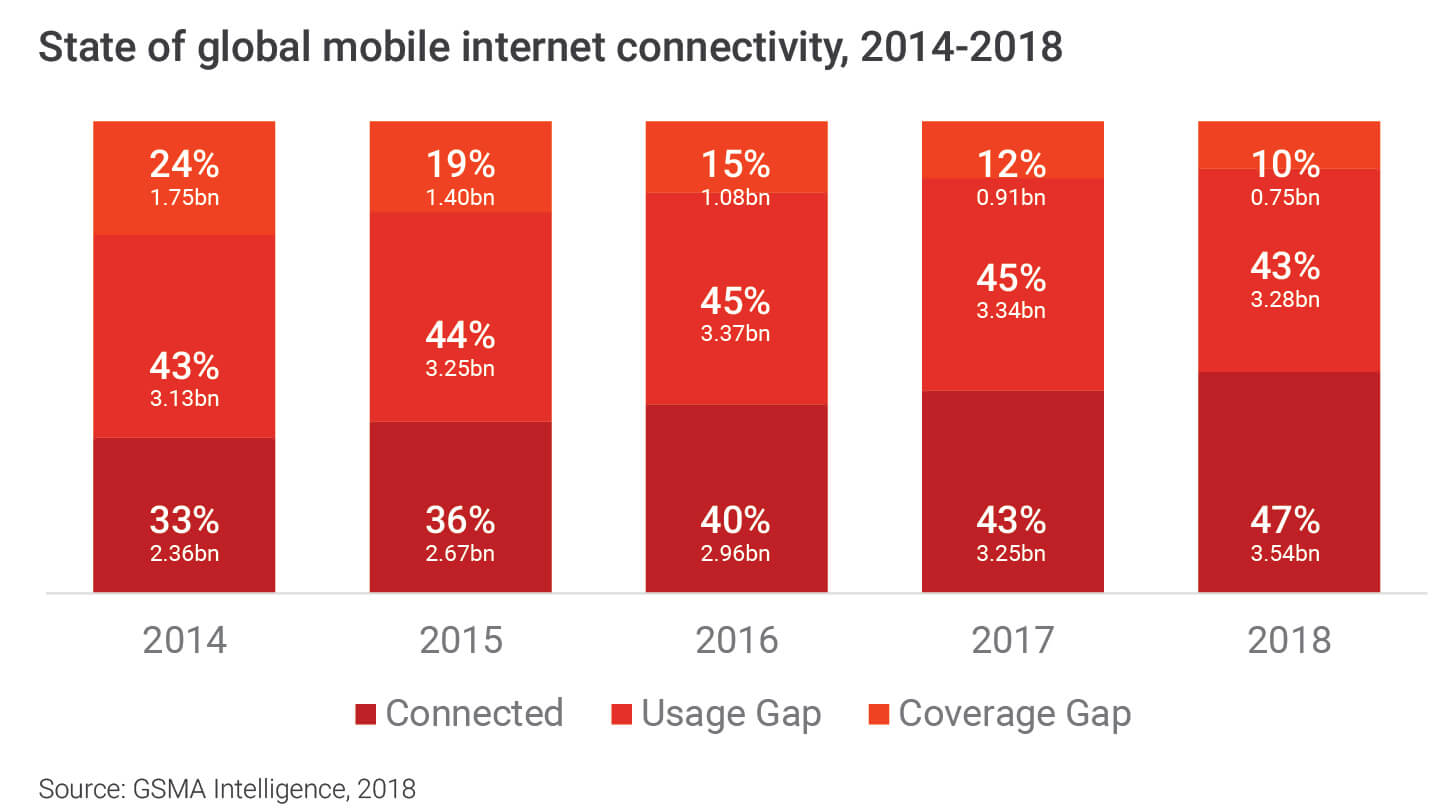

Access to the internet is advancing at a very fast rate with the deployment of new technologies and growing demand for high-speed connectivity for governments, businesses, cloud applications, and international connectivity. Despite these developments in mobile and fixed broadband technologies, globally 3.8 billion people are not connected to the internet due to the connectivity gap. As of 2017, 4G covered 50% of the global population while 3G covered 84%.

