The Securities and Exchange Commission (SEC) presented rule changes that require registrants to include specific climate-concerning disclosures in their registration statements and reports. This data includes details about climate-related risks that are likely to have a material impact on their business.

The required data about climate-related risks will also highlight disclosure of the registrant’s greenhouse gas emissions, which is now becoming a commonly used metric to assess a registrant’s exposure.

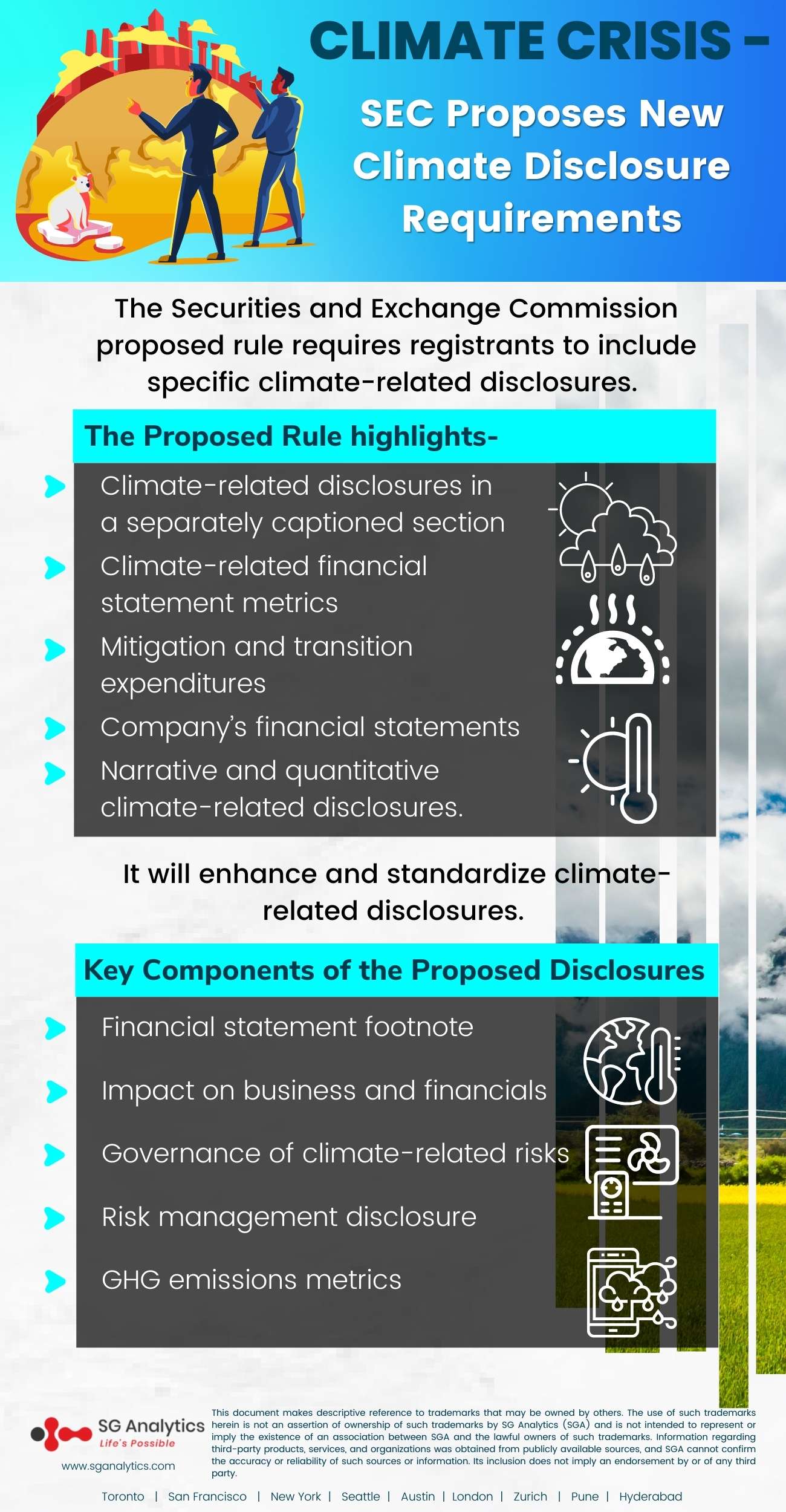

The Proposed Rule would require companies to:

-

Provide climate-related disclosures in a separately captioned section of their registration statement.

-

Provide climate-related financial statement metrics addressing its impact.

-

The mitigation and transition expenditures along with related estimates and assumptions.

-

Company’s financial statements, addressing the influence of online items.

-

Narrative and quantitative climate-related disclosures.

This long-awaited proposal tracks months of discussions at the SEC and represents a major victory for the Biden administration’s environmental agenda. While it may not directly regulate climate change impacts, it will help in improving transparency around climate risks and enhance the accountability for climate-related claims and goals. This is being considered a significant leap forward in response to climate change.

Read more: Climate Action Warriors – Top 15 Women Leaders Fighting Climate Change

The SEC Rule Background

The proposed enhances and standardizes the climate-related disclosures required to be enclosed by public companies. As per the SEC's proposed rule, investors represent tens of trillions of dollars supporting climate-related disclosures as they recognize that climate risks pose consequential financial risks to companies. Investors today demand reliable information about climate risks to make informed investment decisions.

Under the proposed rule, public company registrants would be mandated to provide disclosures about greenhouse gas emissions, financial statement disclosures, and qualitative & governance disclosures within their registration statements and annual reports.

