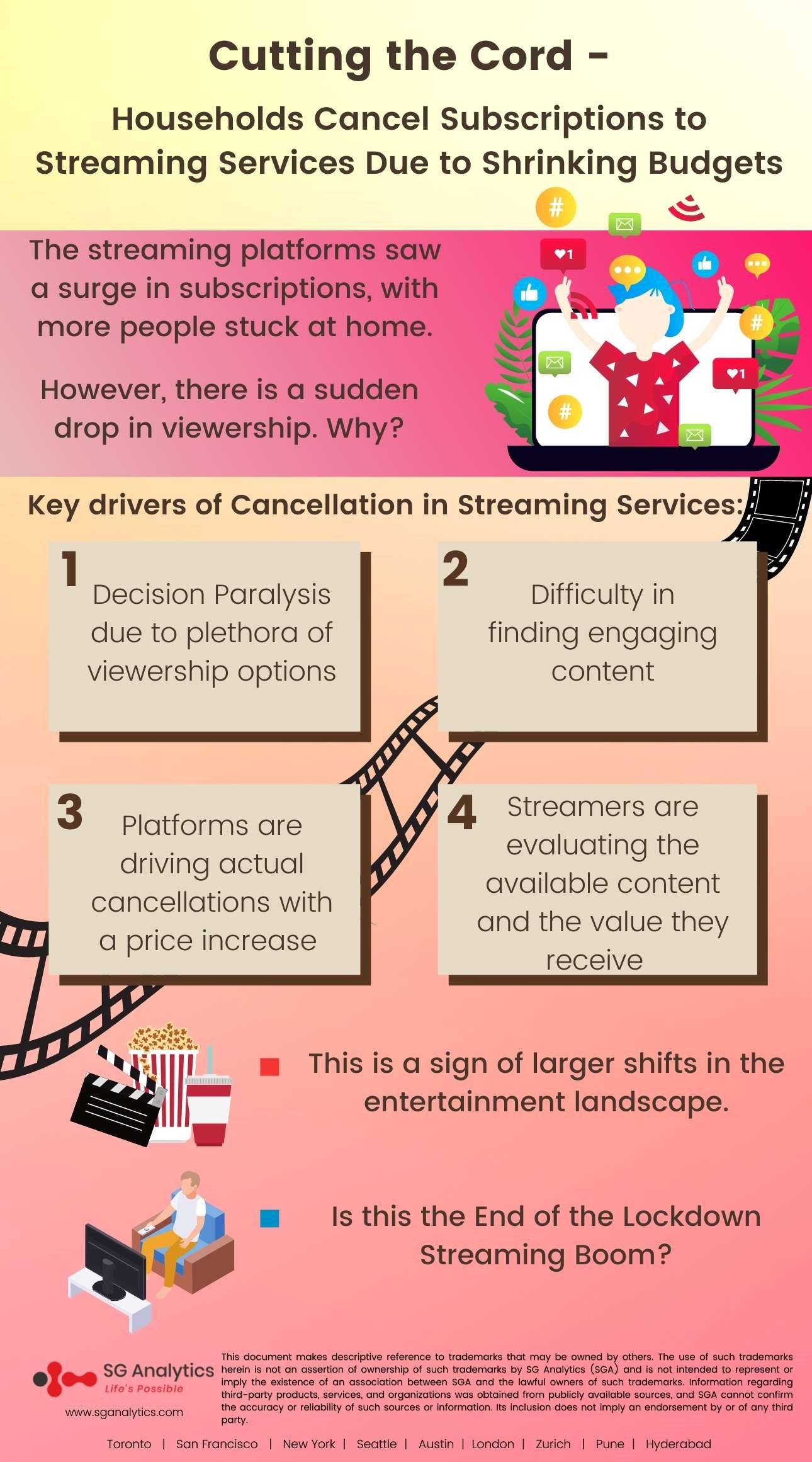

Due to the COVID-19 pandemic and the government-enforced lockdowns, the streaming platforms saw a surge in subscriptions, with more people stuck at home. However, the proportion of consumers now planning to cancel their subscriptions due to cost-cutting has risen to its highest level, with it rising from 29% to 38% in the last few months in 2021.

U.S. households today have stopped adding to their ledger of streaming services. This is another sign that the on-demand video streaming market has reached its saturation point. The number of on-demand streaming services accessed per household leveled off at 4.7, as per the survey from Kantar.

Subscribers are now looking to downsize rather than upscaling their streaming video subscriptions. A study found that nearly half of consumers are feeling overwhelmed by the number of streaming services available. As newer streaming players like Apple TV+, HBO Max, Disney+, Paramount+, and others enter the fray, viewers are facing a challenging time making choices about which services are the most essential. Even Netflix, considered a large company with the biggest streaming service, is facing a wave of rising competition.

Did you know?

Between January and March 2022, the thriller Reacher, starring Alan Ritchson and Willa Fitzgerald, was the most-streamed show on Amazon Prime, followed by Ozark and Inventing Anna on Netflix.

So, why this sudden drop in viewership and subscriptions?

Read more: Top Media & Entertainment Trends to Watch Out for in 2022

Key drivers of Cancellation in Streaming Services

In the past decade, streaming platforms have slowly replaced traditional television. However, the shrinking subscription is a piece of sobering news for the entertainment industry, which saw a boom in its viewership during the height of the coronavirus pandemic. With the rise in energy bills and inflation, many households are now opting to make budget cuts which could have a critical impact on streaming services like Amazon Prime, Netflix, and Disney+.

With the streaming market continuing its evolution, an unprecedented number of entertainment on-demand platforms are witnessing a significant revenue downfall. At a time when living standards are forecasted to suffer indicates that the ballooning home entertainment budgets that were sacrosanct during the lockdown conditions are now being cut.

