Send Inquiry

Jun 13, 2022

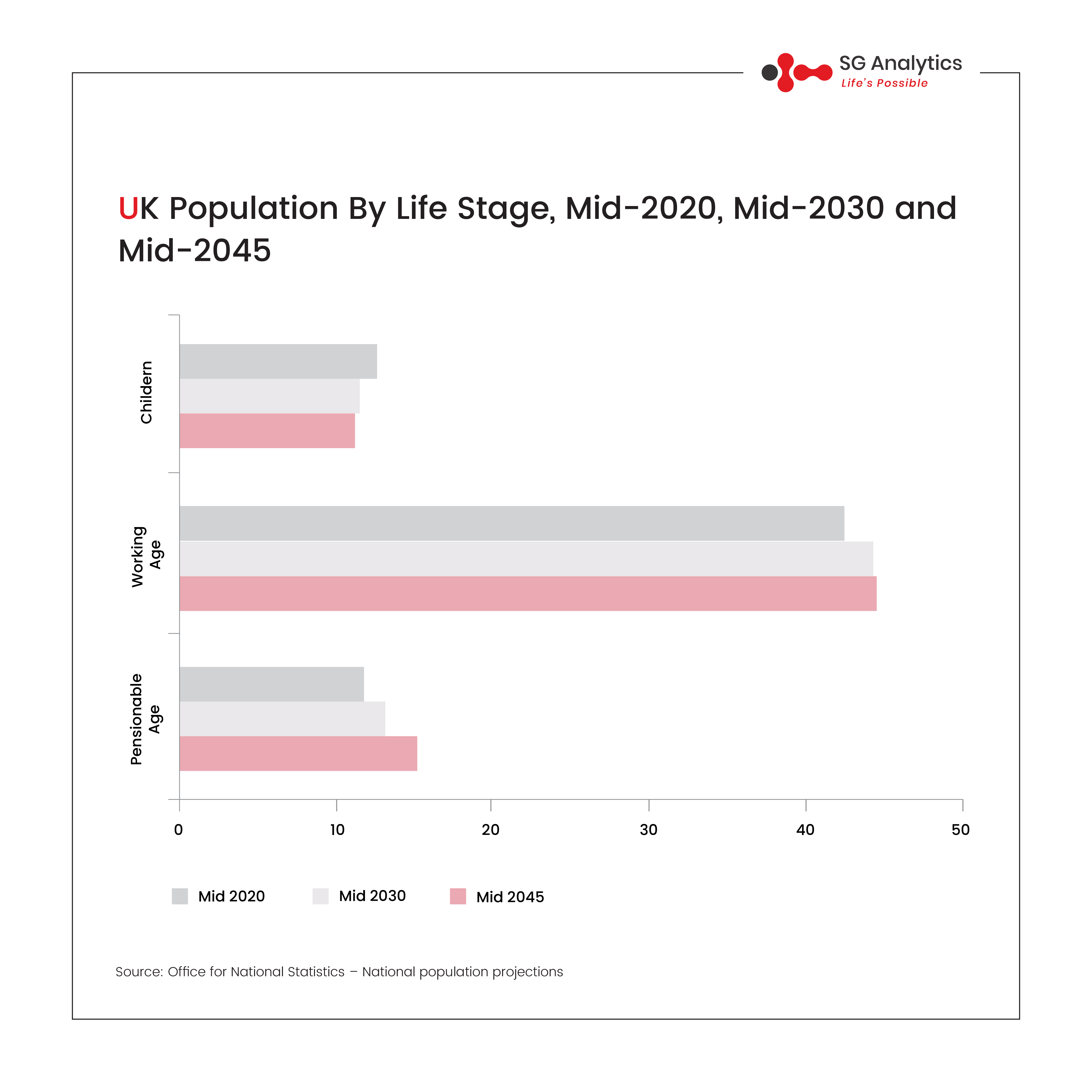

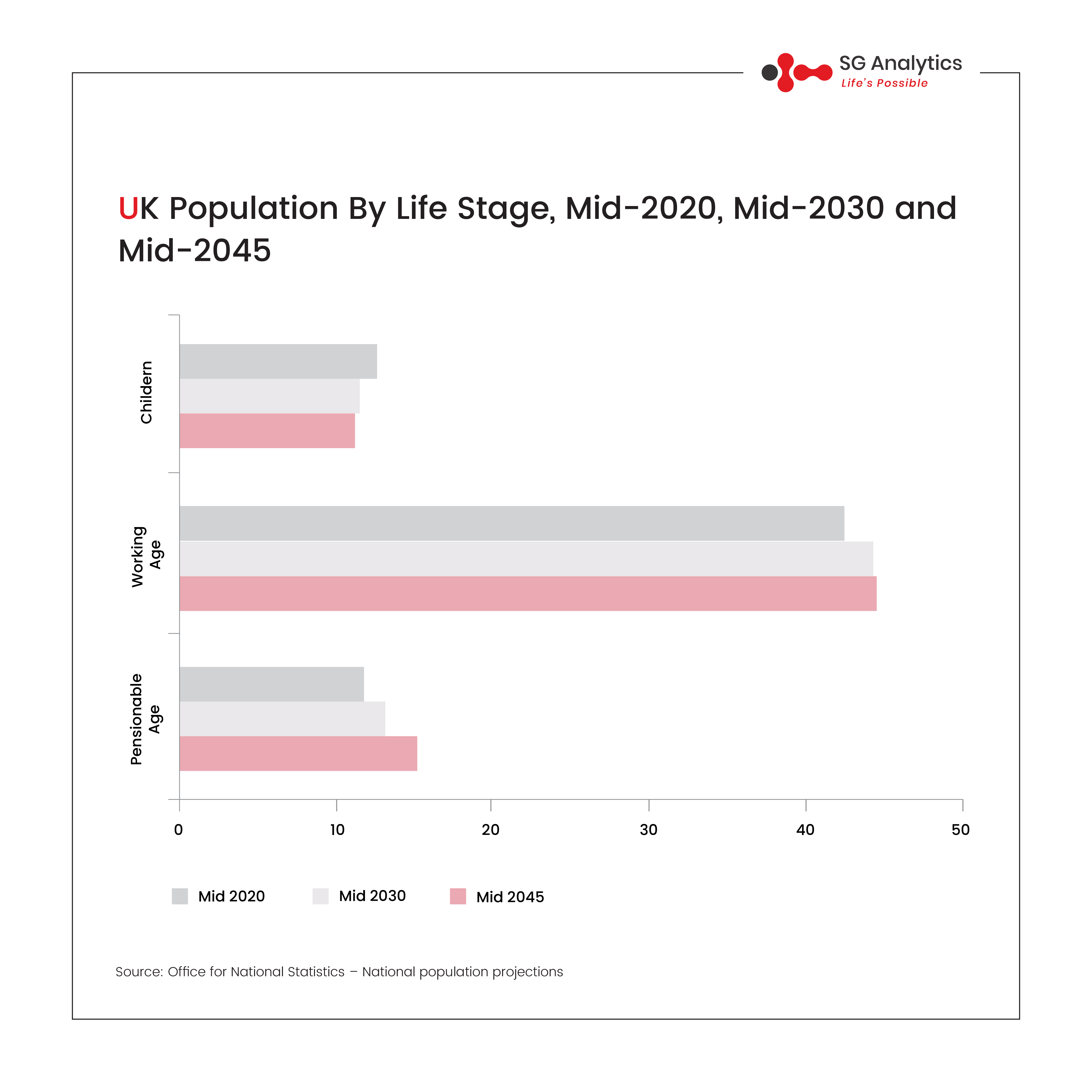

Every nation in the world is experiencing an increase in the size and proportion of older people in the population as people are living longer. Population ageing began in high-income countries due to high standards of living. It is now shifting to low- and middle-income countries. The UK is no exception, as people are living longer than ever before. In 2019, one in every five people in the UK was 65 or older, accounting for ~19% of the population of 12.3mn people. Between 2009 and 2019, the population of this age group increased by 23%, compared to a 7% increase in the overall population.

According to Office for National Statistics, the number of people aged 85 and over is expected to nearly double to 3.1mn by 2045 (4.3% of the UK population), from an estimated population of 1.7mn in 2020 (2.5% of the UK population). There are expected to be many more people in their later years by 2045, owing in part to the fact that the baby boomers of the 1960s are now approaching the age of 80, as well as an overall rise in life expectancy.

All English residents have access to free public health care through the National Health Service (NHS). This includes hospitalisation, physician care, and mental health treatment. The National Health Service budget is supported by general taxation. The number of working-age people and children is projected to remain around mid-2030 levels by mid-2045. During the same time period, the number of people of pensionable age will rise to 15.2mn (28% jump compared to the 2020 level). This increase in the ageing population can put pressure on the NHS’s spending as they are likely to avail of the benefit and not contribute much through tax. However, the ageing population can continue to make an increasing contribution to society if they remain healthy, mould themselves to changing working conditions in the workplace, and access the training to adapt to evolving labour market. Nevertheless, employers must also step up and adapt to an ageing workforce.

What do you think? Are you ready to recruit ageing employees?

