Investing in international equities has gathered prominence across the globe. Many investors are grabbing the opportunity to invest across different geographies and currencies to diversify their portfolios. This growth in various sectors is attributed to superior performance in developed markets.

Greater awareness among the investor community and democratization of investment has enabled investors and entrepreneurs to select segments and markets that yield results. Investing in international equities overpowers the risk associated with them.

India is enjoying the limelight in the growing race of global investments by garnering all the attention.

The History of Global Investment in India

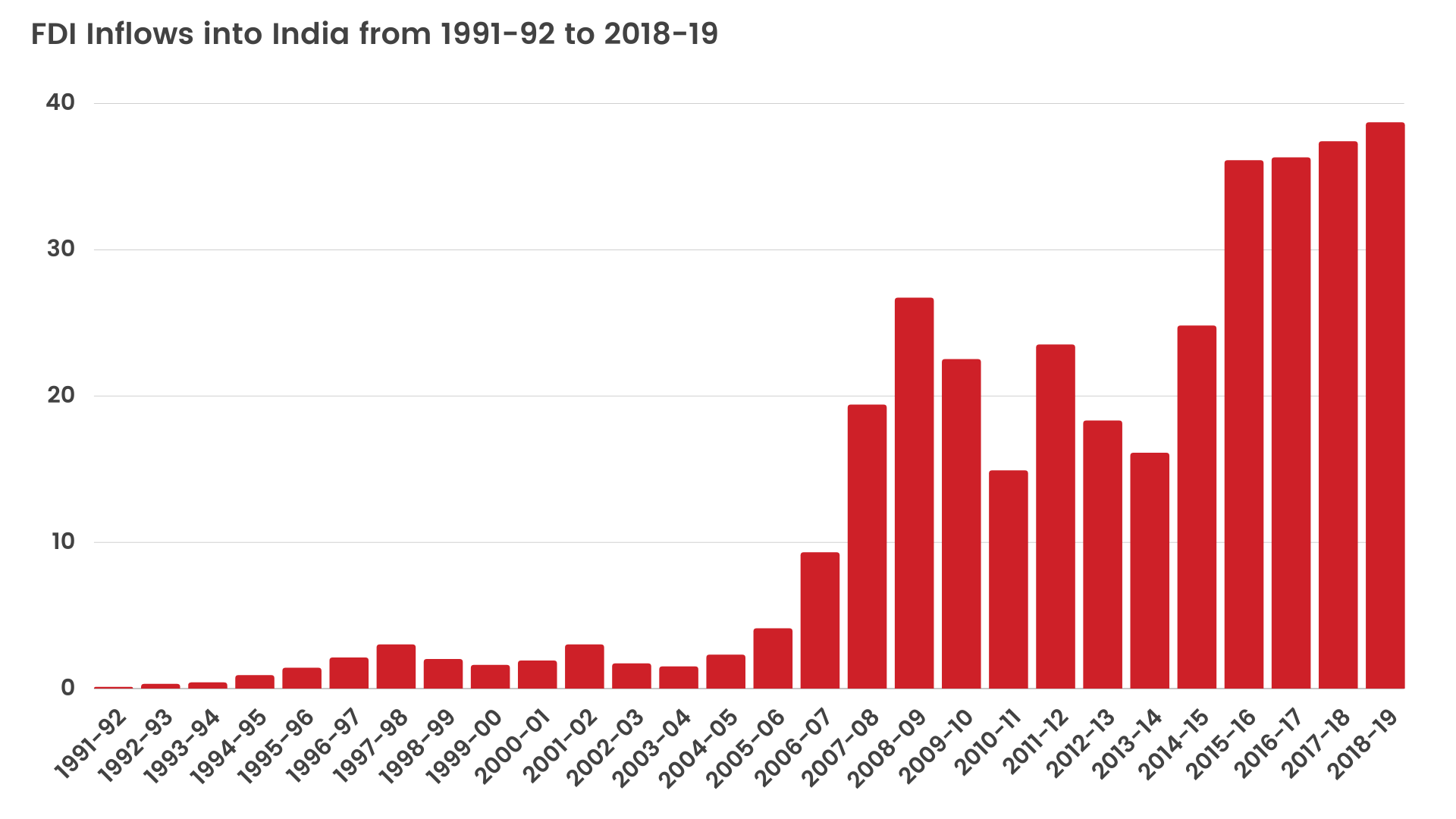

In 1991, after a series of policy measures were announced to liberalize and strengthen the FDI environment, the FDI inflows rose manifold from US$ 2.0 billion in the year 1998-99 to over US$ 26.7 billion just before the crisis in 2008. After the global financial crisis (2008), the FDI inflows to India moderated till 2013-14. The capital expenditure has been on a recovery path since FY18 after tumbling over FY14-17. But post-pandemic, the situation is now shifting.

The recent trends in FDI/foreign direct investment flows at the global level indicate that India has always attracted higher FDI flows and continues to remain among the top attractive destinations for international investors. Even though the FDI flows into India may remain tepid in 2022, India remains an attractive destination for foreign direct investments (FDI) on account of its healthy prospects of economic growth and its skilled workforce.

FDI plays a critical role in the economic development of a country and supports economic growth by meeting the investment prerequisites.

Foreign investors, including FDI and FPI, took home a record net of $13.7 billion as profits from their investments in India during the December 21 quarter. The fresh FDI investments in 2022 are just about $5 billion. This evolving Indian economic framework is giving investors the confidence that India will achieve a consistently higher rate of growth justified by its long-term fundamentals.

The Baby Boomer Factor

Most developed nations today are tackling a common challenge – aging populations. But in India’s case, the demographics are much younger, thus making it among the world’s youngest populations.

India is a $ 3.1 trillion economy today. Baby boomers have experienced major changes that happened in the past 50 years. The baby boomer experienced the nationalization of industries, public works, social reforms, and public investment. For them, economic options were limited due to the sluggish economy, and their options were heavily influenced by their family and peer groups. They have collectively initiated trends that disproportionately benefited certain industries including manufacturing, operations, investments, mortgages, etc.

