Two years into the pandemic, the global economy seems to have seen it all. It has gone upwards, downwards, and sideways.

Despite many warnings, the world’s economies were simply not ready for a pandemic. The result was rapid adaptation—transformation. Many changes, of course, were spontaneous, as governments worldwide acted quickly to manage the catastrophe. Other changes, however, were perhaps imminent, but, thanks to the pandemic, were brought about in mere months.

Two years into the pandemic, many of those changes are still here, and perhaps will continue to impact our lives even in 2022. Here are the top six that will define the new year.

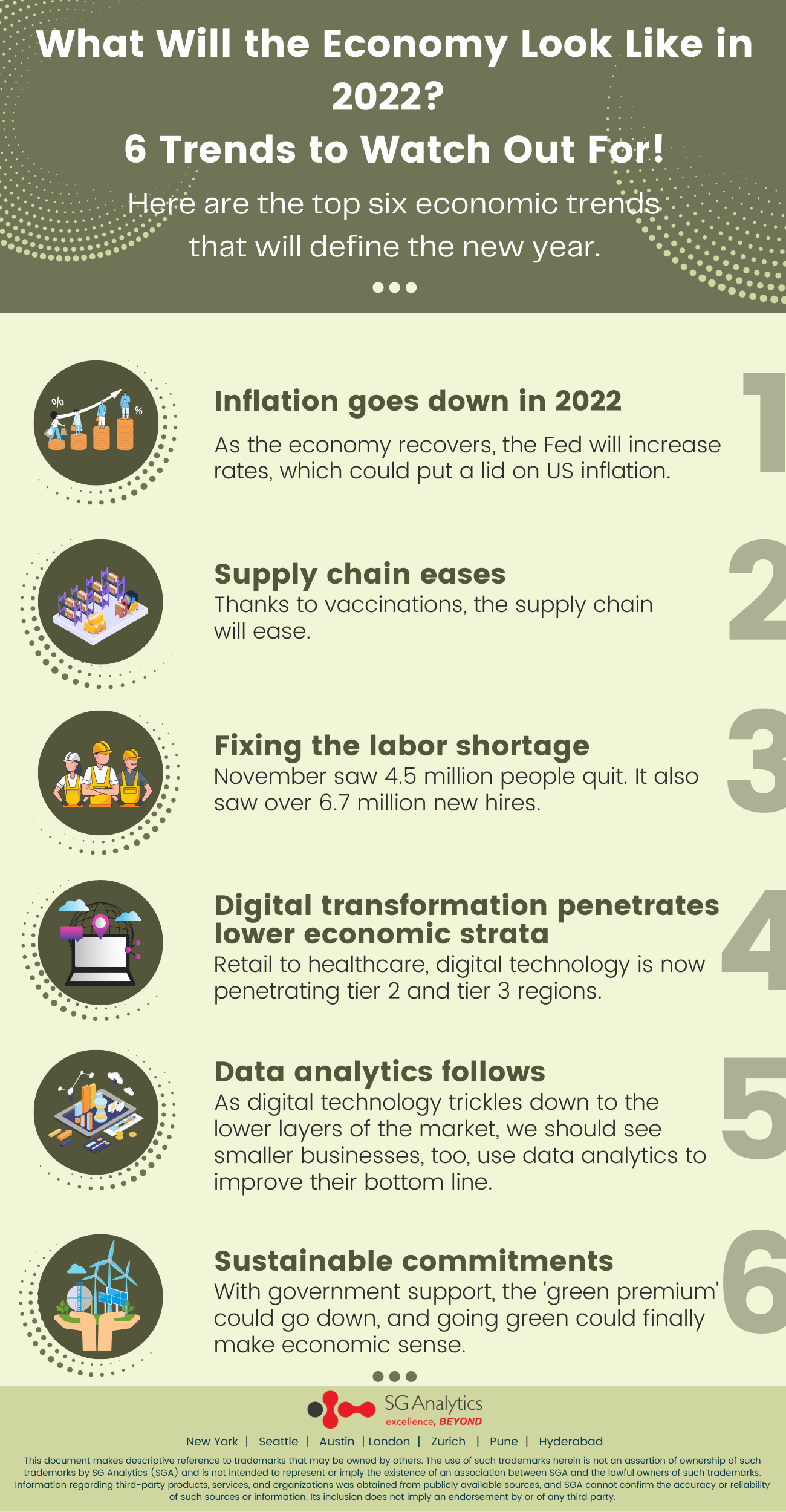

1. Inflation goes down in 2022

Besides achieving mass immunity against the coronavirus, managing inflation is the US economy’s biggest challenge.

