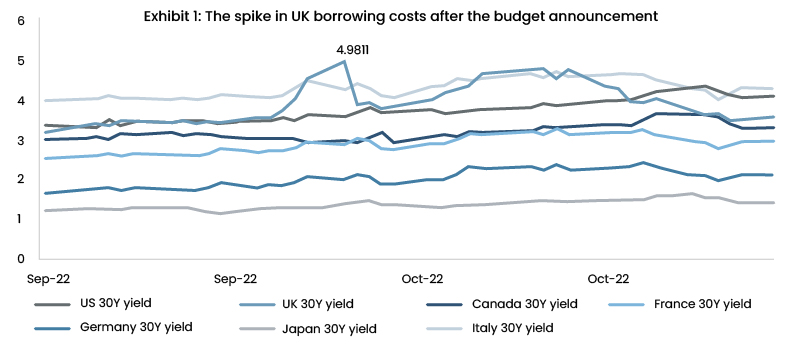

The United Kingdom (UK) seems to be pulled apart on various fronts as the economy grapples with persistent inflation, rising borrowing costs, and weakened growth prospects after the chaos caused by the mini-budget announced in September 2022. Under this budget, the UK government announced a £45bn package of unfunded tax cuts, including support for energy bills, a National Insurance cut, and the reversal of a planned rise in corporation tax. This led to wide-ranging repercussions, with the pound falling to record lows against the dollar and a sharp increase in long-term government borrowing costs.

Source: Investing.com

Read more: The Future of ESG in Financial Services in the UK

Compared to other advanced economies, the UK experienced a significant spike in borrowing costs, as seen in Exhibit 1. This led to a rise in mortgage rates, and many mortgage products were withdrawn from the market. UK pension funds, which trade in government debt, were also affected. The Bank of England (BoE) intervened with a £65bn support scheme to safeguard the pensions sector. This event destroyed the UK institutions’ credibility, and then Prime Minister Liz Truss had to step down from her designated post. Soon enough, the new Prime Minister, Rishi Sunak, came in with the promise to herald a new government that would halve inflation with a reduction in public debt and economic recovery. However, currently, the economy is struggling with stubborn inflation, high yields, weak economic recovery, and shooting public debt levels.

Inflation Hits Alarming Levels

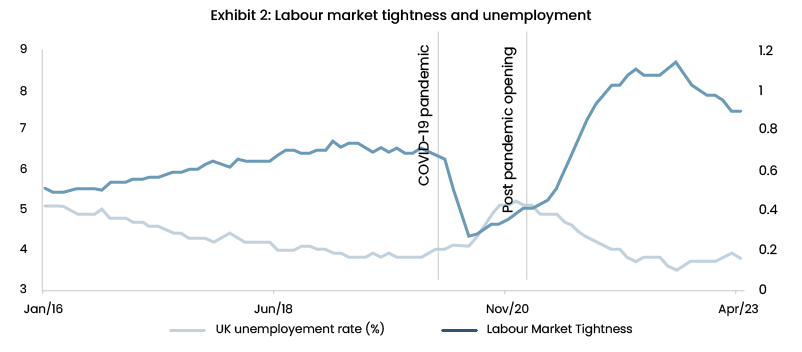

Inflation currently stands at 7.9% in June 2023 after falling from double-digit growth at the beginning of 2023. These price levels are alarming as the British economy has not seen such high levels in over 30 decades. Although it is easing, it remains way over the BoE’s inflation target of 2%. Some of the rationales to this level remain distinctive to the British economy, and one such is the high wage growth observed in the labour market.

Since the reopening after the pandemic, the UK labour market has experienced significant tightening, as shown in Exhibit 2, exacerbated by a decline in the number of European Union (EU) migrant workers caused by the UK’s decision to leave the EU, commonly referred to as ‘Brexit’, which was exacerbated by the pandemic induced lockdown. In 2Q21, as demand rebounded, employers faced an unusually tight labour market with numerous vacancies and low unemployment. Despite some minimal indications of relief, labour market tightness, as measured by the ratio of vacancies to unemployed individuals, remains persistent, leaving companies to grapple with the ongoing recruitment challenges. Additionally, the decrease in labour force participation in the UK can be attributed, in part, to an aging population and the lingering effects of the pandemic.