Streamers are increasingly signing up and then subsequently canceling services as it is becoming harder for them to find the content they want to watch after watching a specific piece of content. In addition, planned cancellations on the streaming sites are increasingly driven by not enough new TV/film content. Top streaming service platforms like Netflix and Amazon Prime are driving actual cancellations with price increases. Netflix’s subscription price increase drove 15% of its canceled subscriptions in the first quarter and 29% of planned cancellations in the second quarter.

Decision Paralysis due to Plethora of Viewership Options

The viewers in the U.S. have reached the point of too much choice, making it harder for them to find engaging content. Streamers are switching more between platforms instead of stacking. Today, viewers are increasingly signing up and canceling their streaming subscriptions for specific content. This indicates that platforms need to heavily market and recommend specific titles to help consumers with decision paralysis. Streaming platforms are now turning to deploying innovative marketing and content acquisition strategies to support and avoid this loss in churn rate.

Subscription Price Plays a Critical Role

The stagnation of overall streaming platforms has been attributed to content factors. However, it is evident that price still plays a role in streaming. Both AVOD/paid ad-supported streaming, and FAST/ free ad-supported streaming services grew during the pandemic-induced lockdown period.

With lockdowns easing and the surge in subscription fees, consumers are considering the value for money per subscription and choosing ad-supported alternatives to get the best-perceived value. If viewers do not see the value in the content of a streaming service they are paying for, they are no longer subscribing to that additional platform at a higher cost. Instead, the lower cost or free options platforms are driving the growth of the streaming category.

.jpg)

Is this the End of the Lockdown Streaming Boom?

While in 2022, streaming platforms saw steady growth in new subscriptions, this was outweighed by the number of cancellations, with half of them attributing the cancellation to money-saving.

Kantar report predicts that to save money, 28% of streamers are looking to cancel at least one of their streaming services. Netflix and Amazon will likely be the last to go when households are forced to prioritize their spending.

It is not just the U.S. households who are tightening their TV entertainment wallets. In the U.K., around 16.9 million households have at least one streaming subscription service. However, after a decade of nearly uninterrupted growth for streaming services, the number of streamers paying for a minimum of one subscription streaming platform fell by 215,000 at the start of 2022.

However, despite the churn rates increasing across all platforms, there is a visible difference in the number of subscriptions canceled outside of Netflix and Amazon. Netflix and Amazon are being perceived as hygiene subscriptions in the UK.

Netflix ranked number one in importance irrespective of what platform it is put up against. But the implications for the likes of Disney+ are significant. Streaming platforms like Disney, Now TV, Discovery+, and BritBox are seeing a significant jump in churn rates quarter-on-quarter.

Disney+ is now turning its attention to getting households to switch from other streaming services like Netflix and Prime, rather than just portraying itself as another incremental addition. If not a cataclysmic moment of analysis, streaming platforms are at a crossroads where they must decide how to maintain their growth to justify the ongoing expenditure.

Will the Streaming Platforms rebound?

The first quarter of the year 2022 saw the lowest ever rate of new subscribers. A total of 1.51 million subscription cancellations happened in the first quarter of 2022.

Despite adding over 8 million new subscribers in the last quarter, Netflix's stock tumbled by more than 20 percent. Disney+, the world’s third-biggest service, saw a decline in its churn rate- the rate at which customers canceled subscriptions.

Inflation rose at its fastest pace, with the cost of food, gasoline, and housing rising across the world. The rise in the cost of living has forced viewers to cancel their streaming subscriptions. People have begun budgeting and are trying to cut back on costs.

In times of financial uncertainty, streaming services are indispensable in subscribers’ minds. These more than half a million cancellations of streaming services were due to the rising inflation. Viewers are now deprioritizing streaming services from their household expenses as they try to make ends meet.

However, cost-conscious streamers are identifying Netflix and Amazon’s Prime Video as the must-have streaming service platforms, proving to be the only two platforms with the lowest rate of customers leaving in the first quarter.

With the streaming service industry becoming a heavily competitive market, it is now more critical than ever for subscription video on demand/SVoD providers to demonstrate to their consumers how their streaming services are indispensable in the home.

Read more: The Science of Music: How Big Data Is Transforming the Music Industry?

Key Takeaways

-

Netflix stocks are routed after a decline in subscribers.

-

U.S. households are no longer adding streaming services to their monthly list of payouts.

-

On-demand streaming services accessed per household levelled off at 4.7.

-

A total of 1.51 million streaming service cancellations occurred in the first quarter of 2022.

-

About 16.9 million households in the UK had at least one subscription service by the end of the first quarter of 2022.

In Conclusion

Numerous lockdowns led to people paying for multiple streaming services like Netflix, Disney+, and Amazon Prime, but now people are cutting back on the subscription cost. Even the world’s biggest streaming services are feeling the pressure of the post-pandemic slowdown.

For streamers today, saving money is the number one reason for cancellation. However, it is not significantly driving a greater proportion of cancellations. Instead, it is content that is driving cancellation viewers to cancel their streaming services. Netflix's price increase had a significant impact on cancellations. Streamers today are evaluating the available content and value they receive from their streaming repertoire. This is a sign of larger shifts in the entertainment landscape and indeed a turning point from continued stacking and increased spending.

With offices in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in the Media & Entertainment space, SG Analytics helps leverage advanced analytics abilities to make authentic decisions and accelerate business growth. Contact us today if you are in search of media & entertainment solutions that enable businesses to solve problems by harnessing disruptive data, artificial intelligence, machine learning, and innovative technologies.