The SEC Proposed Rule Characteristics: The Proposed Rule would mandate public companies to provide climate-related disclosure in periodic reports concerning:

-

the governance of climate-related risks by the company’s management

-

the company’s processes to identify, assess, and manage climate-related risks

-

Scope 1 and Scope 2 GHG (Greenhouse Gas) or greenhouse gas emissions, separately disclosed and expressed in absolute terms

-

Scope 3 GHG emissions and intensity

Focused on climate risks and climate-related disclosures, the proposal will benefit companies and investors alike on the road toward fighting the global climate crisis.

Key Components of the Proposed Disclosures

The proposed disclosure framework released by SEC has modeled on certain aspects of the disclosures registrants as a part of the voluntary framework and recommendations. The disclosure framework will be applicable to both domestic registrants and foreign private issuers (FPIs). It would require them to publicize information about:

-

Financial statement footnote

-

The influence of climate risks on strategy & business model

-

The impact on business and financials

-

The governance of climate-related risks

-

Risk management disclosure

-

GHG emissions metrics

The proposed release cited certain aspects of the disclosure's registrants under existing disclosure frameworks and standards. Registrants will be mandated to provide the following types of disclosures:

-

The expenditures related to mitigating the risk of severe weather events and other natural conditions and transition activities.

-

The impact on financial statement line related to severe weather events like increase in loss reserves.

-

The affected estimates and assumptions are reflected in the financial statements due to severe weather events.

Read more: Creating Value for Climate Change Crisis Through the Lens of Private Equity

GHG Emission Disclosures

-

Scope 1 and Scope 2 GHG or greenhouse gas emissions from a registrant’s owned or controlled operations and purchases would be required to be separately disclosed on a disaggregated and aggregated basis. This disclosure would be mandated on a gross basis and will be relative to the intensity.

-

The Scope 3 GHG emissions from indirect upstream and downstream activities in gross terms and relative to intensity will also be required to be quoted if the registrant has set a GHG emissions target, including Scope 3 emissions. This Scope 3 GHG emission disclosures will be subjective to securities law safe harbor provisions.

Business and Financial Disclosure

The climate-related risks on the business and consolidated financial statements over the short-, medium-, or long-term period. In the proposal, the climate-related risks are defined as actual or potential negative influence of climate-related conditions and possibilities on the registrant’s consolidated financial statements and value chains.

A registrant will be instructed to describe how it defines its short-, medium-, and long-term time horizons, along with how it takes into consideration the expected useful life of assets for planning processes and goals.

The proposed release also demands the disclosure of both acute risks and chronic risks, along with specific insights regarding the location and nature of properties, processes, or operations.

Qualitative Disclosures

-

It highlights how climate-related risks

a) had or are likely to have a material impact on the business and its financial statements.

b) affected or are likely to affect the registrant’s strategy and business framework.

-

It will track the registrant’s processes of detecting, evaluating, and managing climate-related risks and study its broader risk management program.

-

If the registrant utilizes an internal carbon price, it will mandate the declaration of the registrant’s internal carbon price and how the price is determined.

-

If a registrant has adopted a climate transition plan, they should describe such a plan along with the relevant targets and metrics.

-

They should also highlight the scope of activities encompassed, the envisioned time horizon, and the established interim targets.

Additional Disclosure

-

The SEC proposed rule will mandate the disclosures for the registrant’s recently completed fiscal year and for their historical fiscal years included in the consolidated financial statements.

-

The disclosure would also include a description of the methodology, inputs, and assumptions used to calculate the GHG emissions metrics.

How will the Proposed Rule Impact Private Companies?

The Scope 3 emissions disclosure requirement will likely have a substantial impact on private companies and foreign companies not subject to the regulation. Many suppliers or customers who have received loans or investments from public companies will be subject to this proposed rule. These non-subject companies will face pressure to announce their emissions to enable reporting of Scope 3 emissions by public companies that fall under this rule.

It will also drive the market expectations to enclose the same disclosure in private securities offerings under Rule 144A, where it is a standard practice to follow disclosure rules applicable to public securities offerings. In addition, the considerable costs and burden of complying with this Proposed Rule will further discourage private enterprises from going public or potentially influencing public companies to go private.

Read more: ESG & Sustainability: Shaping the Future of Digitized Procurement Value Chain

Key Takeaways

-

The climate-related risks are likely to have a material impact on a public company’s business, their results of operations, or even financial condition.

-

The greenhouse gas emissions associated with the public company will include an attestation report by a GHG emissions attestation provider.

-

Climate-related financial metrics will be mandatorily included in a company’s audited financial statements.

Next Steps to Follow

The Proposed Rule will likely remain available for public comment. Companies need to consider whether they hold specific cost, feasibility, liability, or other concerns regarding the Proposed Rule that may certify participation in the public comment process, either on their own or as part of a coalition.

The SEC Proposed Rule is expected to be challenged with respect to the SEC’s statutory authority to pass comprehensive climate disclosure regulations in the absence of explicit Congressional authorization.

Under the proposed rule changes, the accelerated and large accelerated filers will be required to include an attestation report from an independent attestation service provider covering emissions disclosures. This will assist in promoting the reliability of GHG emissions disclosures for investors. The proposed rules will also include a phase-in period for all registrants, with the compliance date dependent on the registrant’s filer status.

The proposed rule will significantly modify the climate-related disclosure requirements for public institutions. For most businesses, the effort required to comply with these disclosure requirements will be influential, and the time to begin preparing for this is now.

With presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Consulting services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.