Early July this year, Disney released the long-awaited Black Widow. However, instead of releasing it in theaters worldwide, as had every film from the Marvel franchise, Disney released the origin story on its streaming platform, Disney+. What’s more, it did so after 14 long months of delay, thanks to the pandemic.

What made news, however, was the fact that soon after the film was released, Disney revealed how much it had earned over the weekend. Over $60 million, Disney reported. Not bad for a film released just online.

Why was this newsworthy? Because for the first time, a streaming platform had publicly revealed the earnings made from a release. Before, platforms would only disclose indicators of success, such as viewing hours or the increase in subscribers following a release. Disney put a big, fat number on the table.

Netflix, one of Disney’s strongest rivals, has never disclosed such a figure. But recently, following the cosmic success of its original series, Squid Game, Bloomberg reported that Netflix made over 40 times of what it had invested in producing the show, according to leaked data. The story also noted that the controversial Dave Chappelle special, The Closer, could not even break-even.

The problem is, operating on a subscription model, Netflix, like Disney, does not make money as traditional Hollywood productions do—that is, on single titles. What, then, explains the sums? Disney disclosed its earnings publicly, but it was devoid of context. Netflix’s numbers wouldn’t even have come out had the data not leaked. It was supposed to be strictly internal.

“Over $60 million, Disney reported. Not bad for a film released just online.”

“Over $60 million, Disney reported. Not bad for a film released just online.”

No one fully understands how streaming platforms define success, not even the directors and producers who create shows for them. But we can get an idea by piecing together leaks and admissions from here and there. Here goes.