Apr 18, 2022

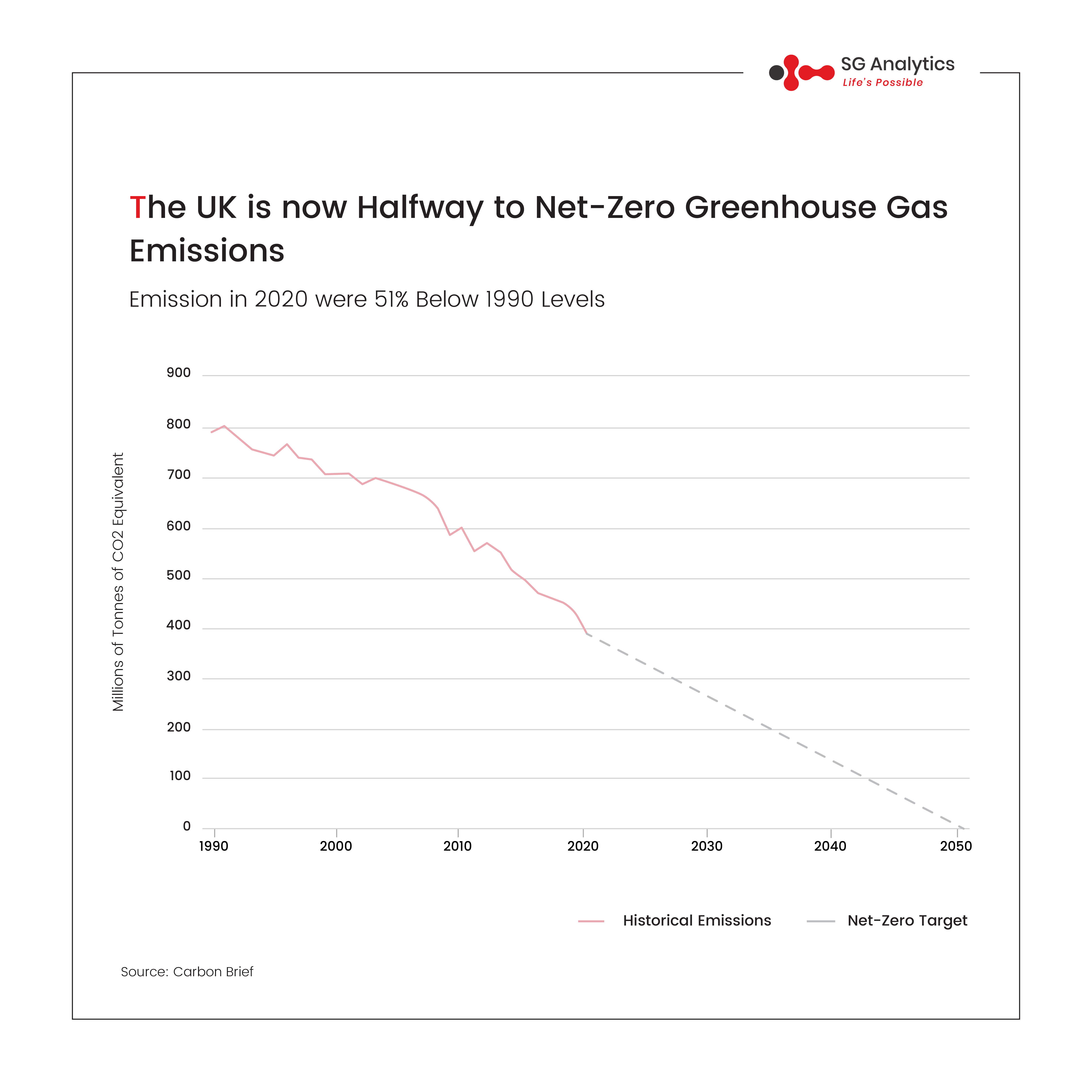

Starting April 6th, it has become mandatory by law for 1300 of the largest UK-registered companies and financial institutions to disclose climate-related financial information, making the UK the first G20 country to enact ESG disclosure laws aligned with the TCFD (Taskforce on Climate-Related Financial Disclosures). The TCFD, launched in 2015 at the Paris COP21 by the Financial Stability Board (FSB) can be used by companies, banks, and insurers to provide consistent and transparent climate-related risk disclosures to relevant stakeholders.

The law came into effect for UK’s largest traded companies, banks, insurers, and private companies with at least £500 million in turnover and over 500 employees, thereby enabling investors and businesses to align their long-term strategies with UK’s net-zero commitments. Companies will have to start collecting ESG data beginning April 6th and disclose them in annual reports.

The UK Energy and Climate Change Minister Greg Hands said that if the UK was to meet its ambitious net-zero commitments by 2050, the financial system including the largest businesses and investors will have to put climate change at the heart of their activities and decision making.