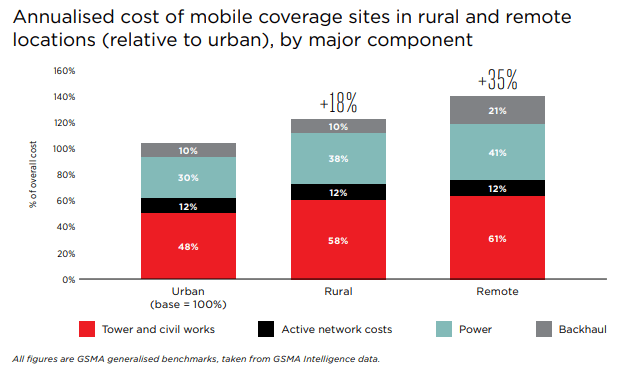

One of the reasons for the connectivity gap is the lack of network coverage in remote and rural areas. Expanding coverage and offering affordable broadband services in remote areas are proving to be a major challenge for telcos as the cost of deploying network infrastructure is high, while the per capita consumer spending on telecom services is low. ITU estimates that it would cost around USD 450 billion to connect the next 1.5 billion people.

Telecom operators are exploring alternatives to bridge the connectivity gap and enhance demand for internet services by reducing both, the opex and the capex required to set up the corresponding infrastructure. Accordingly, operators are collaborating with satellite operators through network sharing agreements and also testing new network technologies to improve cost efficiencies and increase ROI.

