The importance of environmental, social, and governance data cannot be underscored in the present dynamic industry. Eco-friendly, societal, and management concerns are becoming the focus. The era of evaluating achievement solely through the fiscal soundness of a company is a thing of the past. Increasingly individuals are being mindful of the effect of businesses on nature and the world. Also, people focused on the way companies treat their personnel and how they oversee their conduct ethically.

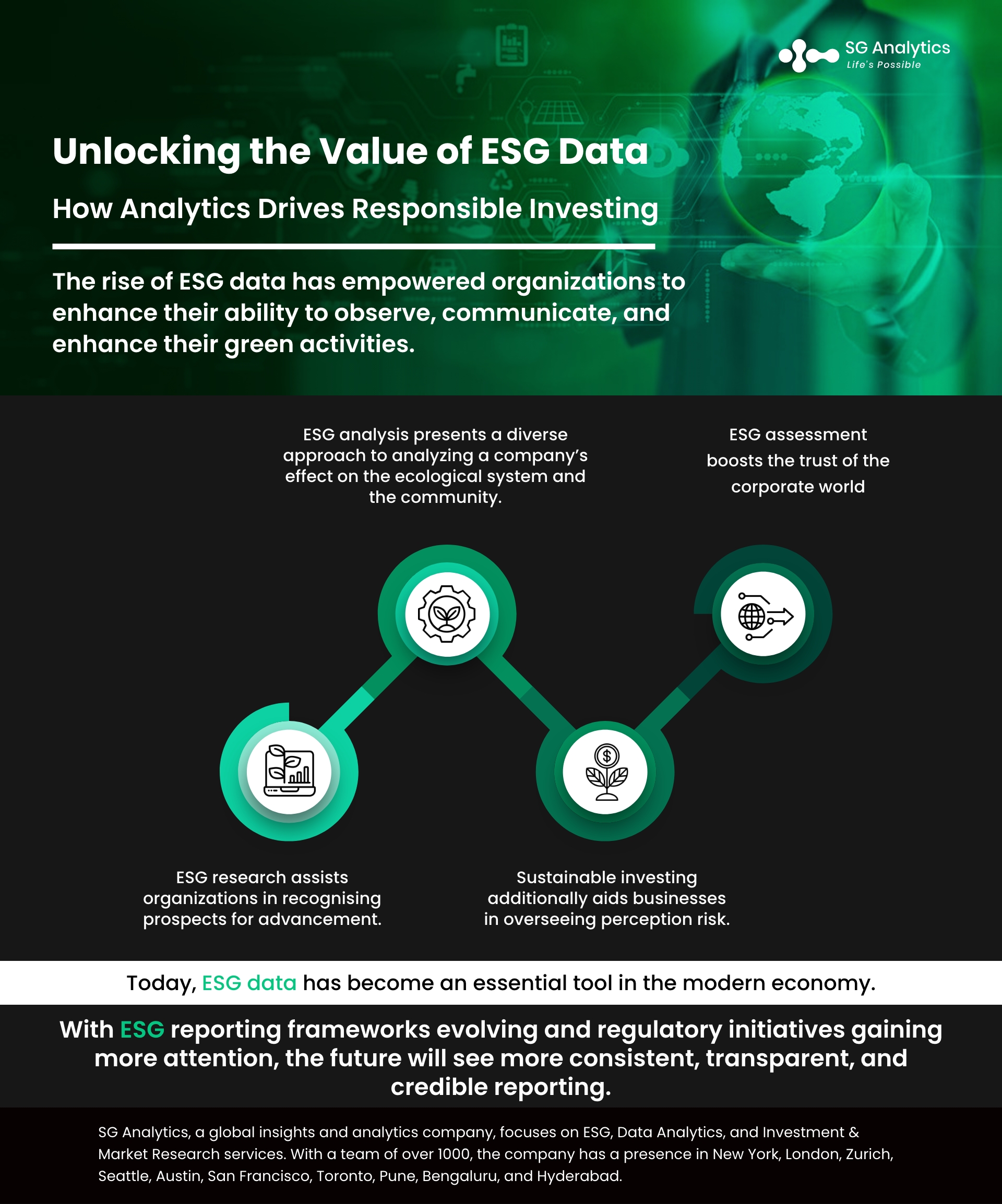

The rise of Environmental, Social, and Governance data as a beneficial source has empowered organizations to enhance their ability to observe, communicate, and enhance their accountable and green activities. Consequently, companies now have the capacity to make decisions with greater information and implement strategies that support environmentally friendly approaches.