The boomer effect or the baby boomer factor is the influence of the baby boomer generation on the Indian economy and its outlook. With the Baby Boomer effect, Govt initiatives including the digital economy, moderation of government spending, reduction of tax rates, deregulation, and lower government intervention have helped the younger population to invest in the economy through various modes like mutual funds, securities, equities, and real estate, etc.

The baby boomers in the age group of the 60s, 70s, 80s, and increasingly beyond are contributing even more significantly. Today, baby boomers are infusing their retirement savings in private equity, venture capital, high-yielding bonds, securitization, municipality bonds, REITs, etc. This huge supply of capital can facilitate massive innovation. The interest of India in SIPs has triggered an increase in retail participation in IPOs, direct equities, REITs, and Infrastructure. Investment Trusts also provide a big boost to liquidity in the economy.

Most baby boomer-era Indians have an inherent tendency to encourage their children to pursue medical or engineering studies. But the scenario is now changing. In India, the 470 million millennial population is drawing attention from across the world. Indian millennials, unlike in other countries, are among the main breadwinners of their households.

India's age pyramid is fundamentally different from developed economies, as India is one of a high proportion of young people. This is India’s main asset and one that investors are already familiar with.

India: The surging economy of 2022 and beyond

For over a decade, India has catered to global consumers. The pandemic opened new avenues for global investors, thus encouraging international businesses to take the first step in this long-term sustainable investment approach.

Today, India is projected as the second-largest global venture capital investment hub for digital shopping companies. It has grown by a whopping 175 percent, from USD 8 billion in 2020 to USD 22 billion in 2021.

On a global scale, India ranked second to the US last year, which attracted USD 51 billion in investment, followed by China at third position with USD 14 billion and the UK at fourth with USD 7 billion.

Read more: The Future of Hedge Funds: Top Trends to Watch Out For in 2022

The Post Pandemic Effect

Despite the pandemic, India propelled into the top five destinations for FDI globally. During the initial four months of 2021-22, direct investment jumped a further 62%.

Global investors are showing a strong appetite for investment in India. With international investors exploring alternative destinations to manufacture, India is well-positioned to capture a disproportionate share of this shift.

