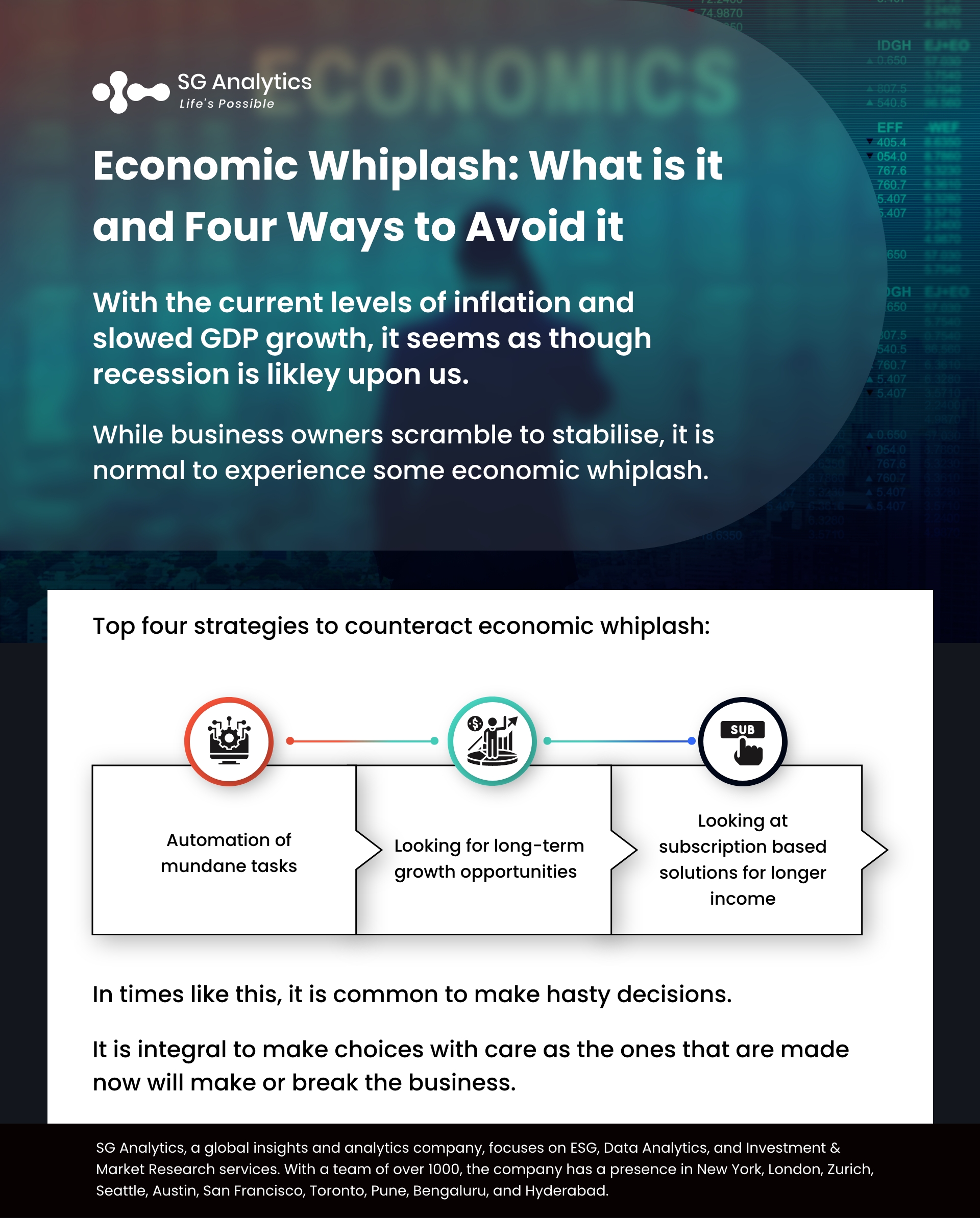

The economic world has been far from stable in the past few years, and it has been volatile galore ever since COVID set in. With the massive demand and supply shocks that occurred as a result of the pandemic and the more recent inflation issues that have plagued the world economy, it has been a quick change for many. Many businesses have faced arduous circumstances because of the mercurial nature of the business cycle of late. This has come to be known as Economic Whiplash. The effects that a company will experience amidst rapid economic changes have become increasingly severe. Therefore, steps to counteract and alleviate the effects thereof are integral.

Many believe that smaller businesses are more prone to feel the impacts of economic whiplash more severely. However, the only firms that will be devoid of any impact are those that are entirely automated. In general, regardless of whether one’s firm is large and completely unconnected to the economic difficulties, higher inflation will mean that employees will require higher salaries meaning that layoffs might become important. Therefore, it is important to avoid corporate arrogance as a large company and still safeguard against it.

The following are four transformational ways to counteract economic whiplash:

-

Automation of Mundane Tasks

-

Looking for Long-Term Growth Opportunities

-

Educating Customers on Value for an Expanded Base

-

Looking at Subscription-based Solutions for Longer Income

Read More: Anticipating the Unanticipated: Balancing Business Resilience in the new age of Innovation

-

Automation of Mundane Tasks

As mentioned earlier, automation is normally more immune to economic whiplash than anything else. This happens for a variety of reasons, but the main one is that employees are likely to have a much more variable output level than that of a machine. For example, during the pandemic, many employees were made to work from home due to the lockdowns that were put in effect worldwide. This meant that many employees (depending on the job and industry) saw substantial declines in their productivity and output.

