Over the past several years, individuals throughout the world have been adopting more sustainable choices in their daily lives, such as recycling household waste, living more sustainably to reduce waste, and utilizing greener modes of transportation whenever they can. So it's no surprise that this is having an effect on financial decisions like Environmental, Social, and Governance (ESG) investments.

It's possible to invest in firms that are committed to making the world a better place through environmental, social, and governance (ESG) investing. Financial rewards are prioritized over the company's impact on the environment, its stakeholders, and the planet when it comes to ESG investing.

The use of environmental, social, and governance (ESG) and climate data and tools by investors and issuers alike is fueling the growth of the ESG investing trend. The term can also be used to refer to impact investing, socially responsible investing, and sustainable investing. An ESG investment is one that prioritizes environmental, social, and governance (ESG) concerns or results over other considerations when making investment decisions. To many, ESG investment means making investments that take into account not only the bottom line but also the health of the planet and the well-being of its inhabitants.

Corporations that score highly on environmental and social responsibility criteria as judged by third-party, independent companies and research groups should be invested in. ESG investing is based on the idea that investors should think about the long-term effects of their investments on the environment and society as well as their own financial gain.

What is ESG, and how does it affect businesses?

Global ESG assets are expected to reach $41 trillion in 2022 and $50 trillion in 2025 (World Economic Forum), with ESG investing expected to increase at a blistering pace.

E: The ESG is one of the most pressing issues of this century. How firms manage their environmental impact and consume energy has far-reaching effects on society and the world. More customers are attracted by sustainable practices, which improve access to resources, reduce energy and water usage, and, as a result, can minimize operating expenses. One way to think about a company's environmental impact is to consider the dangers and possibilities that climate change poses to the company, its operations, and its industry.

S: Social effect may not be immediately apparent, yet it is an essential component of the ESG framework. The way a firm treats its employees and its culture will have a direct impact on the community as a whole. Using sustainable methods improves a company's public image, attracts top-notch employees, boosts morale, and fosters better ties within the community. For example, a social component could focus on a firm's interaction with people and society or if the company invests in its community.

.jpg)

G: This criterion has two parts. One way to do this is to stay on top of potential violations, maintain open communication with authorities, and adhere to industry best practices. On the other hand, there is a set of internal measures and procedures in place to regulate and make decisions that have a real impact. Using sustainable practices can lead to government assistance and subsidies, as well as a reduction in regulatory burdens and an improvement in investor relations, such as more favorable loan terms or lower capital expenses. There may be an emphasis on governance problems, such as how the company is managed and CEO compensation.

ESG Investing Trends and Their Importance

ESG and SRI goods have seen a tremendous surge in demand from clients. However, the question remains as to why ESG investment matters. About 77% (Perillon)of small and mid-cap companies have a clear mission statement that mentions ESG.

For ESG investing, independent assessments of a company's environmental performance, social effects, and governance policies are critical. Increasingly, environmental and social variables are assumed to have an impact on an organization's financial success. Many methods are available to monitor or report on an organization's ESG performance, which helps stakeholders make important decisions.

In the future, investors will be able to make more educated selections based on real-time research of a portfolio's ESG rating. In addition, direct indexing could facilitate customisation at scale. Increased access and choice for investors will allow them to choose from a wider range of funds that promote the issues and values they care most about, such as investing in women-owned businesses or carbon-neutral enterprises.

Today's investors have a strong desire to make a difference by exchanging money for goods and services. Investors can talk to their financial advisors about the best way to diversify their ESG investments, taking into account their total portfolio's risk and return.

Future of ESG Investing

According to The Climate Pledge, more than 200 (Perillon) companies have agreed on the objective of achieving net zero carbon 10 years early.