How Netflix counts wins and losses

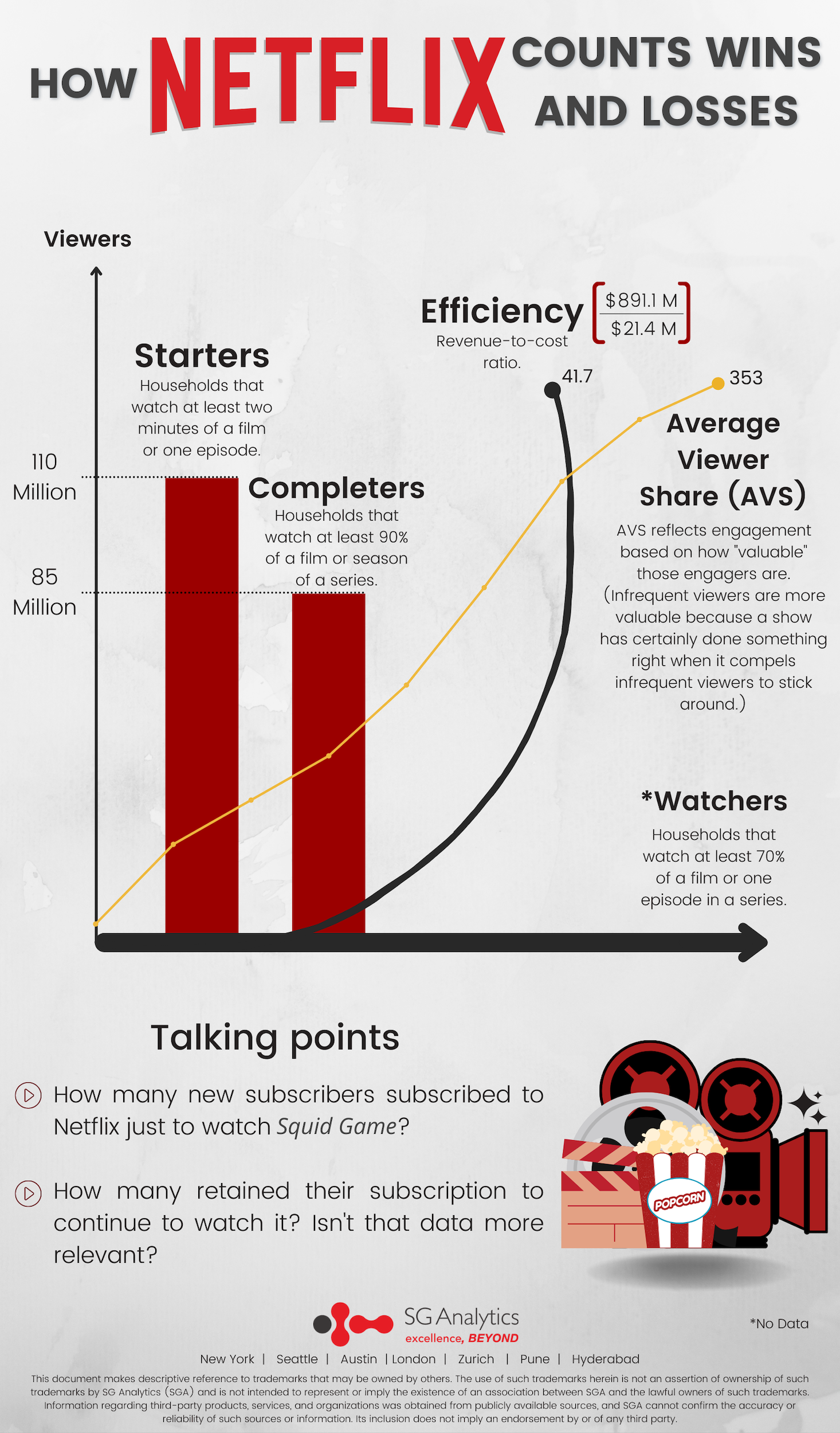

Many indicators of success have surfaced over the years. In 2019, The Verge reported that Netflix relies on three key metrics to determine whether a release is successful. Keep in mind that the values are measured within a window of 28 days.

- Starters: Households that watch at least two minutes of a film or one episode.

- Completers: Households that watch at least 90% of a film or season of a series.

- Watchers: Households that watch at least 70% of a film or one episode in a series.

The Verge reported that the values of Starters and Completers are most telling of whether a show ought to be renewed. The data is often shared with the creators, but not in complete detail. As for Watchers, the data is generic, and Netflix itself has often shared it publicly. Netflix has confirmed, for example, that Squid Game has over 130 million viewers worldwide.

Netflix confirmed that the global sensation broke the previous record of 82 million viewers, held by Bridgerton. Over 110 million of those 130 million were Starters, while over 85 million were Completers, finishing the series within 28 days.

But the numbers only tell one part of the story. Here’s what’s still unclear: How many new subscribers subscribed to Netflix just to watch Squid Game? And how many retained their subscription to continue to watch it? Isn’t that data more relevant?

Viewing data says very little of revenue, and the spike in subscribers—which does—is yet to be uncovered. Bloomberg, however, threw another indicator into the mix. However, it’s still unclear how Netflix arrived at the number.

The new indicator is called efficiency. The indicator provides a better estimate of a release’s success. That is how we know Dave Chappelle’s special didn’t breakeven—the data reported its efficiency to be 0.8. The special cost Netflix just over $24 million. But it made only around $19 million. Squid Game? Its efficiency was reported to be over 41. For a production cost of $24.1 million, or $2.4 million per episode, Netflix made nearly $900 million. Jackpot.

And yet, despite the astronomical figure, despite Squid Game being among the top shows in over 90 countries, we still lack subscriber-related data—data that would confirm the stunning claims.

“The values of Starters and Completers are most telling of whether a show ought to be renewed.”

“The values of Starters and Completers are most telling of whether a show ought to be renewed.”

Lastly, there is the AVS—or Average Viewer Share. AVS reflects engagement based on how valuable those engage-rs are. So, who’s valuable? It depends on whom you ask. Though Netflix’s Chief Product Officer, Neil Hunt, has stated that those subscribers who tune in infrequently are more valuable. That’s because a show has certainly done something right when it compels infrequent viewers to stick around. Frequent viewers would have stuck around anyway.

According to Hunt, the hours of infrequent viewers are more valued at Netflix. Still, “valued hours” remains only one of many indicators that the streaming giant uses to determine the impact of a release.

Transparency and the meaning of growth

Many creators have criticized Netflix for its lack of transparency.

Netflix is a business, so it’s understandable when it cancels a show when it fails financially, even though the show has succeeded culturally. However, what constitutes a success or failure is entirely internal, decided by its executives, hidden to creators. Therefore, the reason why their show has been canceled is technically unclear. That indeed is unfair, and Netflix has acknowledged the problem publicly.

The lack of transparency is also a problem for investors.

Since Squid Game first premiered on September 17, Netflix’s stock rose by 7%, taking its value to over $278 billion. Other than that, however, Netflix had a poor run this year. It released over 100 titles, but in the first half of 2021, Netflix garnered just short of 5.5 million subscribers—the lowest since 2013. Experts argue that Netflix’s growth has saturated in the US and Canada, and faces an identical fate in Europe over the next few years.

Engagement tells one story; subscribers tell another. If anything, we are up for some good entertainment.

With offices in New York, Austin, Seattle, London, Zurich, Pune, and Hyderabad, SG Analytics is a leading research and analytics company that provides tailor-made services to enterprises worldwide. If you’re looking to make critical data-driven decisions, decisions that enable accelerated growth and breakthrough performance, contact us today.