GCC (Gulf Cooperation Council) governments have been initiating concerted efforts over the years to effectively implement their ‘Localization’ programs. GCC governments are increasingly focusing on local talent. And the move is to ensure the local population does not slip into the ‘unemployment zone’. Saudi Arabia – the biggest GCC economy – had kickstarted the Saudization program or the ‘Nitaqat’ system on June 11, 2011. Six years down the line, the GCC workforce localization seemingly hasn’t quite taken off.

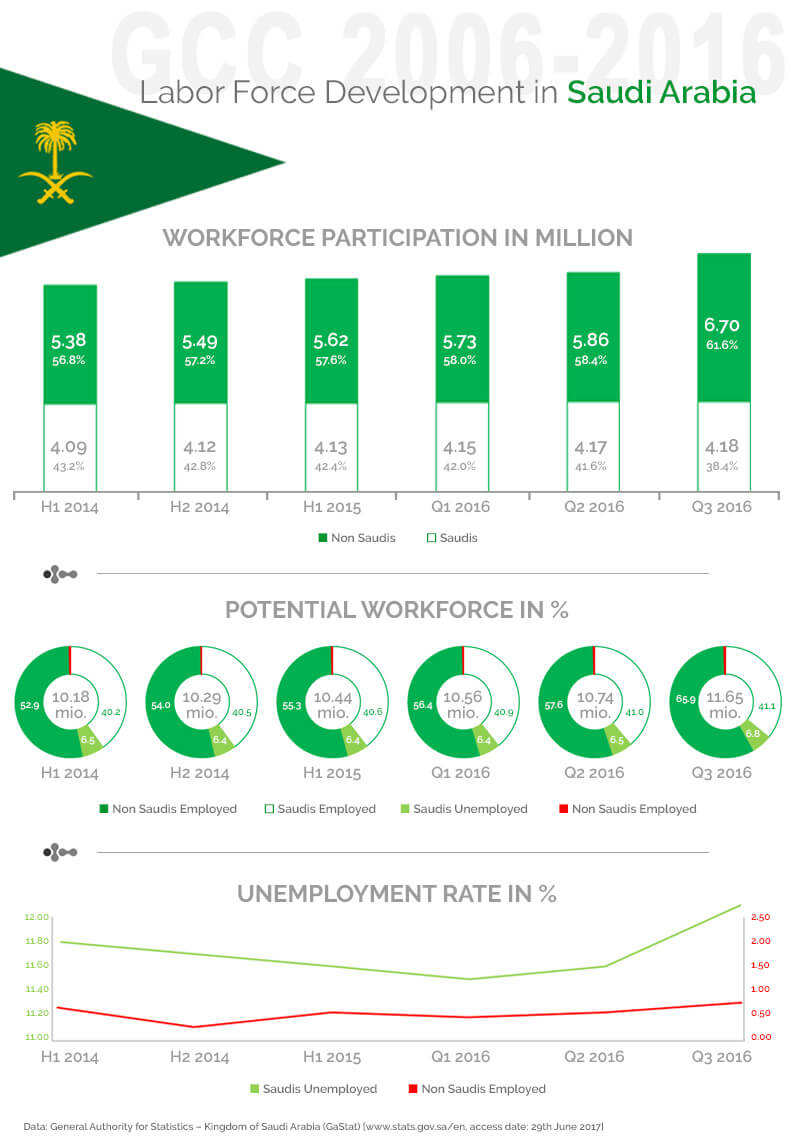

According to the General Authority for Statistics (GAS), the percentage of Saudis among the total employed people has fallen from 43% in 2013 to less than 39% by Q3 2016. Further, the unemployment rate among the Saudi nationals has increased to 12.1% in the third quarter of 2016. These figures indicate that private sector jobs do not attract Saudis. There is a general perception that private companies are reluctant to absorb locals across various private sector jobs.

