While the recent advancements in ESG in finance cannot be denied, it originally started as a tool for investors to ensure their investments go to environmentally and socially responsible organizations along with satisfactory internal governance systems. The standards, protocols, and tools employed to measure and report ESG-related performance has matured, over the years, to the point that climate-related disclosures have been incorporated and have mandated publicly traded companies to incorporate this measure. However, with these changes comes resistance, and that has advanced in many directions.

Environmentalist detractors are of the belief that ESG reporting promotes greenwashing or the manipulation of ESG to represent performance that is better than reality. Another criticism is that ESG reporting conflates environmental, social, and governance factors. ESG reporting can conceal issues along individual metrics by blending them into the overall performance reporting of the organization. On the contrary, many conservative detractors feel that ESG reporting goes far altogether.

With new ESG regulations on the way, the ESG scoring measures are enabling organizations to accomplish what they could never hope to achieve through competition in the free market.

But with the 'E' and 'S' entities in the picture, what about the 'G' or governmental entities?

Read more: ESG and Sustainable Investing: A Guide for ESG-Focused Investors in 2022

Focusing on the 'E,' 'S,' and 'G' in ESG

Today, with the growing opposition to ESG principles, the need for stronger ESG reporting regulations is becoming clearer. The necessity to validate the social and environmental responsibility of a private-sector organization is on the rise. The combination of identifying the risks related to the environment, climate change, and other social injustices, along with how a commercial entity is added to manage those risks, has driven ESG adoption and evolution across industries.

While the set standards to assess the fiscal solvency of the government is relatively advanced, the question arises on the standards and tools set for quantitatively assessing how citizens are served.

Today the argument against ESG as a whole seems unwarranted. However, there are still credible arguments on what to estimate as part of an ESG-based policy. The 'E' in ESG is in debate as there are still members of the American community who do not believe in the climate change crisis or the impact of the human-borne contribution to the crisis. There is a need to debate what social responsibility should be measured.

Investors who are passionate about environmental, social, or governance (ESG) concerns often take into consideration the ESG ratings to assess whether the company's portfolio or equities are worth investing in. The ESG ratings disclose the level of risk exposure a company has in the three areas of 'E,' 'S,' and 'G.' Issues such as energy efficiency and sustainability can likely have current and future financial implications that must be factored into investment decisions. A multitude of factors are employed to determine a stock’s ESG rating.

By understanding the ESG score or ratings of an organization, investors can make the right decisions to drive confident investments that align with their long-term priorities.

Read more: ESG metrics for Businesses - Time to Deliver the Promise of Sustainability

What Is an ESG Rating?

ESG ratings are aimed at evaluating the level of an organization's environmental, social, and governance risk exposure. Essentially, it advises investors on how sustainable a company’s business processes are and what measures they are employing to integrate sustainably into their operations. A high ESG rating or ESG score would demonstrate that the company either has sustainable values that they deem favorable or is proactive about guarding itself as well as the environment against environmental or governance risks like pollution.

Investors are likely to pause for concern with organizations with lower ESG scores, as they might be less favorable for the investors’ portfolio as well as long-term financial goals.

Given the rising crisis, it is equally important for businesses to address the greenwashing risk and challenges arising from the blended ESG reporting. The growing concerns about the counting of Scope 3 emissions (as proposed, the SEC rules would only require limited Scope 3 emissions are accounting while no pending rules mandates emissions accounting for the public sector). What measures, with regards to social parameters, should be employed?

Factors Employed to Determine the ESG Ratings

When referencing the ESG rating, the MSCI ESG is often used. MSCI ESG regulation and ratings aim to estimate a company’s management of financially relevant ESG risks and opportunities. The rules-based methodology is employed to identify industry leaders and laggards as per their exposure to ESG risks and how to assess those risks relative to peers. The ESG Ratings range from - leader (AAA, AA), average (A, BBB, BB) to laggard (B, CCC).

The MSCI ESG score is based on the categories that are broken down as follows:

Read more: The Rise of Sustainable Finance: 2022 Impact Investment Trends

-

Environmental Pillar

-

Climate change crises are impacting the ESG score by calculating carbon emissions, product carbon footprint, financing environmental impact, as well as climate change vulnerability.

-

Natural capital incorporates the topics of water stress, biodiversity, and land use, along with raw material sourcing.

-

Pollution and waste are connected to these toxic emissions, packaging material, and electronic waste.

-

Environmental opportunities examine the company’s usage of clean tech, green building, and renewable energy resources.

-

Social Pillar

-

Human capital comes from labor management, human capital development, health and safety, and supply chain labor standards.

-

Product liability encloses product safety and quality, chemical safety, consumer financial protection, privacy and data security, and responsible investment.

-

Stakeholder opposition comprises controversial sourcing and community relations.

-

Social opportunities related to access to communication, finance, health care, and opportunities in nutrition and overall health.

-

Governance Pillar

-

Corporate governance is scored via the board, employee pay, ownership, and accounting.

-

Corporate behavior is determined through business ethics as well as tax transparency.

Why Does a High ESG rating of ESG Score Matter for Investors?