The companies will have to disclose four key areas: Governance, Plans & Strategies, Risk Management, and Metrics & Targets. Companies will also have to provide data on their Scope 1, 2, and 3 GHG emissions with targets and plans to reduce these GHG emissions.

Is your country next?

Apr 11, 2022

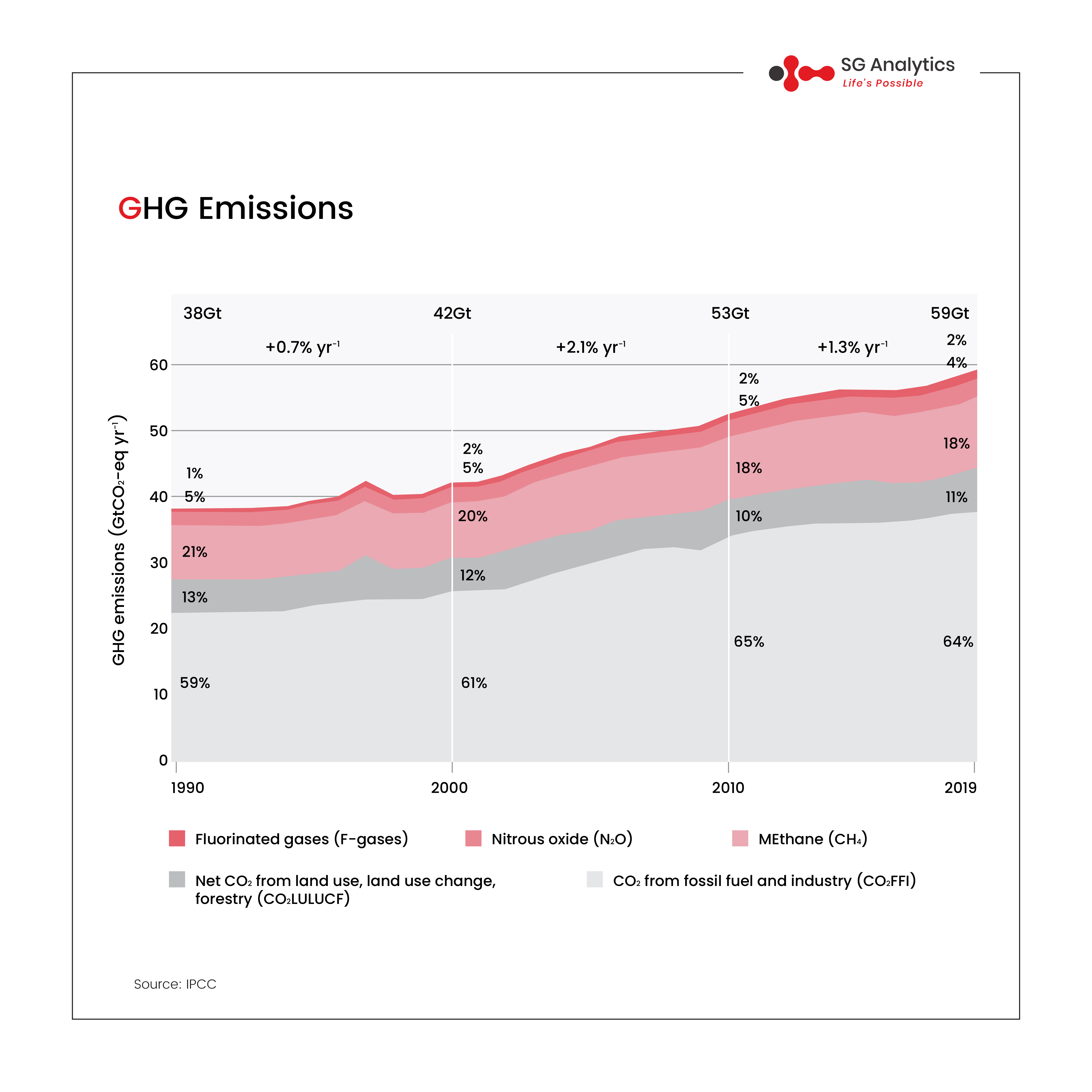

The latest Assessment Report (AR6) by the United Nations’ Intergovernmental Panel on Climate Change (IPCC) makes it clear that it is “now or never” for the planet. The report warns that the global emissions are going to peak by 2025 unless there is a decline of 50% on a global scale to limit global warming to 1.5 °C by 2100. Based on the current trends, the global temperature is estimated to increase by 3 °C. To prevent climate devastation, drastic steps will have to be taken to reduce emissions. To limit global warming to 1.5 °C, GHG emissions will have to be reduced by 43% by 2030, and methane emissions will have to be reduced by 34% by 2030. To limit global warming to 2 °C, GHG emissions will have to be reduced by 27% by 2030.