Read more: Data Consulting for Startups in the UK: Why it Matters and How to Get Started

Source: Office for National Statistics (ONS)

Emerging Doubts About the BoE

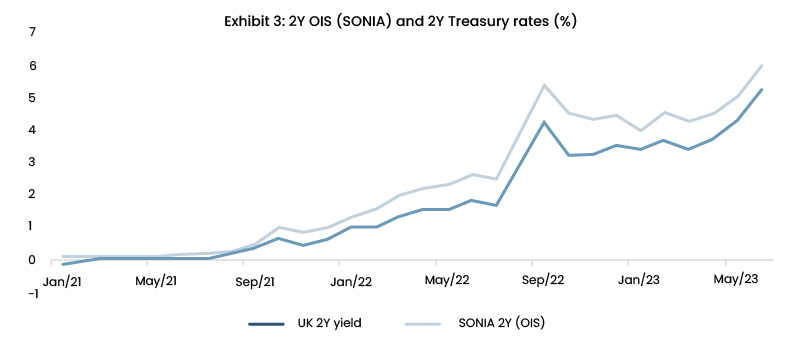

The BoE’s credibility is under scrutiny and can highly influence inflation expectations. Unlike many other central banks, the BoE relies on market-derived indicators rather than its forecasts for predicting future consumer prices. The monetary policy committee, led by Governor Andrew Bailey, tracks inflation trends based on interest rates implied by overnight indexed swaps (OIS), a type of financial derivative.

However, this approach has drawbacks, as the BoE’s inflation predictions over a two-year horizon often proved significantly inaccurate. Reaction to these inaccuracies can be excessive. Let us take the case of April’s consumer price data which exceeded market expectations. These triggered concerns of higher inflation, and OIS rates shot up, as seen in Exhibit 3, causing mortgage rates to surge due to the banks pricing home loans based on these derivatives. Maintaining confidence in the BoE’s grasp of the economy is essential for effectively managing the interest rates and inflation expectations amongst investors, businesses, and households. However, as the bank’s forecasting accuracy continues to falter, trust in the bank is gradually diminishing. A recent survey conducted by the BoE revealed that public satisfaction with the institution reached its lowest point on record last month. Crucially, this vacuum and accuracy of information dents the central bank’s credibility.

Source: Bank of England (BoE), Investing.com

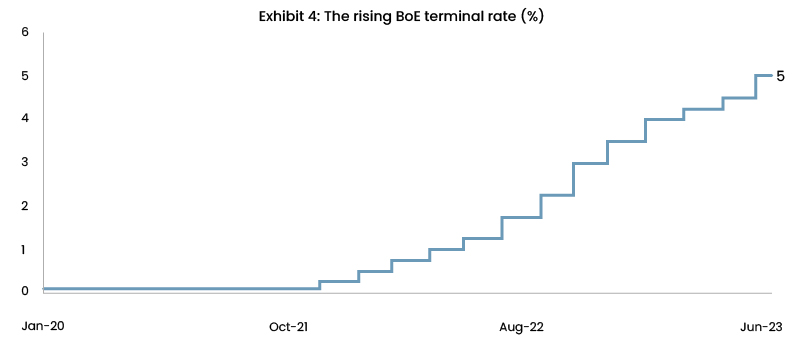

Limitations of the Tight Monetary Policy

From Exhibit 4, we can observe the tightening by the BoE started in December 2021, lifting the rates by 490bps and taking the interest rates to 5% to curb the persistent inflation pressure. However, the lofty interest rates continue to affect the supply side of the economy, which is struggling to recover, and this could tip the economy into danger. Given its size, the UK economy represents only around 3% of the global GDP and has a relatively smaller population. Thus, it is primarily influenced by external factors regarding monetary conditions. Despite any assertions made by Andrew Bailey or his predecessors, there is a certain level of powerlessness in terms of how much domestic monetary conditions can impact the overall economic situation within the country.

Moreover, Brexit’s impact on the UK’s international trade has been a focal point affecting supply disruptions, especially with the EU. Post-Brexit, the UK was excluded from the EU’s single market, leading to a hard border with the continent and the loss of clear tariff rules for trading with the rest of the world. UK exports to the EU and imports from the EU declined by around 22.9% and 25%, respectively, in the first 15 months. The UK-EU trade has decreased, showing some recovery but remains below the potential growth rates. Maintaining a close relationship with the EU is crucial for the UK to mitigate these effects.