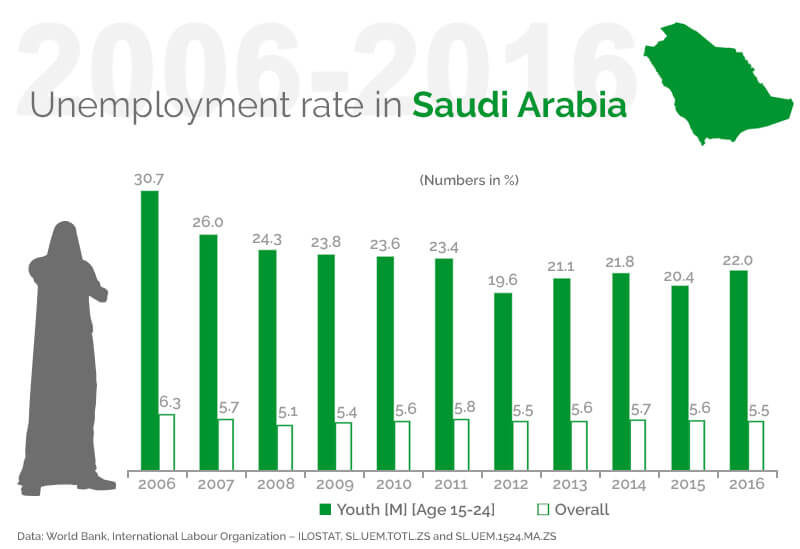

The Saudi government had announced a new ‘Guided Localization” aimed program to achieve Saudization across sectors in March 2016. The Guided Localization in Saudi Arabia was focused on reforming GCC localization policies and practices. Removing youth unemployment is one of the crucial objectives of the government’s Vision 2030 launched last year. However, as the youth unemployment rate has even been rising in 2016, policy makers cannot overlook the fact that their various measures to achieve ‘‘Saudization’ haven’t been a success story as yet.

Spotlight: Localization in GCC countries

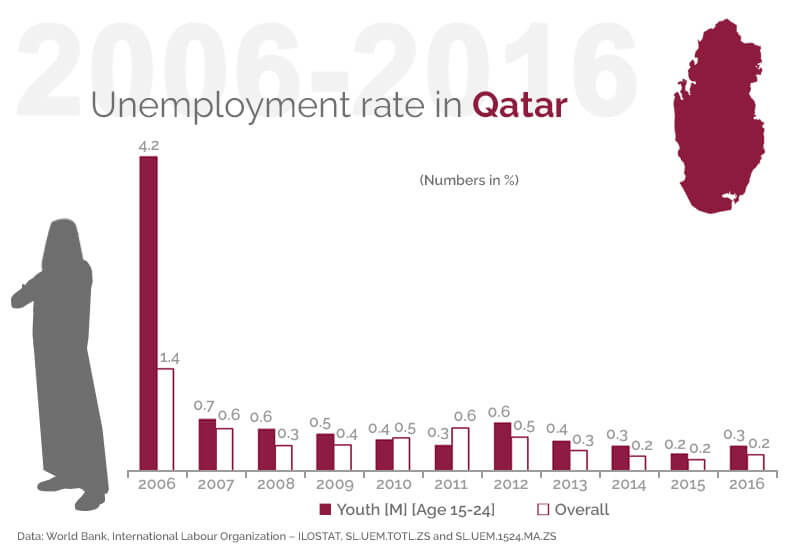

As we talked about workforce nationalization in Saudi Arabia, the scenario is more or less the same in other GCC countries. Workforce localization in emerging Gulf economies is at stake. Like Saudi Arabia, Qatar is also striving to achieve ‘Qatarization’ with a balanced GCC labor market. However, it has a long way to go before localization in GCC can be termed a success. Qatar Prime Minister Sheikh Abdullah bin Nasser Al Thani made a statement in late 2016 when he stressed the need to appoint Qatari citizens in jobs occupied by foreigners. He was categorical that the Qataris must meet the desired job requirements. The country was targeting to achieve a comparative advantage with 15% of Qataris in private sector jobs for the year 2016. Although Qatar has a remarkably flat unemployment rate, only a fraction of nationals became part of the workforce, indicating that a lot of work remains.

