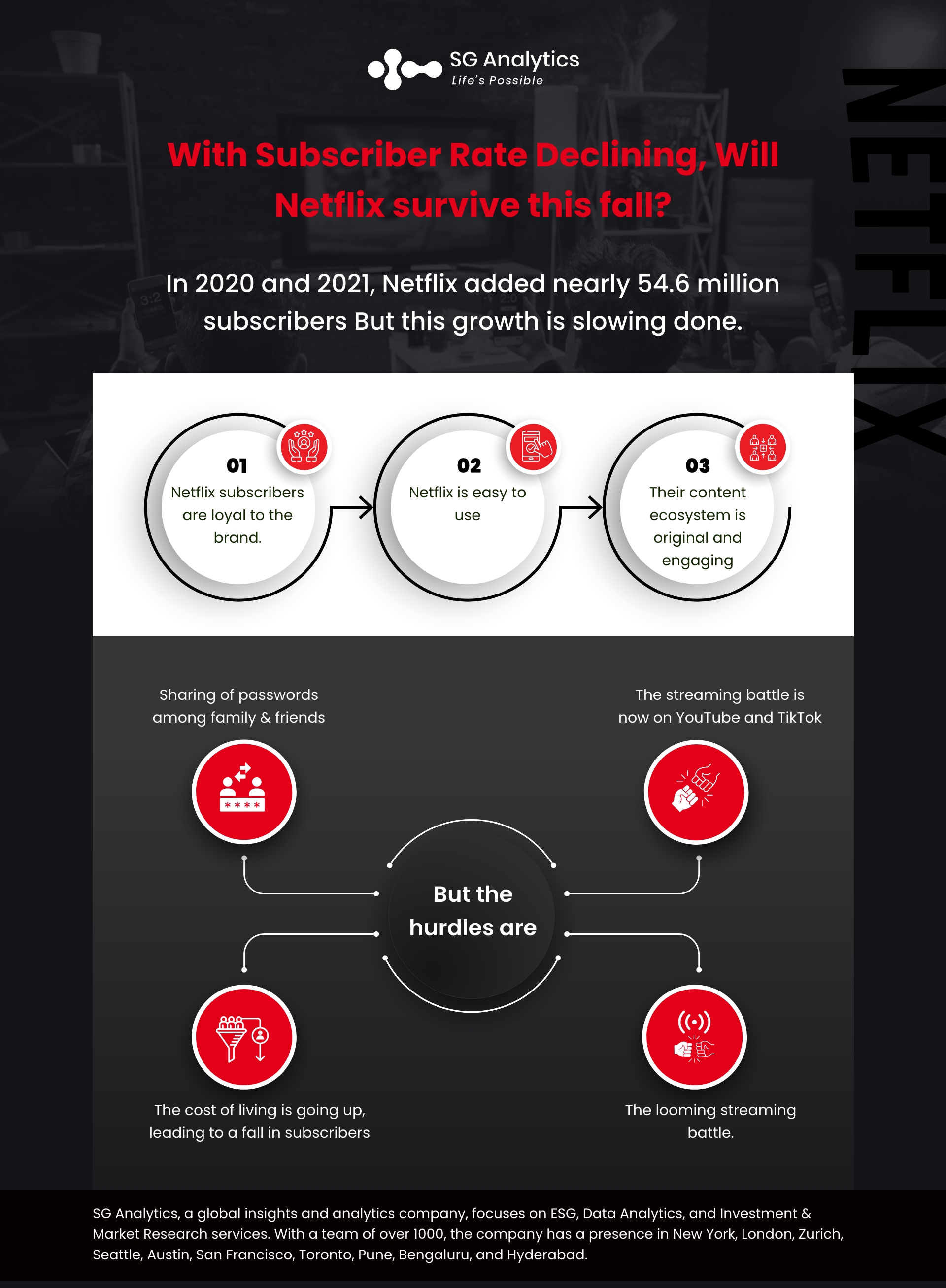

The pandemic pivoted video streaming platforms like Netflix, Disney+, and Peacock towards growth in subscribers. In 2020 and 2021, Netflix added nearly 54.6 million subscribers. The frightening and isolating months due to global locked down led people to seek entertainment in the safety of their homes. But this unprecedented wave of growth is hitting its limits, as the streaming platform is losing its subscribers for the first time in its history.

This decline in the number of subscribers is just one of the many problems Netflix has been facing in recent times. The second one is unhappy customers blaming the content and pricing policy Netflix offers to its viewers The stock market has also begun to factor in this current situation of Netflix. Netflix's shares fell by over $122 — a decrease of over 35 percent in one day and a plunge of $35 billion in market capitalization. This fall in share price is just a lagging indicator of the critical situation on hand.

Does this indicate that Netflix will soon run out of business?

Will the biggest content aggregator business model drop out from the list of top OTT players?

Well, is the situation as dire as it appears? The Netflix business model still has the potential to provide tremendous scope for development, only if Netflix and other streaming platforms are ready to face the realities of subscription, pricing, advertising, and content by adopting an ecosystem perspective.

Read more: Cutting the Cord – Households Cancel Subscriptions to Streaming Services Due to Shrinking Budgets

Netflix's Formidable Challenges

Today, Netflix is facing very steep competition from new powerhouses like Disney+ and Apple TV. The streaming video giant's stocks (NFLX -2.29%) recently sank to their lowest levels since early 2018. Netflix ended the first quarter with 221.64 million subscribers, representing a sequential decline of 200,000 subscribers. Many Netflix naysayers are doubting the streaming giant’s ability to survive and thrive amid the streaming service battle.