The strong global investment that flowed in during the pandemic is slowly beginning to bear the fruits as investors take back home India's profits. Many international businesses and fund managers are putting their money to work in India.

A large proportion of international investment leaders remain confident in India's short- and long-term prospects. They are preparing plans to make additional and first-time investments in the country. With India emerging as an attractive destination for foreign direct investments (FDI), investors are considering healthy prospects for economic growth.

India- An Emerging Investment Hub

In the last decade, India witnessed a drastic increase in foreign direct investment.

Today, India is being viewed as a great investment destination by many international businesses, thanks to its extensive economy, huge consumer market, and abundant talent. An even more exciting aspect is the potential.

Improving infrastructure and new innovations remains a focus, and with India rapidly building its renewable energy capacity and decarbonising industry, more global investors are curiously eyeing the Indian economic market.

Economists are predicting that India will be the world’s 3rd largest economy and 3rd largest consumer market by 2030. With strengths in manufacturing, digital and IT, the economy is increasing evidently.

Reasons to consider investing in the Indian Market:

-

India is one of the world's fastest-growing economies

-

India has attracted the highest ever FDI inflow of $67.54 bn during the first ninth months of the financial year 2020-21

-

The announcement of a special economic and comprehensive package of more than $270 bn by PM Shri Narendra Modi, under the Atmanirbhar Bharat Abhiyan

-

India’s GDP is projected to grow by 8.0-8.5 percent in the year 2022-23

Read more: Top Trends That Will Shape Investment Banking In 2022

Many UK businesses are deeply rooted in India, with 500-strong UK businesses operating in India and employing more than 400,000 people. Many businesses are looking to expand in India, and many UK businesses that have not yet invested are keen to do so. These investment opportunities will enormously help them to maximise the scope and make it easier for their business to trade and reach a larger audience.

There are three main recommendations for businesses to invest in India:

-

Businesses will experience a reduction in tariffs on food, drink, and healthcare.

-

They want to witness a greater alignment of standards and simplified customs procedures.

-

And they will notice the alignment of data protection rules and IP practices.

These partnerships with India will help them realise their true potential, particularly in the innovative and R&D-intensive sectors and drive the partnership for decades to come.

The Ease of Doing Business

Foreign investors have experienced a prominent area: the ease of doing business. Many government-backed schemes in India offer investors a commitment to upholding the ease of doing business and willingness to engage with businesses. This goes hand in hand with FTA type issues and is a vital enabler of greater cooperation. Considered an attractive market, India’s policies provide businesses with regulatory certainty and a sound operating environment.

The better the operating environment for investors, the greater the level of investment.

The huge progress made in recent years, along with the new policies and regulations employed by the Government of India, has helped to improve the ease of doing business to date. These reforms are receiving a positive reception from businesses across the globe and are vital to attracting international investors.

