Customer analytics became an important source of information in decision-making. One of its main benefits is to show the price-sensitivity of customers towards a particular product, which can be seen by developing a price-elasticity model with sales revenue as the dependent variable and price as the major independent variable. This price-elasticity is usually a regression model, and it includes other independent variables (apart from price) representing one or some or all of the following:

- Store-specific information

- Demographic information

- Promotion and discount information

- Competitor details

- Cannibalization information

- Special events, festivals, and holidays

- Macroeconomic factors

How to tweak variables?

Quite often, the price-elasticity model does not end up as a normal multivariate linear regression model. It requires understanding the relationship between sales and price, and tweaking the dependent variable of sales and the independent variable of price accordingly through variable transformation. There is a good reason for that, as there is empirical evidence that models with such transformed variables provide better accuracy and stand up to model diagnostics tests in a much more respectable manner. However, a discussion on empirical evidence is beyond the scope of this article.

Three types of transformations are definitely explored while constructing a price-elasticity model:

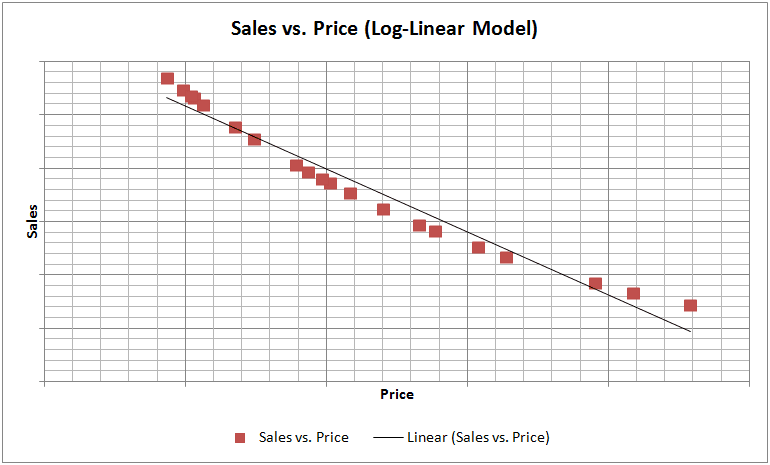

- Logarithmic transformation of dependent variable (sales), no transformation of independent variable (price) (Log-Linear Model)

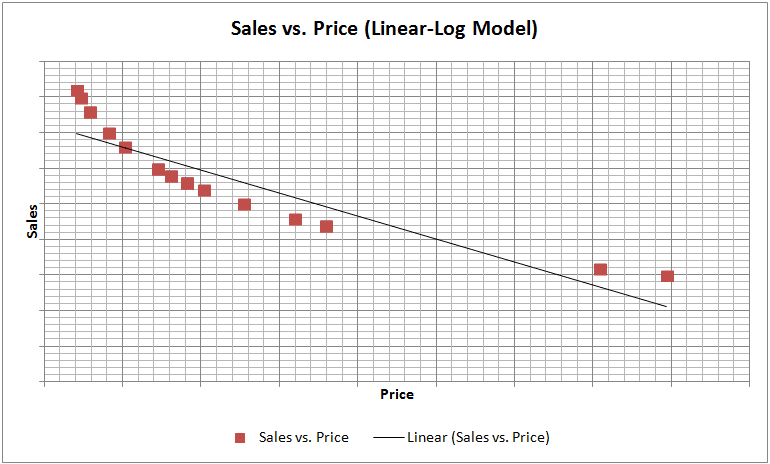

- No transformation of dependent variable (sales), logarithmic transformation of independent variable (price) (Linear-Log Model)

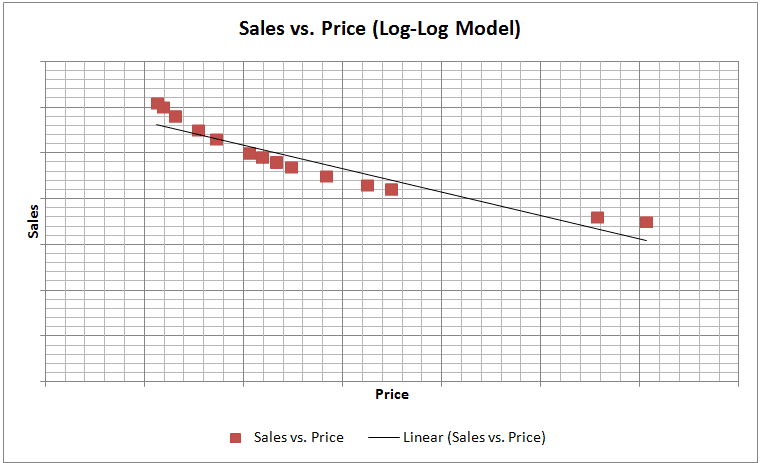

- Logarithmic transformation of dependent variable (sales), logarithmic transformation of independent variable (price) (Log-Log Model)