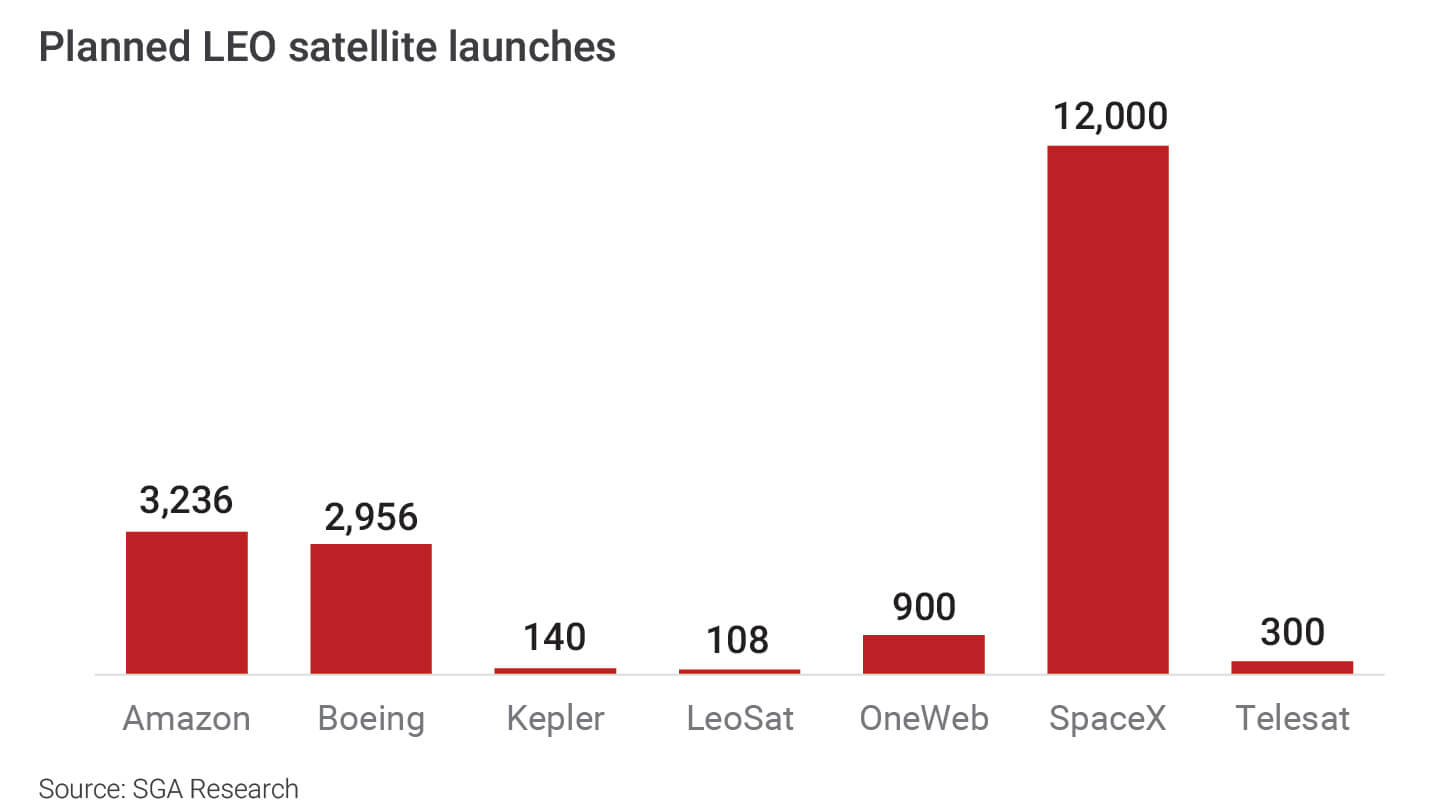

In the past, global telcos had used satellite networks to expand their reach and provide connectivity in rural areas; however, they were unable to meet the growing demand for bandwidth and reliable connectivity. To fulfill this void, companies such as SpaceX, LeoSat, Boeing, Amazon, and OneWeb have revived the 1990s idea of Low earth orbits (LEO) satellite constellation to offer low cost, high speed and low latency network solutions. Around 15 companies are planning to launch around 17,000 LEO satellites by 2022, with a total estimated capacity of 150 Tbps.

What are LEOs?