ESG Data has developed into a guide that shows the path for modern companies to enhance resilience, intention-driven, and inclusiveness. This clarifies the reason it has turned into a key ingredient in the business world in the contemporary era.

The elements of ESG in business processes can be improved in comprehension through the use of ESG data. In this manner, the sustainability of a company, ethical business practices, and the generation of sustainable value might be judged by stockholders, involved parties, and ESG assessment agencies. Nevertheless, it's crucial to observe that such assessments might differ based on the particular standards and methods implemented by all involved.

Investors can improve their decision-making, mitigate risk, and locate firms that have similar values and devotion to sustainability. If they consider ESG data in mind, it has the potential to assist them in accomplishing the desired objectives. Consequently, it is expected that numerous financial institutions are pulling funds from corporations that neglect ESG guidelines.

Importance of ESG Data in Responsible Investing

ESG functions as a valuation technique that takes into account environmental, social, and governance issues. An ESG assessment identifies a company's risks and practices based on environmental, social, and governance criteria.

As a result of ESG frameworks, sustainable investing can help individuals or organizations determine whether a company's values are aligned with their own and analyze the ultimate worth of companies.

Over the past two years, several governmental bodies have enacted new laws requiring corporations to report ESG metrics, and many countries have updated their environmental and social disclosure regulations.

Companies are thus facing pressure from investors to enhance their transparency and performance on the ESG data and analytics front. Yet, most businesses are not able to meet these requirements. They do not have automated solutions for across-the-board compliance tracking and management.

Understanding ESG Analytics and Its Impact on Investment Decisions

Sustainable investing, also known as ESG analysis, thoroughly examines the operational aspects of a company, its achievements, and its influence on various parties such as ecosystems, communities, and stockholders. This offers a thorough comprehension related to the company's environmental practices and assists shareholders in making well-informed choices. The method for investing and business investigation has garnered substantial scrutiny in the recent past. The importance of environmental preservation and business accountability has become more noticeable, which has made ESG Analytics more important.

Ecological factors, as part of ESG analysis, examine the impact of a company has an effect on the surroundings. The foundation examines the carbon footprint, waste minimization, and control, which involve sustainability policies and actions. The influence of the company on the public is the theme of social examination. The examination includes evaluating the firm's workforce policies and processes. Moreover, it encompasses assessing its human rights performance, public relations, and initiatives promoting diversity and inclusion.

An analysis of the company's governance reviews the company's administration and the processes of making decisions. This consists of operational visibility, the performance of its board of directors, and broader corporate culture. This element of Environmental, Social, and Governance analysis is essential for examining the business's prosperity in the long run and steadiness.

Investors utilize Environmental, Social, and Governance analysis to find businesses that uphold sustainability and responsible business practices. Such an examination can help investors in making better-informed investment picks. This can additionally assist individuals in aligning their belongings according to their principles and pursuits. Environmental, social, and governance analysis can also assist companies to spot areas for improvement and keep tabs on their development.

Sustainability analysis has become more significant in recent years as stakeholders have become more concerned about the corporate influence on society and the environment. Consequently, organizations are currently dealing with more intense stress to provide transparency on their ESG initiatives and showcase their dedication to sustainable practices. Consequently, numerous companies started to consider environmental, social, and governance analysis seriously. The company is adopting measures and frameworks to boost its ESG outcomes.

Environmental, Social, and Governance analysis presents a thorough and diverse approach to analyzing a company’s effect on the ecological system, the community, and its interested parties. This offers a complete understanding of a company's sustainability initiatives and assists investors in making informed selections.

