A growing number of industry leaders are identifying sustainability as a top priority for their businesses. A 2022 survey by Gartner showcased that social responsibility and environmental, social, and governance (ESG) features are finding a place on the corporate agenda for about one in five organizations. The survey also demonstrated that organizations are expected to deal with sustainability basis the shifting customer issue.

Gartner insights exhibited that executives that are involved with sustainability strategy and initiatives are striving towards developing a framework within their organization that promotes sustainable practices at different stages in their sustainable business strategies. However, many reported that investment in sustainable practices is increasing and will continue to rise in the next few years.

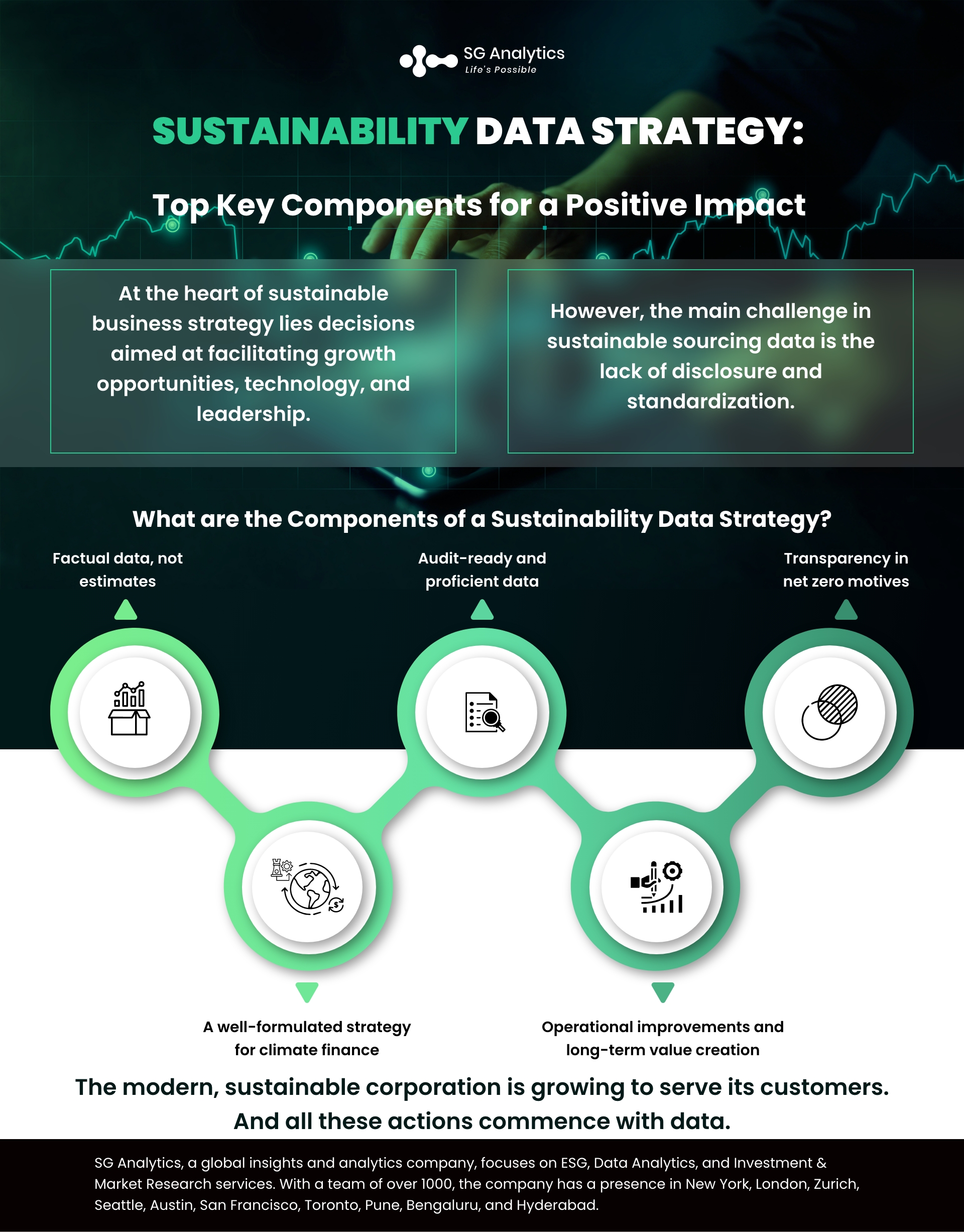

At the heart of sustainable business strategy lies decisions that are aimed at facilitating growth opportunities, technology, and leadership. When planning strategic ambitions and the level of engagement within an enterprise, executives are moving to integrate viable, sustainable business options. This includes doing the minimum through compliance, pursuing new growth opportunities, and differentiating through sustainability. However, this is a fast-paced area. Irrespective of the approach chosen, it is imperative for businesses to sense and respond to the expectations of stakeholders and consumers, put regulatory interventions in place and adjust to market shifts.

Read more: Aligning ESG with Corporate Strategy to Gain a Competitive Advantage

Sustainability Data Challenges

The main challenge in sustainable sourcing data is the lack of disclosure and standardization. While reporting this data is not a mandatory norm, businesses do not have a common framework for disclosing their ESG data. This has led to a requirement for resources to be spent on standardizing as well as interpreting unstructured data, making the process time-consuming and costly.