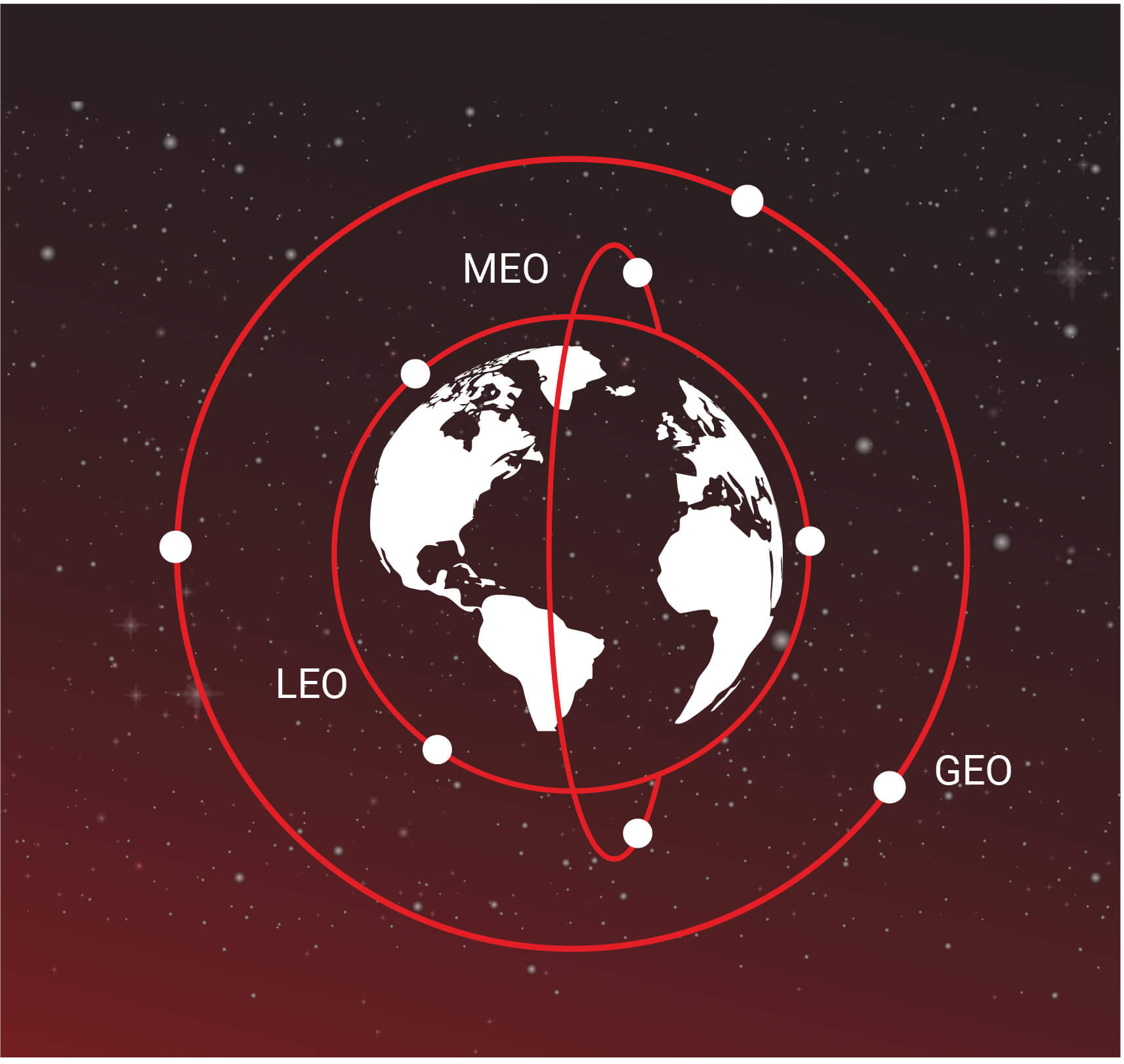

Low earth orbits are of relatively lower altitude range of 160-1,200 km, compared to that of a geosynchronous equatorial orbit, with an orbital period between 84-127 minutes. Since LEO is much closer to earth, the cost of launching a satellite into its orbit is considerably lesser; however, the number of satellites required to provide global coverage rises exponentially. Due to their proximity to earth, LEOs are suitable for mobile communication, navigation and military satellites, reducing the travel time of communication signals between earth stations and satellites, resulting in lower latency and higher bandwidth.

The LEO satellites are interconnected to one another through a laser mesh network, which is 1.5x faster than the optic fiber cables over long distances. The LEO constellations are likely to be more secure than a terrestrial network since the communication between satellites takes place in space, which is not susceptible to natural and man-made factors such as earthquakes, cyclones, hurricanes, fiber-cut incidents, etc.

When it comes to cost implications in launching a satellite, technological developments have enabled the design and manufacture of small, light and cheap satellites. Moreover, reusable next-generation rockets that can be used to launch multiple satellites and cost-effective ground stations provides significant cost benefits for LEO operators. The estimated capex for LEO operators is ~USD 260,000 per Gbps, whereas GEO satellite operators tend to spend around USD 2-9 million.

The companies venturing into this segment are mainly focused on providing global connectivity, mobile backhauling to MNOs, emergency services, disaster recovery, government, and military applications.

LEOs to fulfill backhaul demand

Growth in mobile technology and the emergence of bandwidth-hungry applications has led to increasing backhaul needs for telecom operators to transport a high volume of voice and data traffic over long distances, with high throughput and low latency. As the 5G promises gigabit speeds to the end-users, the backhaul capacity required to handle this spike in data traffic is not available. Also, 5G use cases demand high-density networks and ultra-reliable connectivity in remote and rural areas. Hence, the need for a reliable and cost-effective backhaul solution is imminent. Few of the tech giants have recognized this opportunity and are working on the constellation of satellites to fix prevalent issues of latency and bandwidth. LEOs can aid telcos in augmenting their existing backhaul network to cover rural and remote locations through an LEO-based backhaul solution, which is in compliance with the latest cellular technologies such as 4G and 5G. Telcos can select between terrestrial and LEO- based backhaul connectivity based on traffic demand.

LEO-based backhaul can also be used to add additional backhaul capacity to urban mobile base stations and serve as an efficient alternative to fulfill unexpected surge in demand during large-scale events such as concerts, sports events, etc. Telcos can also rely on LEO satellite links to provide uninterrupted connectivity in aiding emergency response during natural/man-made disasters.