It is significant to note that this is often much easier said than done. For most of the work that is done by employees at bigger firms, it requires a higher skill set that cannot be replicated by artificial intelligence. For people like financial day traders, although algorithms and data guide a lot of their work, our technology is simply not at the level that it can act as a viable substitute. Bearing that in mind, it is also true that most companies carry a lot of employees that are unspecialized and work mainly in unskilled labor jobs. This is the case in more rudimentary factories that employ people in many parts of the assembly line rather than machines. Automation, albeit sometimes very expensive, is an investment for the future. Especially in the case of economic fluctuations, automation can greatly aid in offsetting the impacts.

Furthermore, outside of such exigent circumstances, companies are likely to increase profit margins over time. This is because automation in terms of monthly costs is conventionally lower than employee wages. This means production costs are also lowered, only further benefiting the firms.

-

Looking for Long-Term Growth Opportunities

In times of economic uncertainty, business owners and CEOs are often quick to limit expenditure and lower wages. In the same vein, employees are laid off, and production is often slowed to meet the limited revenue. However, rather than simply saving this money to get the company through the proverbial rainy day, it might be similarly appropriate to look at expanding. This might sound absurd to many, but it is likely that one is able to develop new verticals in their business due to the lower effort required with other aspects of the firm.

It is obviously still not wise to allocate high amounts of capital to a new venture (especially because demand is adequately reduced in the market too). However, if there are certain parts of newer expansions that can be done with relatively limited capital expenditure, it would be a smart investment. This is because having a new product or service prepared and ready to release when the demand boom when the economy reaches its point of inflection means it will have the best chance of succeeding.

Moreover, times of economic stress and downturn are also often the start of new problems that can be solved in new and innovative ways. Because of their recency, there are few solutions to many of these problems. A good example of this is sanitizer and mask manufacturers during the pandemic. If one was able to anticipate their demand beforehand, pre-empting production would be quite clever. When the shortage of those goods did inevitably occur, it was those that had large stocks piled that had the de facto monopoly for a short time. This gave them price rights meaning that they could determine profits easily.

Naturally, foreseeing demand for products is a very difficult skill to cultivate and is far more challenging than it might seem. However, it is these skills that make or break wealth creation in times of difficulty.

Read More: What Is Data Democratization? How is it Accelerating Digital Businesses?

-

Educating Customers on Value for an Expanded Base

As the demand in all markets drops dramatically in these times of turmoil, it might be futile to remain focused on sales. At the end of the day, revenue and profits are what fuel a business. However, when it becomes near impossible to maintain that, it is smart to start looking elsewhere to boost the business. One of the most important things that one could work on is their customer base. Although the pandemic was a difficult time for everyone, it was a very opportune time for marketing and educating the customer about one’s business and the products/services that one offered.

With such a large part of the global population working from home, internet advertisements have become extremely valuable. Expenditure on the same would probably reflect a larger return on the investment simply because these advertisements would reach more people. As explained earlier, when the effects of economic turmoil begin to alleviate and the markets start to recover, having a loyal consumer base that has been cultivated over the course of this time of difficulty is sure to help offset the losses incurred.

Generally, expanding a customer base is something that should be worked against perpetually. High demand for a product or service that one offers is rarely a negative thing. However, if this has been done effectively beforehand, a loyal customer base means that the demand shocks will be slightly offset during the crisis.

-

Looking at Subscription-Based Solutions for Longer Income

With most households trying to wean off large purchases, it is often true that consumers feel more comfortable with a few smaller payments. Although this is more of a psychological flaw, it is also true that such payments can be discontinued at any time to cut the losses, which is not an option with larger purchases. Therefore, a transition to subscription-based solutions might be the way to progress.

For most private consumers, subscription has become normal. Whether it is an online subscription like Netflix or Amazon prime for streaming, Apple Music or Spotify for Music, or it is real-life subscriptions for things such as newspapers, they can all provide massive revenue streams for established businesses. When a service has been in the market for an extended period, consumers feel comfortable opting for a subscription. This also means that the value proposition is worth the amount people are paying for the service. As a result, subscribers will often retain services for longer than they planned as it eventually becomes more habitual, and it becomes more difficult to let go of them.

Read More: Four Ways Traditional Finance is being Disrupted by Open Finance

A Word of Caution

The tips mentioned above are all quite effective. However, it is very important to remember that none of these can act as a proverbial silver bullet for these times of difficulty. When it comes to being that, and the global economies finally go under official recessions, these tips will only be of help to aid in recovering and reallocating funds that might not be getting used. At the same time, this is not to say that these times will become any less challenging. Regardless of what a business can do, there will be some problems that cannot be bypassed because they are governed by parties that are out of any individual’s control. For example, during the pandemic, the world faced large supply chain bottlenecks. As mentioned in the first point, even if one were to automate manufacturing processes and significantly improve the efficiency of production, it would mean nothing if logistics companies were unable to bring these products from the factory to the consumers.

Although there are many things that might help a business, this is a time where grit and perseverance are of the highest value, and those that can maintain that throughout are the ones that prevail.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in Market Research services, SG Analytics enables organizations to achieve actionable insights into products, technology, customers, competition, and the marketplace to make insight-driven decisions. Contact us today if you are an enterprise looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.