However, the fact never caught on with investors until recently. Today, not only is non-traditional or alternative data widely used, but a large chunk of investors thinks of it and not traditional data as their primary source of information to make investment strategies.

We have already covered alternative data in a previous post, and you should really give it a read. Here is a summary: alternative data is primarily qualitative, not quantitative. It provides a more nuanced measure of what the market 'feels'. Therefore, its insights are broader, going beyond the numbers.

But what is the difference?

The rise of qualitative data

Qualitative data is the practice of collecting and analyzing information that explains the dispositions — the needs and wants — of customers. But that is only the concern of market research. From the point of view of investment research, qualitative data reflects the dispositions of all stakeholders involved. Not just customers. But also analysts, credit rating agencies, competitors, and employees, low or high-level, and so forth.

As the name suggests, this information is non-numerical. It lacks structure and therefore presents a challenge to drawing statistical trends or insights. That is because opinions and views are broad and therefore extremely hard to reduce to data points. But investment researchers actively look for qualitative answers because what they convey is far deeper and more nuanced than numbers can. Qualitative data allows investors to penetrate market sentiment more deeply than quantitative data.

And it also makes sense from the perspective of a data scientist. By collecting both quantitative and qualitative data, investment research firms widen their net, learning far more, and therefore making more informed investment strategies.

“Qualitative data allows investors to penetrate market sentiment more deeply than quantitative data allows.”

“Qualitative data allows investors to penetrate market sentiment more deeply than quantitative data allows.”

The question is, why now? Because qualitative data, at the end of the day, is data. Even though the two may seem different on the surface, both quantitative and qualitative data serve the same objective: to better understand the forces shaping the market.

Only now has qualitative data come under the spotlight because technology has finally caught up with what is demanded to collect, process, and analyze qualitative data. We knew that qualitative data is critical to investment research, but only recently have our hardware and software evolved to be able to leverage it.

One technological evolution that stands out is the cloud. The pandemic showed how far cloud infrastructure has come. No more a niche, the infrastructure is robust and stable enough to sustain businesses worldwide. So much so that many are prepared to work remotely forever.

However, the cloud’s true potential is yet untapped. Besides connectivity and stability, cloud technology is expected to undergo a massive enhancement in speed. And nobody would benefit more from the triumvirate than qualitative investment research firms. Cloud represents the foundation for what is to come for the industry in 2022: the ability to develop models with greater ease, speed, volume, and diversity.

Cloud in 2022: Getting qualitative insights at scale

The world generates over 2.5 quintillion bytes of data every day. A large chunk of that data is qualitative — audio, video, text, and other vast and various data generated by users when they interact online. We are talking about reviews, launches, and even protests on Twitter, Instagram, YouTube, and other channels. Indeed, new ones emerge every other week now. This is a goldmine for sentiment analysis, and it is high time investors put it to good use.

“The world generates over 2.5 quintillion bytes of data every day.”