Sustainable investment analysis will become more and more important for financial backers, corporations, and related individuals as the relevance of sustainable practices and business ethics develops. With the global gains of a deeper understanding regarding the ecological and societal effects within the corporate sector, the call for it will grow for openness and responsibility.

The Role of Advanced Analytics in ESG Investing Strategies

Sustainable investing has earned significant interest lately among investors, customers, and regulators, growing more concerned regarding the social and environmental effects of corporations. Sustainable investment analysis carefully evaluates the influence of a company among different stakeholders, taking into account the natural surroundings, local communities, and investors.

A major advantage of environmental, social, and governance analysis allows investors to create well-informed investment determinations. Traders can gain a deeper understanding of potential hazards and chances of an individual investment by giving thought to the ESG performance of a corporation. These can offer valuable perspectives regarding the company's ESG practices, supporting investors in making well-informed determinations. As an illustration, organizations with robust ESG practices are frequently regarded as having lower risk and could potentially provide greater long-term investment returns.

Moreover, there is a possibility that it also entices more socially responsible potential investors. Yet another crucial advantage of environmental, social, and governance research is that it fosters company ethics and sustainable practices. Through concentration on the influence an organization possesses within the community as well as the surroundings, Environmental, Social, and Governance research assists organizations in recognising prospects for advancement. Additionally, it allows them to exert themselves to resolve these matters. Thus, it contributes to an environmentally friendly future and guarantees that businesses conduct themselves morally and with responsibility.

Sustainable investing additionally aids businesses in overseeing perception risk. For instance, organizations that are identified as having social and environmental responsibility maintain a strong image. These can result in greater brand retention of loyal customers and satisfaction and overall achievement in the industry. In conclusion, Sustainability analysis has the potential to assist businesses in improving the extent of honesty and social consciousness.

By offering investors and interested parties a comprehensive view of the ESG performance of a company, ESG assessment boosts the trust of the corporate world that the firm is functioning towards the greatest advantages of each interested party. Ultimately, this causes enhanced decision-making and business practices that are environmentally friendly.

Also Read - Driving Sustainable Innovations: AI for ESG Data Challenges.

Conclusion

ESG data has become an essential tool in the modern economy. It enables companies to measure their sustainability efforts, manage risks and meet stakeholder expectations. The importance of ESG data lies in its ability to drive responsible business practices, improve decision-making and drive long-term value creation.

However, the lack of standardized ESG data remains a major challenge that needs to be addressed to ensure accurate and comparable valuations. As ESG reporting frameworks evolve and regulatory initiatives such as the CSRD gain more attention, the future will see more consistent, transparent, and credible reporting that promotes a sustainable and responsible corporate environment. High ESG data is promised.

Building a Greener and Sustainable Future

Before 2023, accountability was seen as pleasant, but that's starting to change. The epidemic refocused attention on sustainability and clean energy. Sustainability, previously an overarching issue, is now a key focus for every company. This presents a unique chance for businesses to evaluate their current state and consider how they could reduce their carbon footprint in the near and far future.

There is an increasing effort by companies of all kinds to combat the effects of climate change. They no longer include it in the brand's mission statement, but it has become a unifying notion that drives them to carry out essential tasks.

Companies are developing brand-new, long-term plans. They are working to lessen their environmental impact by using cutting-edge machinery. This allows them to protect their worker's interests while maintaining open communication. By 2023, brands that must put sustainability first will have already lost the race.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

SG Analytics (SGA), an industry leader in ESG data solutions, serves the world's largest rating agencies, data platforms, and capital market players. We are highly skilled in managing data across a wide range of ESG frameworks, standards, and themes. Our tailored ESG data solutions include ESG aggregation, cleaning, and validation across 1,500+ ESG indicators from various sources, assisting in developing insightful information that facilitates well-informed decision-making.

Furthermore, At SGA, we specialize in providing organizations with the tools and insights needed to navigate the complex landscape of sustainable and responsible business practices. Our ESG analytics services offer a deep understanding of ESG factors and their impact on business performance. With advanced analytics techniques and industry-specific expertise, we transform raw ESG data into actionable insights that drive informed decision-making.