On the other hand, the report also states the positive impacts of some mitigation efforts. Renewables have taken the center stage in mitigating climate change risks. Solar and wind energy usage has significantly increased globally, having a cleansing effect on climate. Few countries have achieved a steady decrease in emissions consistent with the goal to limit global warming to 2 °C. Zero emissions targets have been adopted by at least 826 cities and 103 regions around the world.

The way forward for the entire world to reduce negative climate impacts is to curb the usage of fossil fuels. Climate models have suggested that emissions from existing and planned fossil fuel projects have already exceeded tolerable carbon emissions. The efforts put in by nations to meet committed goals and targets should not be limited only to curbing emissions but should also focus on expanding green covers such as forests and improved agricultural practices. Also, under-developed nations will require financial aid to make the transition from a fossil fuel-based economy to a greener and more sustainable economy.

Apr 08, 2022

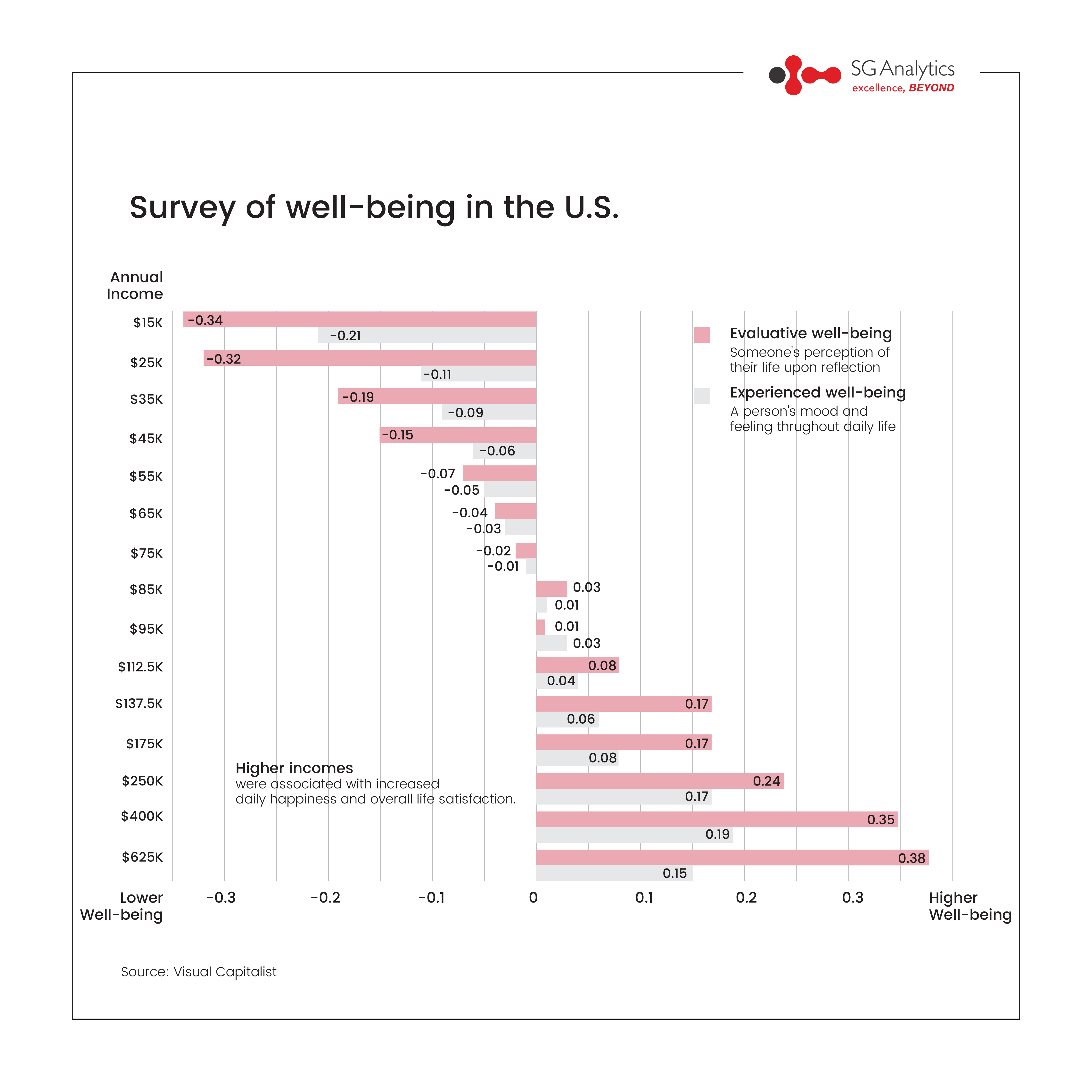

Money has a critical role to play in our lives. It’s a common notion that money can’t buy happiness, but not having it (or enough of it) can cause many sleepless nights. A reliable and comfortable income certainly makes life easier. It is negatively correlated with emotions like stress and is rather correlated with higher self-esteem, security, and dignity. So, yes, money can indeed buy happiness. The question is, how much money is enough? In 2010, a study published by Nobel laureates Daniel Kahneman and Angus Deaton stated that the quality of one's life increases as one earns more. However, the feeling flattens around USD 75,000 (annual income). Although, eleven years later, in 2021, a study published by Matthew Killingsworth of the University of Pennsylvania found that well-being rises with income—even beyond USD 75,000.

So, how much is enough? The truth is, money itself falls short. It is not the end-all-be-all for happiness. Killingsworth's study also found that people who equated money with success reported being less happy than those who didn't. That's because high income comes with tradeoffs. High earners report a heightened sense of achievement, but they are also more stressed. And lonely. Instead, here's the secret to happiness: money, yes, but also the right mix of good social relationships, exercise, and a sense of purpose. In fact, people who have a job they love and which gives them a sense of purpose report greater happiness—regardless of the money they earn.

If you found this post interesting, do 'Like' and 'Share' it, and 'Follow' us here to access more of such exciting content. You can also write to us at beat@sganalytics.com.