Characteristic of the ‘new’ normal, the inflation we are witnessing is unprecedented. According to the Consumer Price Index (CPI) published in October last year, the US economy’s year-over-year inflation had risen by 6.2%—the most in 30 years. A wide range of finished goods saw an increase in price, from cars and computers to groceries and gasoline.

While Biden assured the inflation was temporary, putting his authorities on the task, the problem got worse in the months that followed. In December, the US inflation rate had reportedly risen to 6.8% over the previous year, according to data published by the Bureau of Labor Statistics. The increase represents the worst in almost 40 years. To put it in perspective, gasoline prices rose by over 58% over 12 months.

Read more: “Most Since 2009”: How US Inflation Rose Fastest in 30 Years

Will the trend continue in 2022? Maybe. But many economists suggest otherwise.

The stimulus checks and cutting interest rates to near-zero were a blessing to many. However, the US also saved billions, as traveling and entertainment costs, besides others, were cut completely. Even though demand was already high (we will get there), the excess money meant Americans were willing to pay the premium, pushing prices even further up. Personal expenditures, for example, rose 12% compared to 2020. The ratio of disposal income to household net worth neared a record high.

Now, in 2022, economists claim that as the economy recovers, the Fed will increase rates, which could put a lid on US inflation. The question is, is the economy really recovering? The question seems even more urgent in the emergence of the Omicron variant of COVID-19.

Read more: “US Reports Over 1 Million New Daily Cases”: Omicron vs. Delta, Everything You Need to Know

2. Supply chain eases

The tightening of the supply chain was perhaps the biggest reason why prices shot up. As COVID-19 swept the world in 2020, governments across the world imposed nationwide lockdowns, causing ports and factories to shut down.

The result was a radical shortage. A shortage of everything, from computer chips, lumber, and cereal to chocolate, exercise equipment, and electric trucks.

As explained, while many had saved enough to be able to pay the premium, many could not. Computers, for example, almost a necessity in 2022, central to the home-office setup, were priced higher or simply not in stock. Delays were a defining highlight of last year.

Read more: “Losses of $210 Billion”: How the Supply Crunch Gripped the World

Two years into the pandemic, vaccines have proven to be of great help. Ports, factories, and warehouses are now open. However, danger is just around the corner.

First, vaccine access has been shockingly unequal. As North Americans receive a booster, those from the poorest countries are yet to be fully vaccinated. Over 92% (Our World in Data) have not even received a single dose, let alone two or three. Such countries stand no chance against outbreaks and will have no choice but to re-impose lockdowns when the next wave occurs.

Which brings us to the second point. Companies demand that their workers be vaccinated. However, the few who are in the poorest countries, working ports, factories, and warehouses, receive less effective, more economical vaccines. Variants, like Omicron, can easily evade the immunity such vaccines provide and lead to outbreaks.

The global economy is inextricably connected, and unless the majority of it is vaccinated, the supply chain will always be under threat. As things stand, the global supply chain is expected to further loosen. But one never knows.

3. Fixing the labor shortage

Okay, suppose we do manage to vaccinate the global economy. But what if the workforce does not want to return to work?

Back in April 2020, when the coronavirus hit the US, the economy lost over 22 million jobs. It was devastating. Gradually, as the economy recovered, unemployment went down. However, something had changed. Workers did not want to work—not for low wages, long hours, and unsafe conditions.

What ensued was the Great Resignation or Big Quit—a movement that saw millions quit their jobs willingly. Last November, in fact, data released by the government showed that nearly 4.5 million people had quit their jobs voluntarily—the highest on record.

Burnout was prevalent even before the pandemic. It had been widely covered and decried globally. Perhaps the pandemic was the straw that broke the camel’s back. The line separating work and home was already faint. Working from home erased it.

Just to be clear, the Big Quitters are not abandoning their professional career. They are simply switching to employers who are willing to fulfil their expectations: flexibility, better opportunities, higher wages, better working conditions. November saw 4.5 million people quit. It also saw over 6.7 million new hires.