Choosing the right regression model:

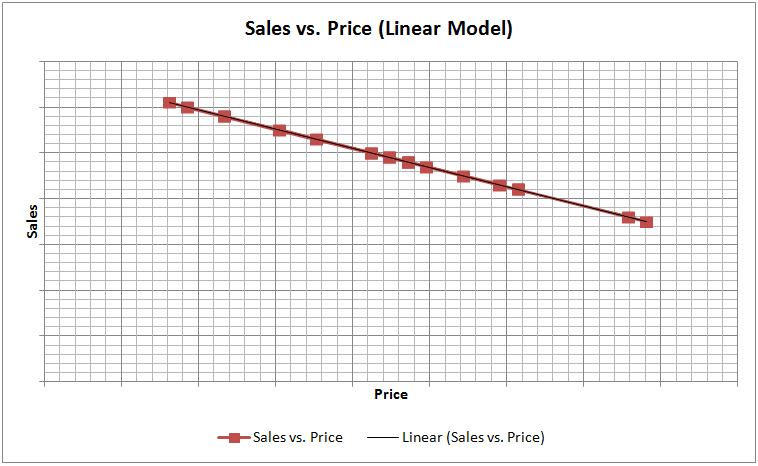

Thus, at least four kinds of regression models are explored: a normal regression model and a regression model for each of the three aforementioned transformations. More models can be explored by considering various transformations, but usually, these four different approaches should suffice for developing a price-elasticity model.

To choose the right approach, one needs to explore the relationship between the dependent and independent variables (Sales vs. Price). This can be done through simple graphical analysis or simple regression. The graphs for each of the four models are shown below:

One of the main assumptions of linear regression is that the relationship between Y and X should be approximately linear. We can observe from the sample graphs above, that if the relationship between Y and X is of curvilinear nature, then it is definitely worthwhile to perform logarithmic transformations and check the linearity between transformed variables and select that transformation, which provides the best linear fit between Y and X. The curvilinear relationship between Sales and Price seems to be a general feature of economic reality and thus, logarithmic transformations tend to work well with these variables.

Read more: The 7 Biggest Technology Trends In 2022

Besides satisfying the linear regression assumption of linearity of dependent and independent variables, another reason for choosing logarithmic models is that these models are consistent with the “no money illusion” theory. “No money illusion” is a microeconomic theory, according to which, if there is an increase in income and prices to the same extent, then the quantity demanded of a product remains the same. However, this is a point of debate among economists. It is quite probable that in the short term, “money illusion” actually exists (due to lack of awareness and alertness related to the real and nominal value of goods and services) and it does have an impact on aggregate consumption. However, in the longer term, “money illusion” fades away resulting in “no money illusion” and aggregate demand returns to previous levels.

Read more: Top AI Trends to Watch Out for in 2022

Thus it can be concluded that to develop the right price-elasticity model, the relationship needs to be studied between sales and price and appropriate transformations, if required, need to be done on these variables. We also need to take into account other factors for model development. Lastly, the general state of economy needs to be studied in the present context (regarding the existence of “money illusion”) and the right model needs to be chosen.

Read more: Top AI Trends to Watch Out for in 2022

With offices in New York, Austin, Seattle, London, Zurich, Pune, and Hyderabad, SG Analytics is a leading research and analytics company that provides tailor-made insights to enterprises worldwide. If you are looking to make critical data-driven decisions, decisions that enable accelerated growth and breakthrough performance, contact us today.

References:

https://faculty.darden.virginia.edu/GBUS8630/doc/M-0805.pdf

https://doc.rero.ch/record/255122/files/PochonV.pdf

https://www3.amherst.edu/~fwesthoff/webpost/Old/Econ_360/Econ_360-10-15-Chap.pdf

https://home.wlu.edu/~gusej/econ398/notes/logRegressions.pdf

https://support.sas.com/resources/papers/proceedings13/425-2013.pdf

https://www.dummies.com/how-to/content/the-linearlog-model-in-econometrics.html