Dec 17, 2021

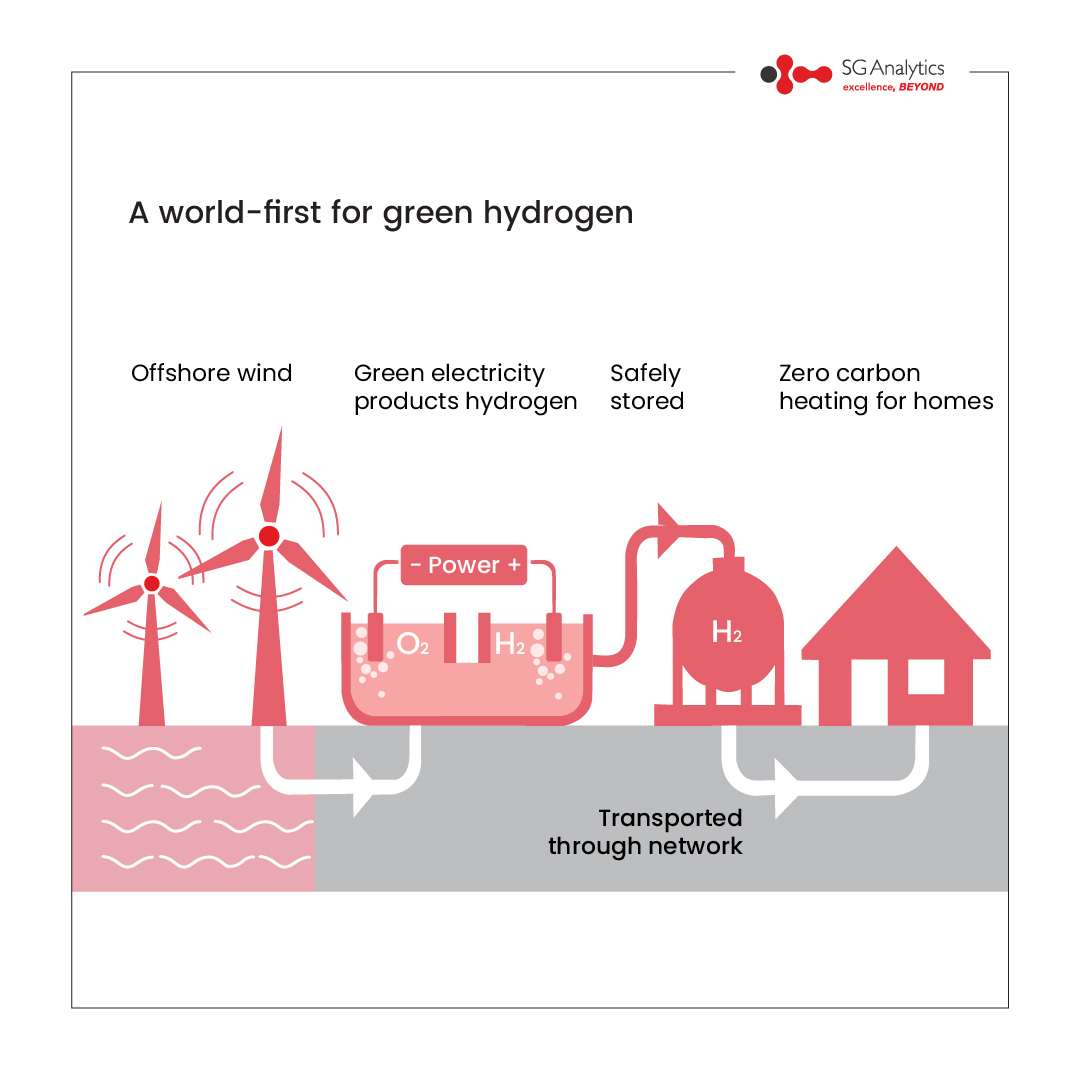

The world is racing against time to achieve the ambitious goal of attaining carbon neutrality by 2050. While solar and wind power have emerged as solid pillars in the transition away from fossil fuels, they are far from perfect. The world is increasingly looking for more efficient and sustainable options. So, what could be the solution? The answer is Green Hydrogen, which can emerge as a quick enabler toward a greener world.

Hydrogen gas (aka Grey Hydrogen) is widely used in various industrial applications. It is primarily produced using steam methane reforming, which uses natural gas and releases carbon dioxide and carbon monoxide. That is anything but eco-friendly. On the other hand, Green Hydrogen is produced using a simple, eco-friendly electrolysis process that leaves behind oxygen as its only by-product. It enables decarbonization and can significantly reduce our dependency on fossil fuels.

It is estimated that the production process would offset c.20% of the CO2 emitted per annum in producing Grey Hydrogen. It gets better. Green Hydrogen can be used in transportation, electricity generation, heat generation, infrastructure, energy storage, and much more. Accordingly, the demand for Green Hydrogen is expected to reach 500mn tons by 2050, making up for ~20% of the global energy demand.

However, the biggest impediment in its widespread adoption is its cost (USD 3-7 per kg, vs c.USD2.0 per kg for Grey Hydrogen). But like any other innovative technology, as it scales, it will become more affordable (estimated cost USD 1.4-2.4 per kg by 2030) provided we make a collective effort and ensure financial commitments from key stakeholders.

Dec 10, 2021

Chinese property developer Kaisa Group Holdings has become another victim of China’s deleveraging campaign under the “three red lines” rule. Yes, it, too, has failed to service its bond.

