until we take collaborative action to prevent it, things will only get nastier. According to the UK State of the Climate report (out in July 2021), 2020 was the third hottest summer year in the UK since 1884. Moreover, all of the years in the top ten have occurred since 2002. 2020 was also the fifth wettest year on record in the UK, and six out of the top 10 wettest years have occurred since 1998. Furthermore, the UK has warmed by 0.9°C and gotten 6% wetter in the last 30 years.

The UK climate in 2050

It is predicted that if no action is taken to combat climate change, all areas of the UK will experience drastic changes in climate and weather trends. The third Climate Change Risk Assessment (CCRA3) Technical Report identifies 61 climate risks that affect multiple sectors of society. The report recognises an eclectic range of unaffordable climate change impacts, including those on health and productivity, which will affect many of our families, businesses, and public services. The report cited that, unless we take further action, annual flooding damages for non-residential properties in the UK are expected to rise by 27% by 2050 and 40% by 2080 under a 2°C by 2100 warming scenario. Considering 4°C change, this rise is expected to be 44% and 75%, respectively.

Following a series of climate change protests in the UK, the government introduced the Climate Change Act to formalise the country's approach to addressing the issue. For many years, the UK has also had the Climate Change Levy (CCL), a government-imposed tax to encourage the reduction of greenhouse gases and higher efficiency of energy used for business or non-domestic purposes.

Good things come in small packages! SGA Beat comprises insights-fuelled short stories on the hottest industry trends and topics, based on the latest information straight off our latest research endeavors. Beat is packaged in bite-sized, short-form nuggets and presented to you as quick reads – enriched with facts and insights that are easy to absorb and assimilate. Catch-up on the latest buzz around, one refreshing read at a time!

The tech industry has struggled owing to several factors like inflation and layoffs in the recent past, but has also been able to innovate successfully owing to the exponential rise in data. More importantly, organizations have been forced to confront some of the biggest challenges related to the collection, storage, analysis, and management of data, while keeping costs at bay.

As the volume of data and its usage continues to grow, the need for organizations to democratize data or make it available to their employees and other stakeholders has become more important. Unlimited access to digital information empowers employees and drives communication and decision-making based on data-driven insights, while also safeguarding company data.

Leadership Role

The top management’s role in actively supporting and participating in the data democratization process is critical, as it causes a huge cultural impact on the organization. Therefore, business leaders need to inform stakeholders about the strategies and operational changes, and lead processes to drive a data-driven ecosystem. They must connect and communicate more often with their employees, while the data analytics team must focus on building a data governance approach to help drive actionable insights.

Data-driven Ecosystem

Data democratization brings about a complete cultural change, wherein employees and stakeholders must be trained to infuse data into their day-to-day operations and also share data to influence the decision-making course. Leaders also need to invest in training and change-management practices to understand how to extract the value of data to make well-informed decisions.

Process Definition

All employees and stakeholders would need access to a robust data management architecture, including the tools, software, and processes. Such a strategy ensures that all authorized users would access the same data or be guided by the same data management principles (training, data sources, security, governance, storage, etc.) to build their decisions.

Cloud is a Game Changer for Governing Data

Integrating and evaluating the large volumes of data stored in siloed systems across industries can be challenging to control, resulting in compliance irregularities, reduced sales, and unnoticed opportunities. As a result, most organizations have been relying on the cloud to store, manage, share, govern, and protect their data across financial services, logistics and supply chain, and other sectors. Cloud enables businesses to gain competitive and customer advantage, and at the same time helps earn maximum business value from data.