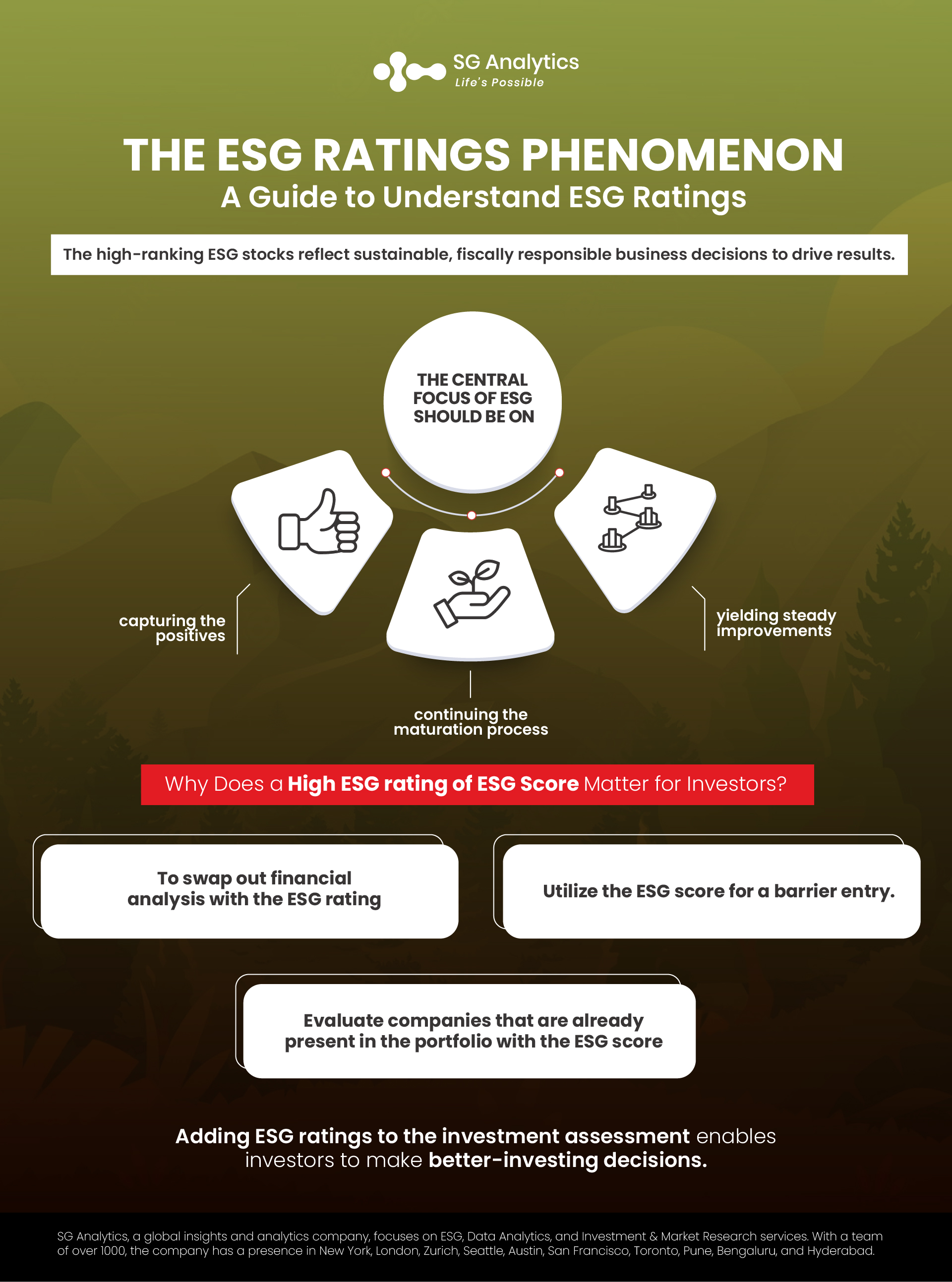

While an ESG score is just one of the factors for investors to determine which investments are most suitable for their portfolio, it is a critically important one. To make a better-informed investor decision, it is important to consider some of the following tips when incorporating the score:

-

Swapping out financial analysis with the ESG rating

-

Utilizing the ESG score for a barrier entry.

-

Evaluating companies that are already present in the portfolio with the ESG score.

For investors who are passionate about companies that focus their operations on sustainability, a high ESG score will assist them in scanning potential investment options. Assessing the ESG scores helps identify the red flags and better understand the potential risks that may arise in the future.

Read more: Integrating ESG in Company Culture – A Move to Drive Resilience

In Conclusion

Investing in ESG has become bigger and more critical for almost every industry. However, there have been various backlashes.

In today's world of investing, ESG has become the buzzword. But what does it signify?

ESG stands for Environment, Social & Governance, and it involves preferring investments in companies that incorporate sustainable policies and work towards keeping the environment well and decreasing the impact of climate crisis and carbon emissions. It also signifies how they treat their employees and stakeholders with regard to society, diversity, and inclusion and are not involved in fraud and trickery.

The high-ranking ESG stocks reflect sustainable, fiscally responsible business decisions that assist in driving better results for both - the company as well as the investor. Company behaviors that lead to a decreased risk and increase in return are always good news for investors who are exploring avenues to enhance their portfolios. Therefore, adding ESG ratings to the investment assessment can empower investors to make better-investing decisions.

While there are still questions that remain unanswered, the principles of ESG are still worthwhile. Their benefits vary from the public sector to the private sector. However, they exist in both arenas. In either case, the central focus of ESG should be on capturing the positives, continuing the maturation process, and yielding steady improvements.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Consulting services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.