Before getting to know more about the EU taxonomy, it is crucial to understand its contribution toward the ‘EU Green Deal’. A new economic growth strategy, the EU Green Deal, aims at achieving a circular, climate-neutral, and competitive economy by 2050. Its mission is to ensure that Europe develops within the boundaries of the well-being of the planet and contributes toward creating a sustainable future for the coming generations.

By mid-2018, the Technical Expert Group (TEG) on sustainable finance was formed by the European Commission for providing recommendations regarding various reforms in the policies. The aim was to ensure that policies comply with climate targets proposed in the Paris Agreement and the SDGs (sustainable development goals) outlined by the United Nations in their Sustainable Development Agenda 2030.

The EU Taxonomy Regulation came into effect on June 18, 2020, ushering in a new era of sustainable financial regulations.

But what exactly is the EU taxonomy? What is its purpose? The framework can be highly intimidating for many; however, this article can help grasp key takeaways of the taxonomy.

What is the EU taxonomy?

According to the European Commission, the EU taxonomy is a tool that enables businesses, investors, project promoters, and issuers to undertake the transition toward a resilient, low-carbon, and resource-efficient economy. It is a central tool for bringing the vision of the EU Green Deal into action, especially in terms of funding long-term growth and enabling Europe to become climate resilient.

The taxonomy is a part of the regulatory classification system that helps businesses determine their environmentally sustainable economic activities. The EU taxonomy allows defining the environmental performance of various economic activities across a wide range of industries, as well as establishing the standards that must be met for business activities to be considered environment friendly.

Furthermore, the regulation requires certain businesses to report their activities and ensure that they comply with the taxonomy’s definition of sustainability. Some may define the EU taxonomy as the response to ‘What is green?’, helping companies gain greater understanding while implementing sustainable measures.

The EU taxonomy is a 600-page manual that includes taxonomy design guidelines as well as information on who is responsible for what and when. Being extremely extensive, the document aims at improving environmental performance. What is expected to follow is that the EU taxonomy will place more stringent reporting standards on organizations impacted by the law.

What is the purpose of EU Taxonomy?

The primary goal of the EU taxonomy is to help businesses, project promoters, and issuers improve their environmental performance by establishing performance benchmarks that can be used to determine which initiatives are sustainable and which are not. To ensure that money is invested in activities that are truly sustainable, the EU has developed a list of universal rules describing what constitutes a green investment.

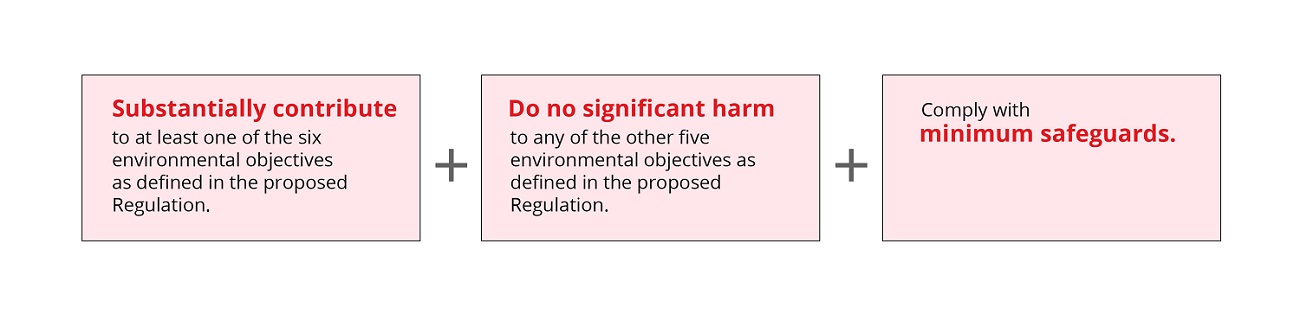

Economic activities must significantly contribute to one of the six environmental objectives in order to be considered aligned with the taxonomy. Following are the six environmental objectives that are defined in the EU taxonomy:

- Climate change mitigation: a company’s impact on the environment

- Climate change adaptation: the environment’s impact on a company

- Sustainable use and protection of water and marine resources

- Transition to a circular economy, waste prevention, and recycling

- Pollution prevention and control

- Protection of healthy ecosystems

Figure: EU Taxonomy proposal, Source: Bloomberg

The ultimate goal is to reduce all emissions by 50% by 2030, in addition to achieving net-zero carbon targets by 2050. In order to meet the climate agreement deadlines, an environment classification system needs to be established.

Why is the EU Taxonomy relevant for investors?

Investors can go head-to-head with the regulation by better understanding the EU taxonomy’s aims, appropriate ways to use the EU taxonomy to strengthen their competitive positioning, and stress-testing current and proposed products against expected legal enforcement.

Aligning with the goals of the EU Taxonomy

On one hand, SDGs provide a framework that includes shared targets and goals of the sustainability agenda at a macro level, whereas the EU taxonomy focuses on real world and business activities at a micro level. This helps investors delve deeper into their investment portfolios.

Strengthening competitive advantage

The EU taxonomy also pertains to those who commercialize financial products in the EU. For example, leaders in the financial sector are beginning to adopt the EU taxonomy and share case studies including the best practices through the ‘Principles for Responsible Investment’. However, it is still at an early phase as smart companies are gaining exposure and demonstrating leadership by being among the first-move-maker group to lead the market. Since the EU taxonomy’s ultimate aim is to direct more investments in a sustainable way, it is an opportunity to generate economic benefit.

An investor’s guide to be ready for the EU Taxonomy

The EU has set a high bar for itself in terms of putting the EU taxonomy into action. So far, the following has been proposed to companies for preparing them for the EU taxonomy:

- Financial market participants should carry out disclosures in accordance with the EU taxonomy by the January 1, 2022, encompassing activities that significantly contribute to the mitigation or adaptation of climate change.

- Technical screening requirements for the outstanding environmental objectives of the EU taxonomy, as created by the EU Platform on Sustainable Finance, should be released by December 31, 2021.

- Companies should report the percentage of their revenue, investment, and expenses that are aligned with the taxonomy for two goals: mitigation and adaptation of climate change for 2022.

Challenges for companies

The taxonomy’s operations remain unclear as of yet. To date, the most detailed research has been performed on companies whose securities are exchanged on the EURO STOXX 50, CAC 40, and DAX 30 stock exchanges. These businesses are among the ones that are required to report in accordance with the taxonomy. According to a report by Adelphi, less than 30% of the turnover in these indices qualifies for the taxonomy. A total of 2% of the turnover of this group of companies is completely compliant with the taxonomy. For example, the automotive industry that has significant potential to contribute by producing electric cars. While 69% of the automotive industry has the potential, only about 1?n demonstrate meeting the criteria for substantial contribution and no significant damage.

Conclusion

Companies require to identify and analyze what data will be required, how the data has to be interpreted, and how to report on it in order to keep up with the EU taxonomy and its benchmarks for performance. In practice, the EU taxonomy entails a more complicated reporting mechanism that necessitates organizations to fully comprehend what they need to do in terms of ESG reporting. Companies must also consider the impact of new regulations on their strategies for marketing and overall investment.

The new EU policies would have far-reaching effects not only within the EU, but also beyond its borders. The EU taxonomy would thus affect the broader financial regulatory landscape, influencing investment flows and the operations of a number of financial professions.