“Telesat along with Vodafone Group successfully achieved 5G backhaul using LEOs with a latency of 18-40ms supporting high bandwidth applications such as video chat, 8K video streaming and transferring 4K video to the edge of the 5G network”.

The initial deployment of 5G will mainly happen in urban and sub-urban areas and microwave backhauling is preferred over fiber and satellite backhauling in these areas. Despite the enthusiasm of LEO operators and promising features of the LEO-based backhaul solution, the deployment of satellite 5G backhauling is expected to start by 2023.

“By 2028, satellites are expected to support 33% of the backhaul market with estimated revenue of USD 32 billion.”

Secured global connectivity

A highly secured and reliable network is an underlying parameter for effective communication within any global organization. Telecom operators face challenges at times in fulfilling the growing needs of governments, private organizations, research centers, defense bases, etc. along with real-time high mobility applications such as maritime, aviation, trains, emergency response vehicles, etc. These challenges can be addressed through an LEO based ultra-secure global network.

Internet of Things

The penetration of IoT is growing exponentially with increasing demand for global connectivity. Certain IoT use cases such as smart cities, autonomous vehicles, asset monitoring, fleet tracking, etc. require always-on-connectivity. For instance, the shipping of temperature-sensitive biological drugs over long distances is challenging as it is very important to track the temperature data and ensure to maintain optimum temperature levels of the drug across the supply chain. Due to inadequate information during transit, the viability of the drug is questionable and will be harmful to use them.

LEO satellites will provide reliable global connectivity to such use cases and will be efficient and economical means to connect various devices, sensors, monitors and controllers to the global internet cloud. Operators like Kepler, Telesat, etc. are developing global connectivity solutions compatible with IoT devices.

In order to facilitate the adoption of LEOs for IoT connectivity, small satellite operators are working in collaboration with ITU in framing national and international regulatory frameworks. A group of small satellite operators has formed Commercial Small-Satellite Spectrum Management Association (CSSMA) for sharing knowledge that aids in developing efficient solutions.

Influencing factors for the uptake of LEOs

Economics of scale:

Cost of deploying a network of satellites and offering connectivity through LEO satellites has reduced significantly compared to the expenses incurred way back in 1990. As each and every satellite was custom built to suit a very specific use case, the costs involved in the design and manufacturing of them were very high. However, driven by innovation in the design and manufacturing process, satellite manufacturing companies are now capable of mass-production of satellites (OneWeb). For instance, Airbus has leveraged its expertise and large volume manufacturing techniques from its A350 aircraft production to manufacture microsatellites for OneWeb.

Reusable launch vehicles:

The main engines and avionics represent 70-80% of the total value of the launch vehicle; space companies are working on reusable launchers to further reduce the launch cost of the satellite. In March 2017, SpaceX launched a communication satellite into geosynchronous orbit, the first stage of the Falcon 9 launch vehicle (which costs USD 62 m) successfully landed on a drone ship stationed in the Atlantic Ocean. AirBus had initiated a reusable launcher program named Adeline in 2010; the first launch of the Adeline reusable launch module is scheduled for 2025. To further reduce the cost of launching a satellite, few space companies are looking at the option to reduce the mass of the launch vehicle. The plan is to reduce the mass of propellant by replacing chemical propulsion with new electric propulsion systems.

Smaller launch vehicles:

Instead of decreasing the cost of bigger launch vehicles, few companies are developing low-cost small satellite launch vehicles to launch satellites into LEO such as Virgin Galactica’s LauncherOne and Rocket Lab’s Electron.

Challenges

Tracking of satellites is quite challenging:

US Air Force’s Space Surveillance Network tracks satellites by locating the rockets launching the satellites through its telescopes and radar. However, this system is effective in tracking large rocket launches involving fewer satellites. The size of the satellites has decreased significantly; allowing operators to launch many smaller satellites in a single launch. As these smaller satellites remain closely packed in an orbit, it would be difficult not only for the satellite operators to identify their satellites but also for the Air Force to distinguish them from each other. Furthermore, the proposed plans to launch thousands of satellites in the low-earth-orbit and constantly increasing space traffic may enhance the probability of collisions. Hence, it is critical to have an effective system to track densely populated smaller satellites.