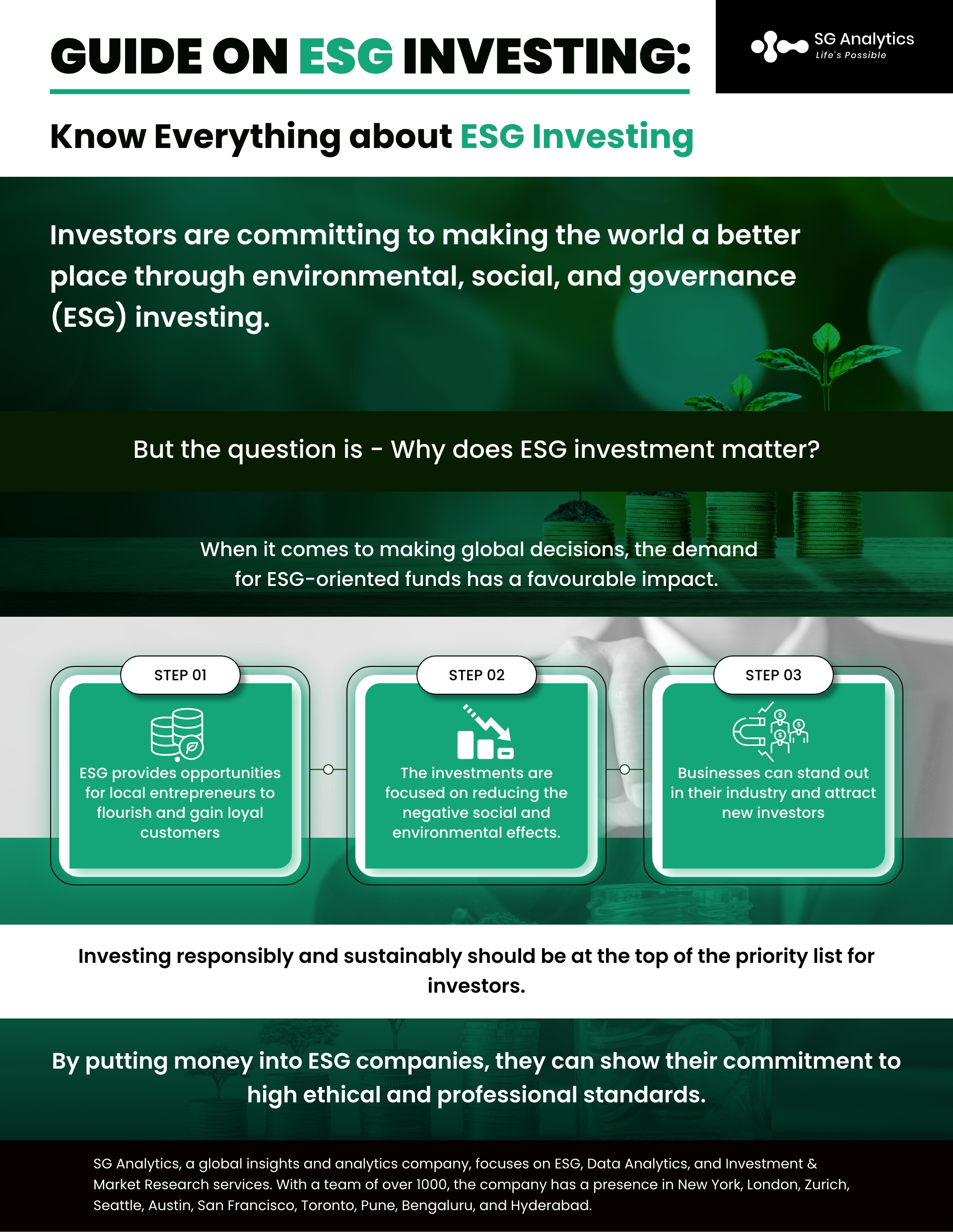

When it comes to making global decisions, the demand for ESG-oriented funds is projected to have a favorable impact on the way global decision-makers work. ESG rules provide additional opportunities for local entrepreneurs to flourish and gain loyal customers by focusing on solutions that are good for both society and the economy. Investments in ESG focus on quantifying an organization's or investor's efforts toward reducing their negative social and environmental effect.

Demonstrating your dedication to environmental and social responsibility as a business owner is a wise move since most customers and investors are wanting to invest in firms that have a beneficial influence on the earth and people. If you take the right steps to reduce the environmental impact of your business, it can help you stand out in your industry and attract new investors, as well.

More and more clients from all over the world can be attracted to your firm if you gain an improved grasp on ESG investment. ESG investment funds can also help you build more authentic relationships with your potential customers by allowing you to talk about more than just business.

Also Read - Top ESG Investing Trends to Watch Out for in 2022

Conclusion

People are increasingly concerned about environmental issues and maintaining social equality, which is likely to influence their financial decisions. A win-win situation for investors, ESG investment gives higher profits while also allowing them to make a good impact on the world around them.

It's time for investors of all ages to consider ESG investment options, given the many advantages they offer. It might be argued that ESG investing is an attempt to address a number of pressing global issues, such as poverty, deforestation, and global warming. ESG investing is poised to pave the way for a more prosperous and sustainable future as more companies and brands control their marketing methods and implement sound CSR initiatives. The spread of the coronavirus has also increased the importance of ESG investing, according to many investors or consumers.

Investing responsibly and sustainably should be at the top of your priority list if you adhere to ESG guidelines. By putting money into ESG companies, you can show your commitment to high ethical and professional standards while also increasing the value of your portfolio.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Consulting services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.