The trend will continue in 2022. Employers, not employees, will adapt. That said, economists are worried that while rampant hiring is a sign of good health, the movement could lead to wage inflation.

Read more: Capturing the COVID-19 Pandemic Through 5 Iconic Data Trends

4. Digital transformation penetrates lower economic strata

Given the surge in cases of burnout, many would argue that the Great Resignation was imminent. The pandemic just saw it accelerated. Another phenomenon that has suffered an identical fate is rapid digital transformation.

Business intelligence tools are becoming cheaper and more accessible every year. As a consequence, digital empowerment is no longer a luxury. Retail to healthcare, digital technology is now penetrating tier 2 and tier 3 regions. E-commerce, for example, has a greater reach. But so have smaller businesses, plenty of whom have their own website and offer the convenience of online shopping.

In 2022, more and more small businesses will become digitized, tracking orders digitally and going cashless. The push will come from customers who prefer the convenience. Soon, digitized businesses will become the norm, such that businesses that are slow to adapt will risk losing customers.

Read more: “51% Rely on AI”: Marketing Insights and Challenges in 2022

5. Data analytics follows

As digital technology trickles down to the lower layers of the market, we should see smaller businesses, too, use data analytics to improve their bottom line.

Digitization offers more than convenience. It generates data. While automation and increased efficiency are two of the biggest advantages of using business intelligence tools, what is less talked about is the valuable data the tools generate.

Digitization offers more than convenience. It generates data. While automation and increased efficiency are two of the biggest advantages of using business intelligence tools, what is less talked about is the valuable data the tools generate.

For example, the tools enable retail owners to track shipping, manage orders, and automate refunds. However, they also track customer data in transactions and content engagement. If owners are willing to invest more, they can also track which sections are clicked the most on their app or website. That is highly valuable information that says a lot about customer behavior and preferences.

Data analytics tools, too, were a luxury. But that is changing. Building and monitoring a website or app is also getting cheaper and easier every year. In 2022, smaller businesses will take a step forward in not just going digital, but also using the tons of data they produce to better understand their customers.

Read more: Top AI Trends to Watch Out for in 2022

6. Sustainable commitments

The world is running out of time. If we fail to contain global warming within 2° C before the end of the century, millions of lives and livelihoods would be lost.

Solving the climate crisis is one of humankind’s mightiest challenges. Perhaps the mightiest. It demands global cooperation and firm commitments. Take food, for example. The human population is estimated to reach 10 billion by 2100. At the same time, the food and agriculture sector is responsible for emitting nearly one-third of global emissions. The excess population must be fed, but feeding it is unsustainable.

And that is just food and agriculture. What about transport, energy generation, steel, and concrete? Where will the excess population live and work? Food and energy demand will only go up, but we must ensure that it is met sustainably. For that, we must innovate. And innovate now.

Read more: 100% Clean Energy? The US Need Not Look Beyond Solar, Wind, and Hydropower. Here’s Why

Over 190 countries agree. At last year’s Climate Change Conference held in Glasgow, UK, leaders from over 190 countries gathered and made certain commitments to do their bit in fighting climate change. The US and Europe have committed to achieving net-zero emissions by 2050. China and India, by 2060 and 2070, respectively.

The large commitments are resting on smaller commitments, such as generating 50% of electricity sustainably by 2030 (India). Or ending foreign public financing of coal, oil, and gas projects by the end of 2022 (France).

Read more: A Brief on United Nations’ Climate Change Conference, 2021

In 2022, projects supporting those commitments will take off. Already, the world’s biggest companies like Apple, Google, and Microsoft have pledged to achieving net-zero emissions by 2035. Soon, smaller companies will follow. Government support will play a massive role in the transition. After all, cost is the biggest reason why we choose non-renewables over renewables.

With government support, the ‘green premium’ could go down, and going green could finally make economic sense.

With offices in New York, Austin, Seattle, London, Zurich, Pune, and Hyderabad, SG Analytics is a leading ESG research and analytics company that provides tailor-made ESG insights to enterprises worldwide. If you are looking to make critical data-driven decisions, decisions that enable accelerated sustainable growth and breakthrough performance, contact us today.