The impact of Disney+ and other streaming platforms in the market most certainly has a subscriber effect on Netflix. While it is believed that the platform's loyalty and primacy will shield Netflix from dramatic near-term losses, it is also true that the decline in subscription rate may continue to rise.

Netflix, however, does need to rethink its strategic plan to sail smoothly in the coming tide. This likely indicates that Netflix requires a combination of subscriber growth and/or revenue growth. The new OTT competition could be the move that sets Netflix on the path towards incorporating new monetization models like introducing advertising or higher service fees. This slow defeat from Disney, Apple+, and Hulu will give Netflix a stronger reason than ever to continue aggressive development and acquisition.

The Psychology of a Subscriber

Primarily a content aggregation platform, Netflix's purpose from a customer's perspective is to provide a wide range of shows, documentaries, and other forms of content that they can choose and watch at will. This indicates that Netflix collects content from content publishers and distributes it to its customers. This is where Netflix's business model stops, making it a gateway to content.

But, with consumers' changing tastes and choices in viewing content, the image of subscription business OTT platforms is changing. And Netflix seems to be giving its subscribers reasons to leave. Netflix is facing the heat of customers' unhappiness with the quality, variety, and regulation of content.

The Pricing Issue

Apart from content issues, the loss of subscribers is also being driven due to Netflix's pricing model, which is a pure subscription model. Inflated pricing is hardly a strategy that makes sense. Raising subscription charges is likely to drive away subscribers and create negative customer opinions. When prices are increased, customers’ perspective toward the brand’s changing values starts to decline, and so does customer engagement. This leads to a fall in time spent on the platform and word of mouth, thus creating space for competitors. Increasing perceived costs without increasing perceived benefits is one of the least clever ways in this highly competitive game.

Read more: Top Media & Entertainment Trends to Watch Out for in 2022

The Advertising Rivalry

Why do businesses perceive advertising as the solution to the pricing problem? Bringing in advertising and charging lower subscription fees will not solve the problem. The purpose of paying for a subscription-based streaming platform is to get rid of the advertising nuisance. Netflix bringing in advertising is causing a major backlash of TV-based subscriptions, which is further leading to a loss of customers. Advertising is a revenue stream but is also a value killer, as advertising punishes uninterrupted consumption. The question is, will Netflix viewers tolerate this advertising disturbance or hop on to advertising-free streaming platforms?

The Password Piracy Headache

Netflix's plan to arrest password sharing shows the brand's desperate attempt to undermine consumer psychology. Sharing resources and content is a consumer instinct. But instead of preventing customers from sharing the password of their subscription, it is time for Netflix to adapt to what customers like to do - offer content they want to talk about and explore ways to monetize on that.

Should Netflix Build a Consumer-Centric OTT Ecosystem?

Today’s content consumption ecosystem revolves around the consumer. It highlights that consumers do not just consume content that is provided to them. They:

-

Seek quality information from the content they consume

-

Enjoy talking about the content they love or hate

-

A more open to content made by or feature people like them

The strategic ecosystem of Netflix encompasses only two blocks - content publisher and content aggregator. This makes Netflix a conduit for content. But the time when the viewer chooses an OTT platform merely for its content is gone. Today, every OTT platform offering content understands that it is no longer sufficient to keep the consumer engaged with just the content. Instead, platforms are exploring areas beyond their current forte and employing a diversified business model that provides novel and relevant customer value.

For the platform to survive, Netflix should move from a gateway to a destination. The faster they incorporate this in their strategy, the better it will be for Netflix as well as the consumers who will engage with the Netflix universe.

The big streaming shakeout is getting closer to reality. Netflix’s biggest hurdle today is the looming streaming battle. Netflix’s immediate concern should be getting their existing subscriber to stay. Quality content is the way to keep subscribers engaged and explore new growth potential.

While Netflix has scored several recent wins through mega-hits like Squid Game, Don’t Look Up, and Bridgerton, to stay ahead in the game, Netflix needs to crack down on its strategies for winning over new subscribers while keeping the existing ones.

Read more: Netflix’s ‘Squid Game’ Worth Almost $900 Million. But…What Does That Even Mean?

Key Facts:

-

Netflix’s first loss of subscribers coincided with HBO's sequential growth.

-

The decision to arrest password sharing and the development of a cheaper ad-supported tier is indicative of its appetite for growth.

-

Irrespective of the fall, Netflix is continuing to dominate the streaming ratings.

What lies ahead for Netflix?

Netflix is exploring avenues by following the footsteps of many competitors who are introducing similar lower price points for consumers and ad-supported tiers to support their revenue. Estimates state that it is not bad news. Hulu and Peacock have managed to increase and maintain their average revenue per user since their introduction of a half-price, ad-supported option.

Taking into account the current scenario, it can be inferred that Netflix may not lose its prominent place in the entertainment industry any time soon. The subscriber gain in the Asia-Pacific region has helped Netflix offset its losses in the United States, Canada, and Europe. While Netflix's first-quarter results were disappointing, many believe that the tide is turning.

The future of the media & entertainment industry as a whole will transform into a subscription-based model. Their goal today is to offer people content from across the globe they can enjoy from the comfort of their couch. And we are beginning to see this is happening. In order to keep up with the times, the race to emerge as the best streaming platform is getting tougher.

What will the future for Netflix look like?

While the company has managed to weather and conquer several storms, till now, will it be able to keep the same pace moving forward?

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in the Media & Entertainment space, SG Analytics helps leverage advanced analytics abilities to make authentic decisions and accelerate business growth. Contact us today if you are in search of media & entertainment solutions that enable businesses to solve problems by harnessing disruptive data, artificial intelligence, machine learning, and innovative technologies.