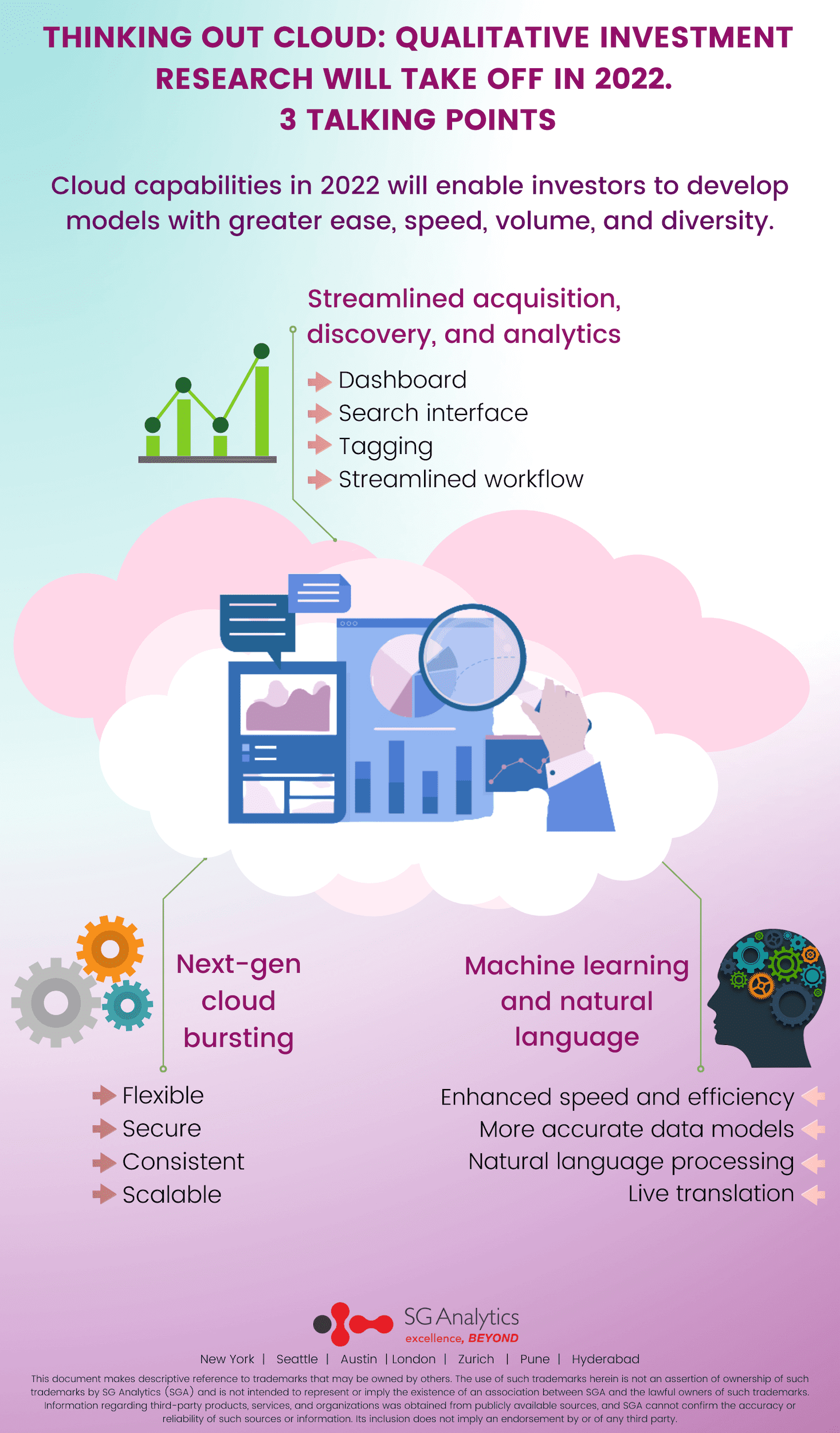

And now they can. Cloud capabilities in 2022 will enable investment research firms to onboard and process high-quality, highly differentiated data easier and faster than ever. Here are 3 ways how.

1. Streamlined acquisition, discovery, and analytics

As data becomes more vast and complex, it becomes more challenging to onboard and process. Moreover, as markets are revealed to be more and more interconnected, valuable patterns or insights also become more challenging to find. It becomes harder to determine whether two market occurrences are causally connected or merely correlated.

The point is, if investors are going to deal with a variety of data, that data ought to be not just collected and processed faster, but also be more convenient to reach and share.

More volume will enable investors to aggregate large and differentiated datasets. High-performance engines will crunch data at breakthrough speed. And a dashboard and search interface will make tagging old insights and discovering new ones remarkably easy. A more streamlined workflow will emerge.

More volume will enable investors to aggregate large and differentiated datasets. High-performance engines will crunch data at breakthrough speed. And a dashboard and search interface will make tagging old insights and discovering new ones remarkably easy. A more streamlined workflow will emerge.

2. Next-gen cloud bursting

As volume rises, so does the requirement for cloud bursting.

For those who are not aware, cloud bursting is a technique wherein an application running on a private database ‘bursts’ onto a public database in response to a spike in capacity. Cloud bursting is triggered when computing demands exceed a certain threshold. However, organizations may also strategically trigger bursting to better optimize their computing resources.

The problem is, organizations always have had to make a compromise between flexibility and security: the load on IT drops as data gets distributed, but public databases are relatively less secure than private ones.

“The reason why only now has qualitative data come under the spotlight is that technology has finally caught up with what is demanded to collect, process, and analyze qualitative data.”

But all this will change in 2022. We will see more evolved cloud capabilities — the result of advanced hardware — that will edge cloud computing ever-closer to the right balance between being elastic and being secure.

3. Machine learning and natural language

The biggest jumps in speed and efficiency will come from directly integrating machine learning techniques and natural language processing algorithms into cloud workflows.

As qualitative data becomes the primary focus of investment research, simulations and risk calculations become more sophisticated. The development of investment strategies and counter-strategies and counter-counter strategies also increases in sophistication.

What lies at the heart of both is data modeling. Investment research firms that employ cutting-edge machine learning techniques in their workflow will be empowered to create comprehensive models in reduced time. Even small leaps in productivity would result in a significant competitive edge.

Secondly, data would not be just differentiated by medium, but also language. The market generates mountains of analyses, news articles, research material, etc. Now, it also generates tweets and other content—both in multiple languages. NLP will finally enable investors to use that content in their research, as live translation becomes more accurate powered by the cloud.

Ultimately, cloud capabilities in 2022 will enable investors to better manage their information portfolio so that they can better manage risk. That is how they will create the most value: by making the most of quantity and quality—together.

With offices in New York, Austin, Seattle, London, Zurich, Pune, and Hyderabad, SG Analytics is a leading research and analytics company that provides tailor-made services to enterprises worldwide. If you’re looking to make critical data-driven decisions, decisions that enable accelerated growth and breakthrough performance, contact us today.