However, the challenges surrounding ESG data do not end here. Stakeholders or the client side also face a lack of quality data, thus creating dilemmas in integrating ESG into their technology stack, conceding to new regulatory requirements, and utilizing strong benchmarks. Similarly, different data points are reported by organizations from one year to the next. This lack of consistent, sustainable data reporting standards presents a major barrier to the advanced adoption of sustainable investing, making it challenging for clients as well as organizations to meet evolving ESG regulatory reporting requirements.

The Sustainability Data Shift

Organizations employ well-defined processes to assemble financial data that is carefully tracked and validated. It has a limited risk of being incorrect. On the contrary, sustainability data has always been handcrafted. With the data often scattered across spreadsheets, it becomes difficult to understand and identify the unknown risks.

The responsibility of sustainability data has shifted over the past few years. Sustainability teams within organizations were previously responsible for identifying the key data series and then rearranging them to produce them every year. However, the situation is changing today. With sustainability data becoming a critical part of public disclosures, the finance team within the organization is taking over. These finance teams are experiencing shock at the state of sustainability data.

Read more: How is Multi-stakeholder Assessment Helping to Create Long-Term Sustainable Value?

What are the Components of a Sustainability Data Strategy?

With organizational teams confronting the challenges of preparing sustainability data, the common elements of modern data strategy involve a centrally stored, well-structured data repository to eliminate duplicate data sets and a well-documented plan to reliably and easily provision the data for multiple use cases, despite the distinct pitfalls of sustainability data that should be top when formulating a strategic plan.

Here are the top key components of a data strategy for sustainability data.

-

Factual data, Not Estimates

While this seems to be a bit obvious, the state of sustainability data is such that many vendors funnel in industry and sector averages to enable summary results for their emissions data. The problem, however, is two-fold-

The emission data estimates are quite coarse and are not even mildly accurate. A recent study presented by FTSE Russell indicated that the noise in the data is huge.

Investor expectations are not solely about the data this is being reported, but it also regards the data that portrays emissions and water reductions for the next few years. But industry averages do not work for these goals.

-

Audit-Ready and Proficient Data

Regulatory requirements and investors both mandate credible and transparent data. The audit function in the regulatory processes plays a fundamental role in building confidence in sustainability data. Audit-ready and structured data enables the audit team to sample records from a data set and take a deep dive into the samples to track how the data was assembled and formulated at every step.

Reduced audit time and expense can be considered as the payoff for paying for a higher quality of sustainability data. With sustainability data becoming more standardized, the audits are also integrating these standardizations. Gone are the days of audits that are done in the nine months on annually reported data. Organizations are now functioning in a world of quarterly reporting of sustainability data with the normal audit process.

-

Transparency in Net Zero Motives

Organizations are disclosing their net zero plans but are refraining from disclosing the underlying components: actual emissions and offsets purchased. The price of carbon offsets is portraying a fearsome trajectory: Carbon offsets prices are expected to see a 10x increase by 2030. Net zero is predicted to get expensive.

Read more: The Rise of a Data-Driven Work Environment: What Do Enterprises Need to Know

With sustainability data being scrutinized, analysts are building models to link the pace of emissions reductions and offsets to financial data. To guarantee that carbon emission numbers line up, the finance team is taking a step forward to present their net zero stories through reported data and statements. Being transparent in net zero reports empowers institutions to stay away from significant disclosure problems.

-

A Well-formulated Strategy for Climate Finance

Emissions and water reductions mandate changes. While the change was expected to be behavioral in the initial days, businesses are now facing the underlying wrath of the consequences. Carbon reductions can come from building improvements, upgrades in equipment, and replacement of current fuels with clean energy. However, the incorporation of these changes comes with up-front costs. In our uncertain world, monetary assets must be preserved as a buffer against uncertainty.

With new service providers emerging for this process, businesses are integrating data and models to reliably estimate the size and cost of reductions. Verified financing partners are playing a significant role in effectively providing organizations with a steep discount on the up-front costs of change.

The data required depends on the financing source. However, it must be actual, audit-ready, and trackable. In addition, the sustainability data must be at the same granular level in case an equipment change-out is required. Finance teams are now creating the option for climate finance by drafting the right data from the start.

-

Operational Improvements and Long-Term Value Creation

The initial four components of the sustainability data strategy are related to work and expenses concerning the finance team. But these elements help benefit the enterprise in the fifth component.

The phrase "carbon emissions" signifies the use of carbon-intensive fuels in an organization. With the rapid drop in wind, solar and battery prices, businesses are switching to clean fuels to save money. Upgrading the building equipment also helps reduce operating costs. By employing high-quality sustainability data, businesses can reduce back-office expenses over current processes.

Read more: Data & Analytics Strategy: Must-Have Crucial Elements for Decision Making

To Sum Up

Today the actions of businesses are being monitored closely by stakeholders as well as consumers. This has compelled them to not only enhance their operational efficiency but also to lay the foundation for decoupling their revenue growth and emissions. The modern, sustainable corporation is now growing to serve its customers insulated from energy price volatility and climate change risk and support higher future cost of emissions reductions.

With investors searching for climate change winners, employees are also in search of employers who are integrating sustainability into their actions. Customers are choosing vendors and partners who portray a future-forward attitude. There is indeed a heightened upside to the effort being taken behind emissions and water reductions. And all these actions commence with data.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in Data Analytics, SG Analytics focuses on leveraging data management & analytics and data science to help businesses discover new insights and build strategies for business growth. Contact us today if you are looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.