Artificial intelligence has evolved to find uses across different industries. What started as a means to optimise operational efficiency for IT and its teams to reduce the time taken in developing new programs, tools, and devices has now grown to help multiple industries across the spectrum. Artificial intelligence helps with the management sector, finance and banking sector, medical and healthcare sector, automobile sector, supply chain sector, and more.

One such industry that artificial intelligence has found its use in is the investment management and portfolio management sector. AI investing tools have been developed to help investors and their investment advisors make sound financial and investment decisions with their wealth. Wealth management is growing in popularity as a service-based industry where people who belong to the high net worth category use the expertise and services of trained and educated professionals to manage and build on their wealth.

Portfolio management has multiple uses. It can be used for asset management purposes, liquid or otherwise. It can be used to track real estate, stock options, bonds, and more. Wealth management can also be used to help individuals plan for their retirement. There are a lot of reasons why people would opt for portfolio management services, and the main one is so that they can leave their hard earned wealth in safe hands.

Building on one’s wealth is crucial if you want to make it last across your lifespan, even after you retire, and for your future children and grandchildren. This is why asset management, wealth management and portfolio management become important factors for the same. With the inclusion of AI in portfolio management, investors and their advisors can rest assured that all the financial decisions that are made with their wealth are done so with a data-driven, precise and calculated approach.

Read more: Top Trends That Will Shape Investment Banking In 2022

What is AI portfolio management?

AI investing tools include an AI portfolio management option which is available for investors to make better financial decisions with their income. Investment firms, wealth management agencies, and portfolio management companies can use the technological advancement that comes with artificial intelligence to make better investments for their clients.

Currently, the asset management industry is worth more than 100 trillion USD (BCG), which is a lot. It accounts for a lot of individual income that people from across the world have worked extremely hard to acquire, and the responsibility of managing that income rests on only a few.

The introduction of artificial intelligence as added assistance to investment portfolio management agencies has really helped investment bankers and financial advisors provide better services for their clients. How does AI portfolio management change the landscape of investment? How does AI investing impact firms beyond optimising operational efficiency? What are the new opportunities created with artificial intelligence investing tools and services?

Artificial Intelligence Investing Impact in the Market

Different sectors of finance have benefited from including artificial intelligence in their strategy planning, execution and operations phases. Even in finance sectors like fintech, the market share of AI tools is expected to increase drastically. The growth of the AI industry in fintech is estimated to reach from nearly 8 billion USD in 2020 to over 26 billion USD by 2026. (Datamation)