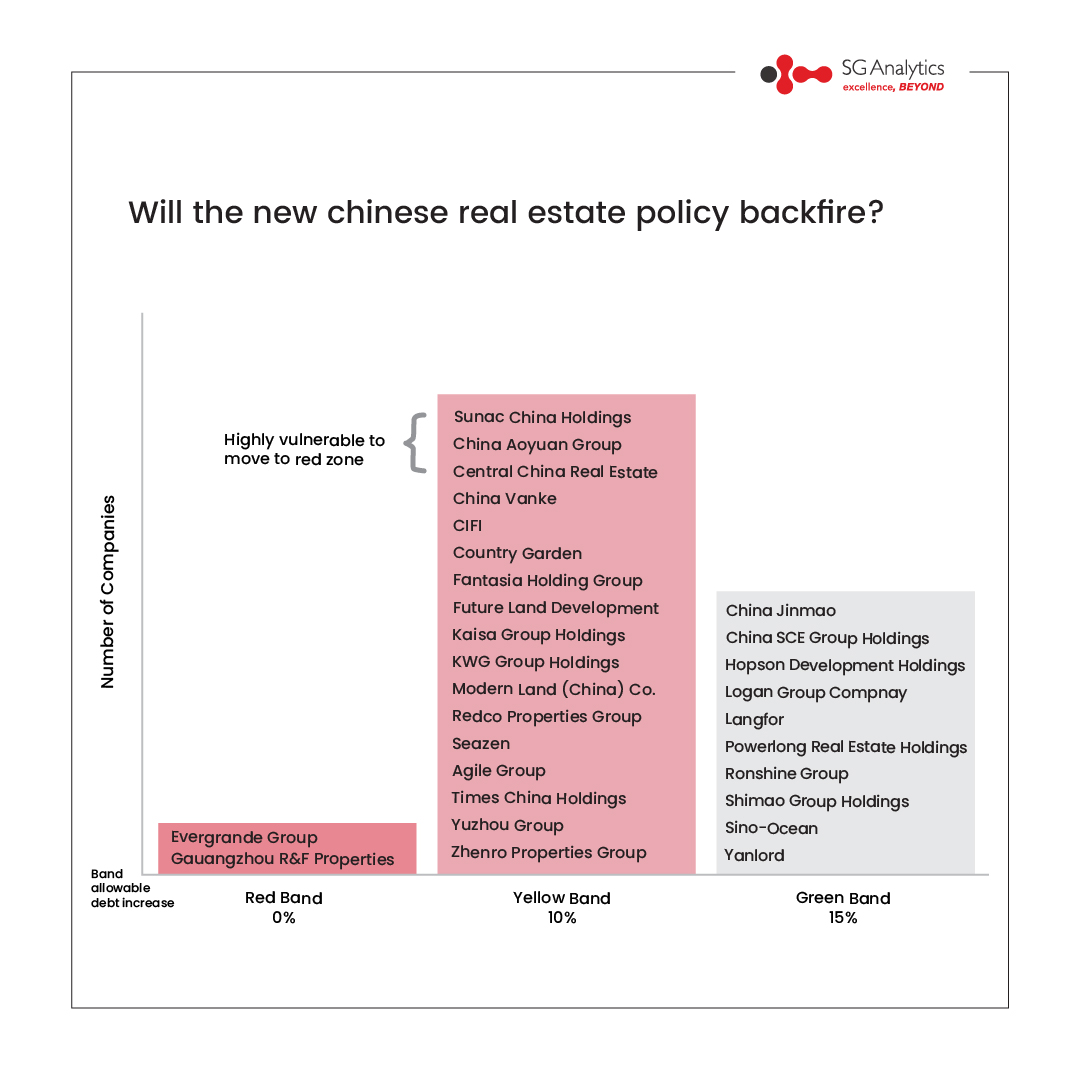

The much-criticized policy has shaken the foundation of the Chinese real estate sector, which, along with related industries, contributes c.30% to China’s GDP. After 20 years of rapid growth, the Chinese real estate sector is worth more than $50tn, or ~2x the US property market. In a previous SGA Beat, Will the New Chinese Real Estate Policy Backfire?, we highlighted the policy's possible implications on China’s real estate sector. Subsequently, we covered Evergrande's crisis in a much-shared blog. https://us.sganalytics.com/blog/chinas-perfect-storm-will-evergrande-swim-or-sink

China's Evergrande averted technical default by paying the interest at the fag-end of the grace period till last month. However, the tightening of the financial condition following the Evergrande crisis has led to several developers such as China Fortune Land Development (CFLD), Sunshine 100, Sichuan Languang, Sinic Holdings, and Fantasia Holdings Group, etc., failing to service debt, and leading to a default scenario. Now the likes of Kaisa, having a cash-to-short-term debt ratio of more than 1.5x, have come under pressure. Falling property prices and sales amid a sector rout have deteriorated liquidity and pushed the cash-to-short-term debt ratio lower. As more developers come under stress, the government looks prepared to support the sector rather than allowing more players to default. That said, a few companies still look vulnerable.

Good things come in small packages! SGA Beat comprises insights-fuelled short stories on the hottest industry trends and topics, based on the latest information straight off our latest research endeavors. Beat is packaged in bite-sized, short-form nuggets and presented to you as quick reads – enriched with facts and insights that are easy to absorb and assimilate. Catch-up on the latest buzz around, one refreshing read at a time!