Many private companies and national space programs are developing advanced systems for tracking and classifying densely populated satellites and millions of smaller space debris. Lockheed Martin Corporation developed the “Space Fence Program”, which aims to detect, track, measure and catalogue objects as small as 2-4 cm.

“In December 2018, SpaceX launched 64 satellites through its Falcon9 rocket, but the US Air Force could not distinguish 19 of the launched satellites.”

Space debris:

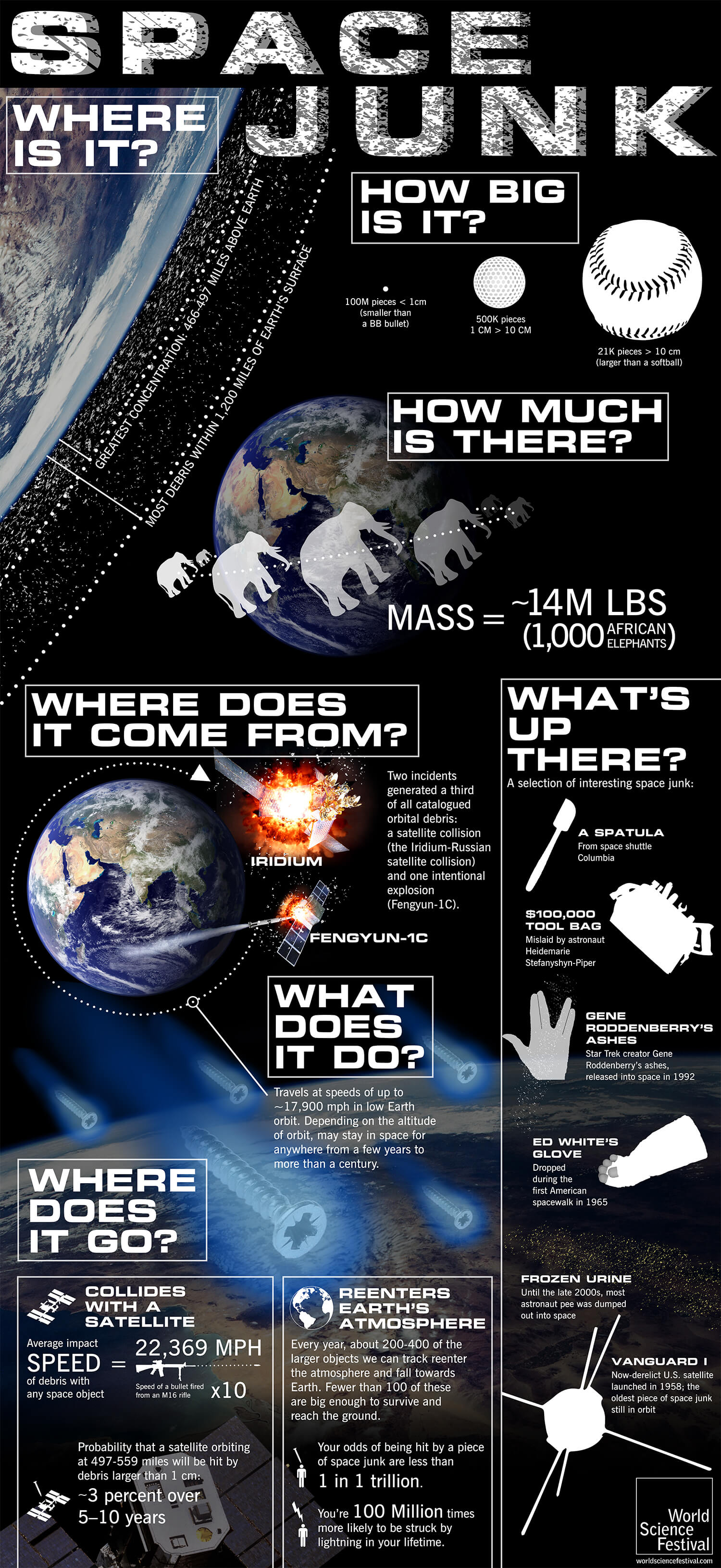

Low Earth Orbit is the most congested orbit with vital space assets such as International Space Station, crewed spacecraft and Hubble space telescope. Despite these developments in LEO constellations and its importance in serving various purposes such as earth observation, communications, etc., industry experts have expressed their concerns over space debris that would be generated with the launch of all these satellites. According to the US Air Force, currently, 12,000 known pieces (larger than 10 cm in size) of debris are present in space. Moreover, millions of units of smaller debris are also floating in space, with the potential to destroy some satellites.

Source: https://cdn.worldsciencefestival.com/wp-content/uploads/2014/06/Space-Junk-Infographic.jpg

As the satellites in LEO revolve at a higher speed of ~8km/s, the risk of a satellite colliding with space debris is much higher, considering a large number of satellites that will be launched to form mega-constellations. According to a paper presented at International Astronautical Congress – 2018 by Glenn Peterson, current tracking technologies are simulating 67,000 collision alerts per year. With advanced tracking systems capable of tracking smaller debris, there will be a significant increase in the count of collision alerts. Going forward, Leo operators should figure out a practical solution to mitigate collisions.

Cost implications:

Even though the capex and opex of LEO constellations have fallen, given economies of scale, re-usable launch vehicles, etc., the real challenge lies in offering differentiated services and further lowering costs to compete with cable and fiber-based broadband services and bring down the price of user terminals.

“No one has been successful in deploying a huge constellation for internet broadband. I don’t think physics is the difficulty here. I think we can come up with the right technology solution, but we need to make a business out of it.” – Gwynne Shotwell, President, SpaceX.