Source: Bank of England (BoE)

Market Response to the UK 'Condition'

Elevated interest rates have impacted several sectors, but the housing sector in the UK has been affected the most. Notably, the consequences resulting from previous interest rate hikes are yet to be experienced, primarily due to the characteristics of the mortgage market in the UK. It typically takes around 18 months to feel the effects of monetary policy adjustments. The situation is particularly evident in the looming mortgage challenge faced by 2.5mn mortgage holders, whose favourable fixed-rate deals will expire before the end of the following year. Additionally, investors anticipate substantial downward adjustments to certain asset values, which could exacerbate the risk of defaults.

Read more: Rise of Sustainable Consumption in the UK: Market Research Insights

In the fixed-income market, the UK gilt yields have surged and surpassed the levels seen during the Mini budget crisis in 2022. As a result, the UK government is now paying the highest yield for a gilt issue in the last 16 years. A recent issuance of a short-dated bond with a maturity set for October 2025, totaling £4bn, saw an average yield of 5.68%, marking the most substantial yield for any gilt issue since mid-2007. The offering’s attractiveness led to an oversubscription of 2.77 times.

Source: Investing.com

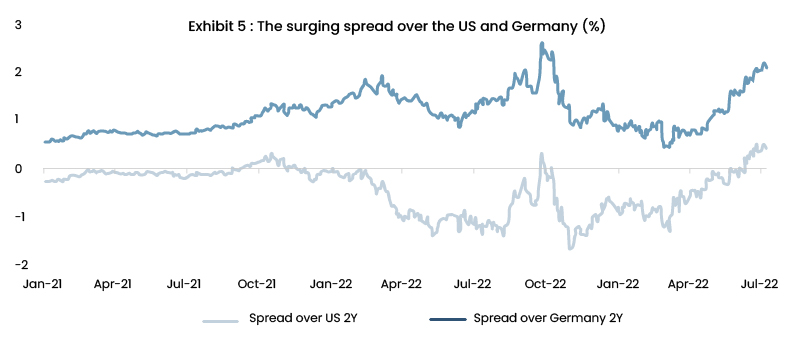

Similar trends in European and US government bond yields have been observed, although less pronounced than in the UK (Exhibit 5). The rise in the UK gilt yields mainly reflects increased expectations regarding the path of the rates, driven by sticky inflation. Whilst liquidity in the UK gilt markets has shown signs of recovery from the disruption experienced in autumn 2022, bid-ask spreads for 10-year UK gilts have remained elevated.

Expectations Going Ahead

As we enter the second half of 2023, there are growing concerns about entrenched inflation in the UK, as the country’s supply-side capacity has suffered significant damage and continues to do so with higher borrowing costs. Addressing high inflation in the UK is expected to present significant challenges. Whilst headline and core inflation have eased somewhat, the focus should remain on core inflation, which remains elevated. The country is experiencing high wage growth, facing labour shortages, alarming productivity levels, and dealing with Brexit-related supply chain and trade-related issues. All these factors are likely to make taming high inflation a difficult task in the UK. Moreover, the impact of monetary policy on inflation occurs with prolonged and unpredictable delays. Hence, the UK borrowing costs may continue to rise; however, effectiveness remains doubtful.

Read more: Unlocking the Power of Data Analytics: A Guide for UK Businesses

Businesses with a structural growth path and pricing power in a challenging economic environment could be attractive options for investors. Furthermore, government bonds may be preferred due to their lower credit risk and attractive starting yields, offering income and diversification. With the recent shift in underlying interest rates, bonds have become a credible alternative to equities and other asset classes, especially short-dated bonds protected from interest rate volatility whilst providing strong yields; however, caution is advised due to inflation risks.

The current market situation has shifted credit investors’ focus, possibly making this the best investment scenario for distressed debt investing since the global financial crisis. The worsening macroeconomic situation, a significant increase in debt outstanding, high leverage, and deteriorating investor protections (covenant-lite loans and bonds) have laid the foundation for distressed opportunities to flourish. The growing need for distressed investing, which involves seizing opportunities and making timely decisions, presents a greater challenge for investors in distressed debt.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A market leader in Investment research, SG Analytics assists in strengthening investment decisions by leveraging custom research support. Contact us today if you are in search of an investment research firm that offers tailored research support across a broad range of asset classes.