Every nation in the world is experiencing an increase in the size and proportion of older people in the population as people are living longer. Population ageing began in high-income countries due to high standards of living. It is now shifting to low- and middle-income countries. The UK is no exception, as people are living longer than ever before. In 2019, one in every five people in the UK was 65 or older, accounting for ~19% of the population of 12.3mn people. Between 2009 and 2019, the population of this age group increased by 23%, compared to a 7% increase in the overall population.

According to Office for National Statistics, the number of people aged 85 and over is expected to nearly double to 3.1mn by 2045 (4.3% of the UK population), from an estimated population of 1.7mn in 2020 (2.5% of the UK population). There are expected to be many more people in their later years by 2045, owing in part to the fact that the baby boomers of the 1960s are now approaching the age of 80, as well as an overall rise in life expectancy.

All English residents have access to free public health care through the National Health Service (NHS). This includes hospitalisation, physician care, and mental health treatment. The National Health Service budget is supported by general taxation. The number of working-age people and children is projected to remain around mid-2030 levels by mid-2045. During the same time period, the number of people of pensionable age will rise to 15.2mn (28% jump compared to the 2020 level). This increase in the ageing population can put pressure on the NHS’s spending as they are likely to avail of the benefit and not contribute much through tax. However, the ageing population can continue to make an increasing contribution to society if they remain healthy, mould themselves to changing working conditions in the workplace, and access the training to adapt to evolving labour market. Nevertheless, employers must also step up and adapt to an ageing workforce.

What do you think? Are you ready to recruit ageing employees?