Regulatory framework:

The need to establish an international regulatory framework to monitor low earth orbit is increasing, as this orbit is vital for space exploration. However, the increasing number of satellite launches in this orbit, along with dead satellites and debris would make it difficult to launch satellites in higher orbits. The commercial success of LEO constellations depends on the formulation of an international regulatory framework addressing access to orbits and space traffic management.

To Sum Up

Many players have invested billions to develop the LEO ecosystem in a bid to offer connectivity to underserved people. With its capability to offer high throughput connectivity across the globe, LEOs have paved the way for new use cases and business opportunities for players in the ecosystem. Despite the progress that has been achieved, a proper framework is required to regulate the space traffic and ensure fair usage of launch orbits.

References

- https://satelliteprome.com/news/operators/leo-constellations-opportunities-for-telecom-operators/

- https://www.semiconductorstore.com/blog/2018/LEO-vs-MEO-vs-GEO-Satellites-Whats-the-Difference-Symmetry-Blog/3327/

- https://www.radio-electronics.com/info/satellite/satellite-orbits/low-earth-orbit-leo.php

- https://www.universetoday.com/85322/what-is-low-earth-orbit/

- https://www.semiconductorstore.com/blog/2018/LEO-vs-MEO-vs-GEO-Satellites-Whats-the-Difference-Symmetry-Blog/3327/

- https://www.universetoday.com/85322/what-is-low-earth-orbit/

- https://www.telecomasia.net/content/telesat-completes-5g-backhaul-demo-over-leo-satellite

- https://www.nsr.com/nsr-report-5g-to-drive-1-3-of-satellite-backhaul-revenue-by-2028/

- https://interactive.satellitetoday.com/via/february-2019/leo-capacity-customers-discuss-new-applications/

- https://www.thespacereview.com/article/3473/1

- https://www.theverge.com/2019/4/2/18277344/space-situational-awareness-air-force-tracking-sso-a-spaceflight-cubesats

- https://www.thespacereview.com/article/3473/1

- https://techcrunch.com/2019/10/14/leo-labs-and-its-high-fidelity-space-radar-track-orbital-debris-better-than-ever-from-new-zealand/

- https://www.technologyreview.com/s/613239/why-satellite-mega-constellations-are-a-massive-threat-to-safety-in-space/

- https://www.spacelegalissues.com/satellite-constellations-a-race-is-engaged/