Similar to initiatives by Saudi Arabia, the UAE and Oman have also initiated ‘Localization’ programs decades back. The UAE has cranked up its ‘Emiratization’ program over the last few years or so. One can famously recall how General Secretariat of the Executive Council (GSEC) laid off around 60-70 foreign staff in July 2013. A Gulf News report stated that the UAE’s Human Resources and Emiratization Ministry is closely monitoring the adherence of private companies to its Emiratization program. The localization in GCC is saddled with obstacles, including wavering workforce nationalization scenarios. Farida Al Ali, assistant undersecretary for employment of national human resources pointed out that private companies in the UAE are not hiring Emiratis because they lacked the necessary language and communication skills and also do not meet the required qualifications or experience.

Oman offering sops to ensure private firms embrace localization

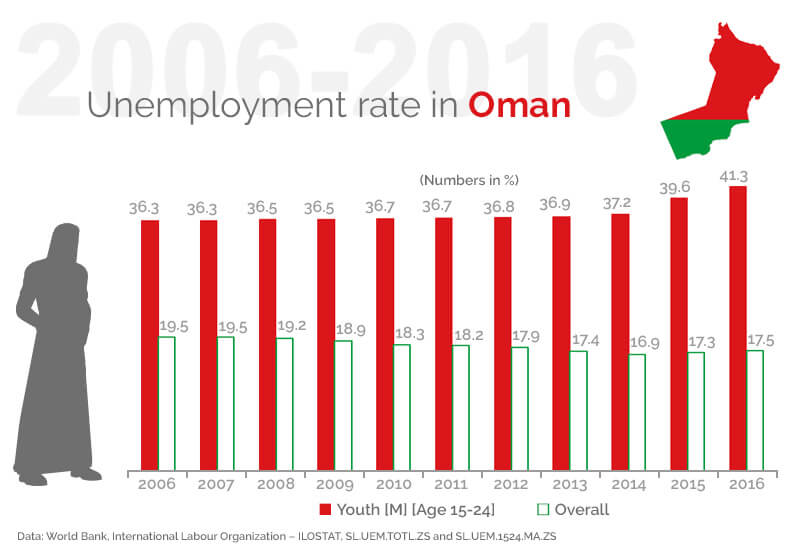

Oman is striving to effectively implement the recommendations of the National Manpower Employment Forum to boost workforce nationalization – ‘Omanization’. According to media reports, Oman’s Ministry of Manpower has set flexible Omanization targets, with different targets for each industry. The Sultanat, that has seen continuously rising unemployment rates during the last 10 years, is initiating efforts to encourage private companies to hire locals.

Kuwait and Bahrain

Kuwait also unveiled its Kuwaitization” policy decades back but its localization program still leaves a lot to be desired. According to the 2015 Ministry of Planning’ statistics, the Kuwaitis represent around 33% of the 2.2 million labor force. It is pertinent to mention that a majority of the Kuwaitis is holding public sector jobs. As far as the private sector is concerned, the percentage of national labor is still low in comparison to the high percentage of expatriates.

Bahrain is also striving to ensure implementation of ‘Bahrainization’. According to the Arabian Business website, companies must adhere to the Bahrainization. That is hiring one Bahraini for every four foreign workers. If companies fail to adhere to the law, they will face penalties. Such a move became necessary after several companies allegedly misused the law. These firms keep Bahrainis on their payrolls only to secure work permits for foreigners and fire them afterward. The Labor Market Regulatory Authority (LMRA) has indicated that it will stop renewing permits if the quota is not adhered to.

Need for strong focus on improving education structure

So it appears that private companies lack the enthusiasm to hire locals in the GCC region? All GCC governments are facing a local talent crunch. There appears to be a ‘skill mismatch’ in these countries, preventing private companies from hiring locals. There is a need to overhaul the education structure. Of course, this is not to belittle the existing education structure in place. A robust education structure will help GCC nations plug the current skill gap, and set up effective workforce localization in emerging gulf countries. It’s not just the ‘skill’ factor only. Most jobs available in the market, unsatisfactory salary, lack of desired geographic location and inconvenient work hours do not seem to excite the locals. The local populations in GCC appear to be more interested in better-paying public-sector jobs.

The agenda of localization in GCC countries have a long way to go before it can be termed a success. A strong focus on improving the region’s education structure could facilitate the effective implementation of localization in GCC nations.

The writer would like to offer his sincere thanks to GCC region expert and Lead Analyst Varun Goela for helping out with his Saudi data inputs