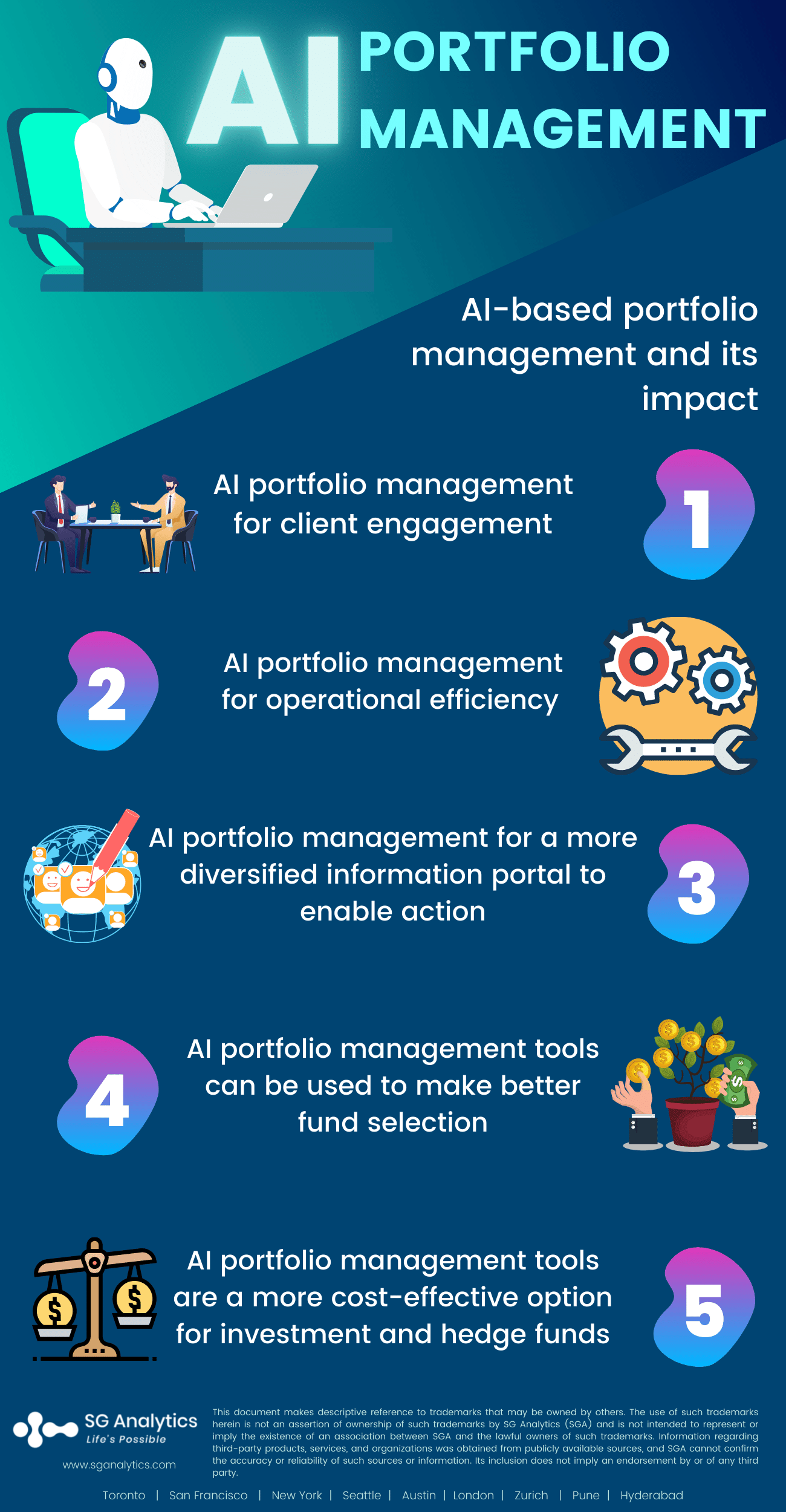

Including artificial intelligence investing options for AI portfolio management can be done in multiple ways to enhance the business and its services. Some of these are listed below

AI portfolio management for client engagement

The most popular use for artificial intelligence is to generate automated insights and reports for organisations, and it can be of use in the investment banking and portfolio management industry as well. The first thing that goes into making the right long term investments for the future is to understand the past, present and the future of the market of the type of investment the client wants to make. AI tools can help develop insights based on the past climate and current scenario to develop insights that can be used to create forecasts. It can be used to find the relationship between various indicators and the securities of the clients.

AI portfolio management for operational efficiency

Machine learning is one of the AI tools that can be used to optimise operational efficiency with the help of automating various repetitive tasks. This not only saves the agency a lot of time and resources but also helps eliminate the chance of human error. AI tools also help build a more risk aware organisation. AI can be used to tag any suspicious activity occurring on the servers or in any applications to avoid any breach in the organisation or data loss. Another way in which artificial intelligence can help is by helping the firm track employee performance to keep a track of how they are managing their investments and portfolios for their clients.

AI portfolio management for a more diversified information portal to enable action

AI investing tools can also be used for gaining insight and information through multiple channels across the board. It can be used to track user or market activity on social media to generate reports, or through news channels, press releases, or any other online activity channel. Artificial intelligence tools can gather all of this unstructured data and create reports that can be used by portfolio managers to build better investment strategies.

AI portfolio management tools can be used to make better fund selection

Portfolio managers often make investments in mutual funds, build hedge funds, and more for their clients. The accuracy of data generated with artificial intelligence investing tools can be used to make better decisions in terms of which funds to invest in, what portals to use, and which ones will generate the most profit for their clients. 50% (Infosys BPM) of the investment managers who participated in a certain survey revealed that including AI in their decision making process enabled them to make more profitable funding decisions for their clients.

AI portfolio management tools are a more cost-effective option for investment and hedge funds

There are multiple ways in which AI investing tools can help companies save up on their resources.

-

They eliminate the chances of human error in the data generation, analysis and reporting processes, which means that there are no financial losses caused due to mistakes of the investment managers.

-

Artificial intelligence investing tools also take significantly less time to process all the data and generate insights, which means that they save up on time that would have otherwise been spent in doing these tasks.

-

AI tools can also help with building risk management strategies for the company itself, which means that organisations can have risk mitigation strategies in place to prevent huge financial losses as well as risk data breach and loss of business.

-

AI tools can also offer compliance regulation services. The finance industry has a lot of laws, rules and local, national and international regulations that the investment management and portfolio management agencies need to follow. These regulations keep evolving over time, so there are chances companies can lose out on following up on all of them and remaining compliant throughout. AI tools can help investment fund agencies to maintain compliance for all their clients and all their financial decision making processes so that they can avoid a hefty fine for breaking any of them.

Read also: Investment banks generated over $2.9 tn business value with AI – a revolutionary partnership

Final Thoughts

AI in investing has come to play a big role in helping companies make better financial and investment decisions for their clients. Artificial intelligence cannot replace the actual financial advisors and portfolio managers, as clients may believe to be the case. Wealth management requires a lot of experience and expertise for it to generate more long term profit for individuals. This requires the skills of educated professionals who can perform these tasks for their clients and act as portfolio managers. AI portfolio management tools and RPA consulting services are simply tools that can be used to improve the efficiency and effectiveness of the portfolio manager’s services so that they can perform better for their clients over time.