Made in India for the World

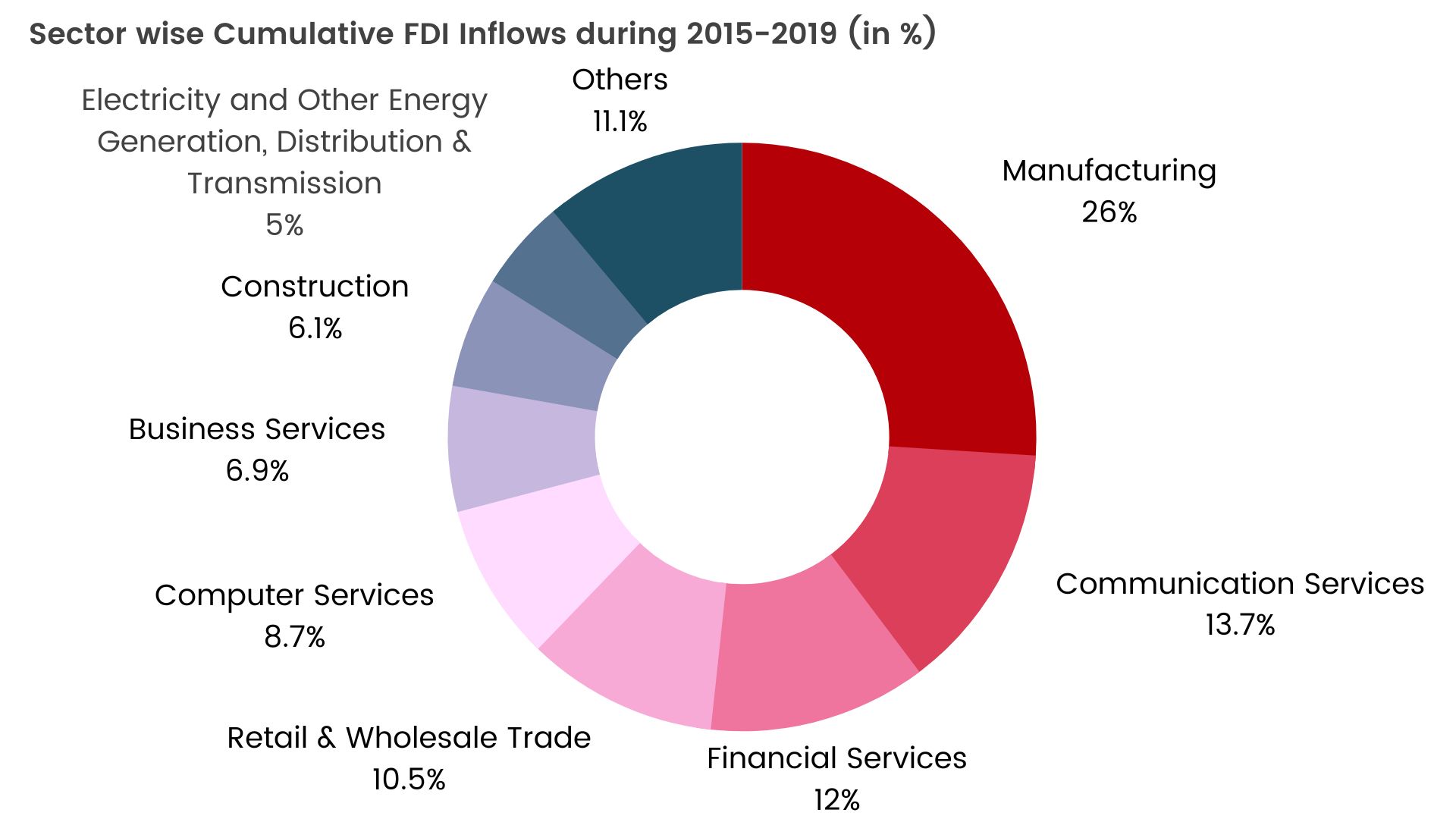

The Make in India initiative by the Government of India in September 2014 opened new doors that provide investors a direct avenue to foster innovation and build best in class manufacturing infrastructure. This reform created a favourable foreign investment climate in India and has helped in increasing growth in FDI inflows. The strong investment recipients are ‘manufacturing,’ ‘communication’ and ‘financial services’.

Global businesses and investors are tapping into the interim of early harvest deals. With the Indian market, they acquire a building block that is likely to transform their bilateral partnership, thus enabling them to hit their target of doubling the trade. This empowers them to capitalize on the excellent momentum already initiated by the Governments enabling them to lock in wins and deliver economic benefits.

Read more: How is AI creating ripples in investment management?

To Sum Up

India has leapfrogged the average growth curve and strengthened its position as an economic powerhouse. The promotion of a digital economy coupled with innovation in fintech, telecoms, manufacturing, media and data, and the growth of holistic healthcare from developing drugs and vaccines has put India in a prominent position on the map of global investors. This transition has engendered myriad opportunities for both entrepreneurs and investors to invest and flourish.

The Indian market is attracting greater FDI into seven major capital-intensive sectors - textile and apparel, pharmaceuticals, food processing, electronics, vehicles and parts, chemicals, and capital goods. With the government continuing to enact reforms and initiatives to drive improvement and build confidence and competitiveness, the Indian economic market is likely to emerge as the next investment destination for global businesses and entrepreneurs.

With offices in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A market leader in Investment Research Services, SG Analytics assists in strengthening investment decisions by leveraging custom research support. Contact us today if you are in search of an investment research firm that offers tailored research support across a broad range of asset classes.